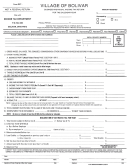

OTHER TAXABLE INCOME

13. TAXABLE INCOME NOT REPORTED ON W-2

(ATTACH FORM 1099 OR FEDERAL SCHEDULES - SEE INSTRUCTIONS BELOW)

........ $ ________________

MUST BE

14. NET PROFIT/LOSS FROM BUSINESS (ATTACH FEDERAL SCHEDULE C).............................................. $ ________________

COMPLETED ONLY

BY THOSE WHO

15. NET PROFIT/LOSS FROM RENTS, PARTNERSHIPS, ETC. (ATTACH FEDERAL SCHEDULE E) .............. $ ________________

HAVE TAXABLE

16. TOTAL NET PROFIT/LOSS FROM ALL BUSINESS ENTITIES (TOTAL OF LINE 14 AND 15) .................. $ ________________

INCOME OTHER

17. TOTAL BUSINESS LOSS FROM PREVIOUS TAX RETURNS ............................................................... $ ________________

THAN WAGES

(OPERATING LOSS MAY BE CARRIED FORWARD FOR A MAXIMUM OF 3 YEARS)

OR WHO CLAIM

18. TOTAL BUSINESS LOSSES AND GAINS

EXPENSES AS A

A: TOTAL OF LINE 16 AND 17. IF RESULT IS A LOSS, ENTER ON THIS LINE FOR FUTURE CARRYOVER ..... $ ________________

DEDUCTION FROM

(Business activity loss MAY NOT be used to offset salary or wage earnings)

B: IF THE CALCULATION ON LINE 18A (TOTAL OF LINE 16 AND 17) RESULTS IN A GAIN, LIST HERE .................................................. $ ________________

SUCH WAGES.

19. CREDITS

A: DEDUCTIBLE EXPENSES (ATTACH FORM 2106 - SEE INSTRUCTIONS BELOW) .................................. $ ________________

B: NON-TAXABLE INCOME (EXPLAIN - SEE INSTRUCTIONS BELOW) .................................................... $ ________________

C: TOTAL CREDITS ......................................................................................................................................................................... $ ________________

20. TOTAL TAXABLE INCOME (LINE 13 PLUS LINE 18B MINUS LINE 19C) .......................................................................................... $ ________________

(ENTER TOTAL ON PAGE 1, LINE 2)

INSTRUCTIONS FOR LINES 1 THROUGH 20

List all sources of earned income including, but not limited to: qualifying wages (usually Medicare Wage, Box 5 of Form W-2), bonuses, commissions, fees, tips, sick pay, stock

1.

options, employer supplemental benefits (SUB) pay and employee contributions to retirement plans. (You must pay municipal tax on your contributions to qualified retirement plans,

annuities or individual retirement account (IRA) plans, including deferred compensation and stock options, whether or not your W-2 form shows this income as taxable.) Attach all W-2

forms and/or documentation - photo copies acceptable.

2.

Total from Line 20. Interest, dividends, capital gains, retirement income, military pay and State unemployment comp. are not taxed.

3.

Line 1 plus or minus Line 2. NOTE: Business losses MAY NOT be used to offset W-2 wages.

(c) Credit for tax withheld and paid to another municipality may not exceed 1.2% . The credit for tax paid to a municipality with a tax rate greater than 1.2%, is limited to the

5.

Evendale tax rate of 1.2% (e.g. the credit for tax paid to Cincinnati at 2.1% is calculated by dividing the Cincinnati tax withheld by 2.1% then multiplying by 1.2%). The credit for tax

paid to a municipality with a tax rate 1.2% or less is limited to the actual tax withheld, provided that the withholding amount was properly calculated on the correct wage. The tax

credit must be computed individually for each W-2. If taxes are paid directly to another municipality rather than withheld, verification must accompany this return.

6.

Indicates amount of TAX DUE. If the sum of this line is five dollars or more, full payment must be received on or before the due date. An amount under five dollars is not collectible.

6a. 2015 – Interest rate is 3%, calculated as prescribed by ORC Section 5703.47. Interest is not computed on a balance due of $100 or less.

2016 – Interest rate is 5%, calculated using the Federal Short-term rate rounded to the nearest whole percent plus five percent as prescribed by ORC 718.27.

6b. Penalty for failure to pay taxes when due is calculated at one and one-half percent (1 1/2%) per month; Penalty for failure to pay the estimated tax when due is not calculated on a

balance due of $100.00 or less. Penalty for failure to file the return by the due date, or by the date resulting from extension, is twenty-five dollars ($25.00).

7.

Overpayment will be applied to your 2016 estimate unless a refund is requested. By law, all refunds or credits in excess of $10 are reported to the I.R.S.

2016 Estimate – No estimated tax payments required for estimates under $200. Estimate should be based upon at least 90% of the amount of income you expect to make in the year.

8.

11. You may pay the full amount declared with the filing of this form. An estimated liability of under $200 does not require quarterly estimated payments, although quarterly payments

may be made if you so desire.

12. A payment made by check may be processed as an electronic funds transfer from your bank or other financial institution account according to the terms of the check.

13. Interest, dividends, capital gains, retirement income, military pay and State unemployment compensation are not taxed.

15. Complete if gross income on all rental property exceeds $250 per month.

19. Deductions allowed only when a W-2 is attached and all expenses have been substantiated by proper schedules.

(A) Employment expenses are allowable on the same percentage basis as wages are allocated and tax is paid to Evendale.

(B) Income may be pro-rated for residents who moved into or out of Evendale during the current year. Moving expense deduction may NOT be used unless reimbursement is included

in Line 1. All other uses of the line must be accompanied by proper documentation.

20. Enter Total on Line 2, Page1.

EXTENSION POLICY: Requests to extend the date for filing must be made in writing, and filed with the Village of Evendale, by the original due date of the return. A copy of the Federal

Extension, filed with the Village of Evendale by the original due date of the return, is acceptable. Only those requests received in duplicate with a self-addressed, postage paid envelope will

have a copy marked and returned.

2016 DECLARATION AND RETURN PAYMENT CALENDAR

APRIL 15, 2016

JUNE 15, 2016

SEPTEMBER 15, 2016

DECEMBER 15, 2016

APRIL 17, 2017

File 2015 Income Tax Return

Remit 2nd

Remit 3rd

Remit 4th

File 2016 Income Tax Return

with 2016 Declaration and

quarterly payment

quarterly payment

quarterly payment

with 2017 Declaration and

1st quarterly payment.

1st quarterly payment

PAGE 2

1

1 2

2