Form Ct-186-E - Telecommunications Tax Return And Utility Services Tax Return

ADVERTISEMENT

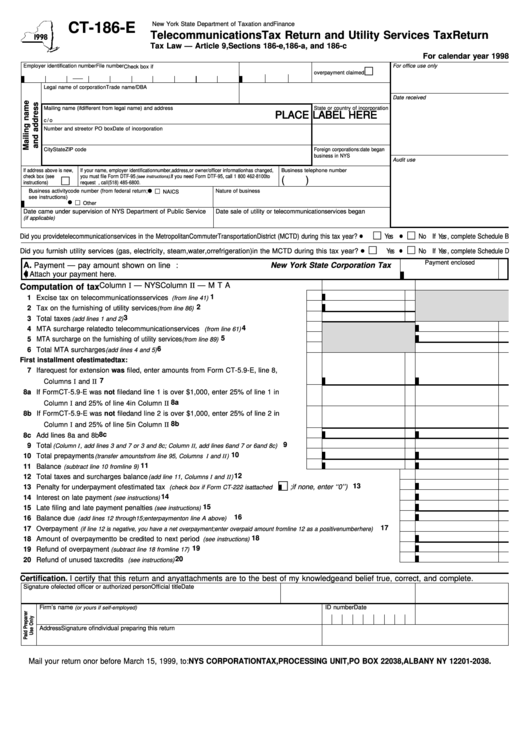

CT-186-E

New York State Department of Taxation and Finance

Telecommunications Tax Return and Utility Services Tax Return

Tax Law — Article 9, Sections 186-e, 186-a, and 186-c

For calendar year 1998

Employer identification number

File number

For office use only

Check box if

□

overpayment claimed

Legal name of corporation

Trade name / DBA

Date received

Mailing name (if different from legal name) and address

State or country of incorporation

PLACE LABEL HERE

PLACE LABEL HERE

c / o

Number and street or PO box

Date of incorporation

City

State

ZIP code

Foreign corporations: date began

business in NYS

Audit use

If address above is new,

If your name, employer identification number, address, or owner / officer information has changed,

Business telephone number

check box (see

□

you must file Form DTF-95

. If you need Form DTF-95, call 1 800 462-8100 to

(see instructions)

(

)

instructions)

request one. From areas outside the U.S. and outside Canada, call (518) 485-6800.

●

□ NAICS

Business activity code number (from federal return;

Nature of business

see instructions)

●

□ Other

Date came under supervision of NYS Department of Public Service

Date sale of utility or telecommunication services began

(if applicable)

□

□

Did you provide telecommunication services in the Metropolitan Commuter Transportation District (MCTD) during this tax year? ●

Yes ●

No If Yes , complete Schedule B

□

□

Did you furnish utility services (gas, electricity, steam, water, or refrigeration) in the MCTD during this tax year? ●

Yes ●

No If Yes , complete Schedule D

Payment enclosed

A.

Payment — pay amount shown on line 16. Make check payable to: New York State Corporation Tax

. . . . . . Attach your payment here.

Column I — NYS

Column II — MTA

Computation of tax

1

1 Excise tax on telecommunications services

. . . . . . . . . . . . . . . . . . . . . . . . . . .

(from line 41)

2

2 Tax on the furnishing of utility services

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(from line 86)

3

3 Total taxes

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 1 and 2)

4

4 MTA surcharge related to telecommunication services

. . . . . . . . . . . . . . . . . .

(from line 61)

5

5 MTA surcharge on the furnishing of utility services

. . . . . . . . . . . . . . . . . . . . . . . .

(from line 89)

6

6 Total MTA surcharges

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 4 and 5)

First installment of estimated tax:

7 If a request for extension was filed, enter amounts from Form CT-5.9-E, line 8,

7

Columns I and II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8a If Form CT-5.9-E was not filed and line 1 is over $1,000, enter 25% of line 1 in

8a

Column I and 25% of line 4 in Column II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8b If Form CT-5.9-E was not filed and line 2 is over $1,000, enter 25% of line 2 in

8b

Column I and 25% of line 5 in Column II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8c

8c Add lines 8a and 8b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

9 Total

. . . . . .

(Column I , add lines 3 and 7 or 3 and 8c; Column II , add lines 6 and 7 or 6 and 8c)

10

10 Total prepayments

. . . . . . . . . . . . . . . . . . . . .

(transfer amounts from line 95, Columns I and II )

11

11 Balance

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(subtract line 10 from line 9)

12

12 Total taxes and surcharges balance

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add line 11, Columns I and II )

□

13

; if none, enter ‘‘0’’ ) . . . . . . . . . . . . .

13 Penalty for underpayment of estimated tax

(check box if Form CT-222 is attached

14

14 Interest on late payment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

15

15 Late filing and late payment penalties

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

16

16 Balance due

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 12 through 15; enter payment on line A above)

17

17 Overpayment

. . . . .

(if line 12 is negative, you have a net overpayment; enter overpaid amount from line 12 as a positive number here)

18

18 Amount of overpayment to be credited to next period

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

19

19 Refund of overpayment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(subtract line 18 from line 17)

20

20 Refund of unused tax credits

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(see instructions)

Certification. I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Signature of elected officer or authorized person

Official title

Date

Firm’s name

ID number

Date

(or yours if self-employed)

Address

Signature of individual preparing this return

Mail your return on or before March 15, 1999, to: NYS CORPORATION TAX, PROCESSING UNIT, PO BOX 22038, ALBANY NY 12201-2038.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5