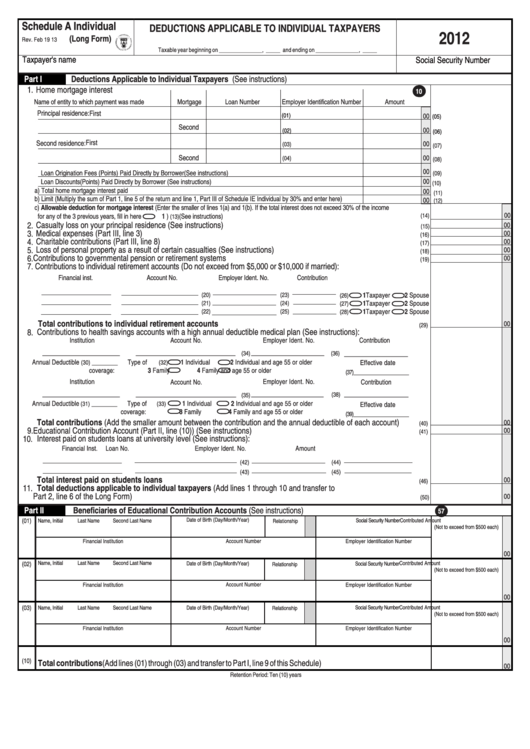

Long Form - Deductions Applicable To Individual Taxpayers - 2012

ADVERTISEMENT

Schedule A Individual

DEDUCTIONS APPLICABLE TO INDIVIDUAL TAXPAYERS

2012

(Long Form)

Rev. Feb 19 13

Taxable year beginning on _______________, _____ and ending on _______________, _____

Taxpayer's name

Social Security Number

Part I

Deductions Applicable to Individual Taxpayers (See instructions)

1. Home mortgage interest

10

Name of entity to which payment was made

Mortgage

Loan Number

Employer Identification Number

Amount

Principal residence:

First

(01)

00

(05)

Second

00

(02)

(06)

First

Second residence:

00

(03)

(07)

Second

00

(04)

(08)

00

Loan Origination Fees (Points) Paid Directly by Borrower (See instructions)

(09)

Loan Discounts (Points) Paid Directly by Borrower (See instructions)

00

(10)

a) Total home mortgage interest paid ...................................................................................................................................................

00

(11)

b) Limit (Multiply the sum of Part 1, line 5 of the return and line 1, Part III of Schedule IE Individual by 30% and enter here) ..........

00

(12)

c) Allowable deduction for mortgage interest (Enter the smaller of lines 1(a) and 1(b). If the total interest does not exceed 30% of the income

00

for any of the 3 previous years, fill in here

1 )

(See instructions) ........................................................................................................................

(14)

(13)

2.

Casualty loss on your principal residence (See instructions) ............................................................................................

00

(15)

3.

Medical expenses (Part III, line 3) ...................................................................................................................................

00

(16)

4.

Charitable contributions (Part III, line 8) ...........................................................................................................................

00

(17)

5.

Loss of personal property as a result of certain casualties (See instructions) ..................................................................

00

(18)

6.

Contributions to governmental pension or retirement systems .........................................................................................

00

(19)

Contributions to individual retirement accounts (Do not exceed from $5,000 or $10,000 if married):

7.

Financial inst.

Account No.

Employer Ident. No.

Contribution

(20)

(23)

1Taxpayer

2 Spouse

(26)

(21)

(24)

1Taxpayer

2 Spouse

(27)

(22)

(25)

1Taxpayer

2 Spouse

(28)

Total contributions to individual retirement accounts .............................................................................................

00

(29)

Contributions to health savings accounts with a high annual deductible medical plan (See instructions):

8.

Institution

Account No.

Employer Ident. No.

Contribution

______________________________

______________________________

__________________________

_________________________

(34)

(36)

Annual Deductible

________

Type of

1 Individual

2 Individual and age 55 or older

(30)

(32)

Effective date

coverage:

3 Family

4 Family and age 55 or older

___________________

(37)

Institution

Employer Ident. No.

Account No.

Contribution

______________________________

__________________________

______________________________

_________________________

(38)

(35)

Annual Deductible

________

Type of

1 Individual

2 Individual and age 55 or older

(31)

(33)

Effective date

coverage:

3 Family

4 Family and age 55 or older

___________________

(39)

Total contributions (Add the smaller amount between the contribution and the annual deductible of each account) ....

00

(40)

9.

Educational Contribution Account (Part II, line (10)) (See instructions) ............................................................................

00

(41)

10.

Interest paid on students loans at university level (See instructions):

Financial Inst.

Loan No.

Employer Ident. No.

Amount

(42)

(44)

(43)

(45)

Total interest paid on students loans ..........................................................................................................................

00

(46)

Total deductions applicable to individual taxpayers (Add lines 1 through 10 and transfer to

11.

Part 2, line 6 of the Long Form) .......................................................................................................................................

00

(50)

Part II

Beneficiaries of Educational Contribution Accounts (See instructions)

57

Date of Birth (Day/Month/Year)

(01)

Social Security Number

Contributed Amount

Name, Initial

Last Name

Second Last Name

Relationship

(Not to exceed from $500 each)

Financial Institution

Account Number

Employer Identification Number

00

Name, Initial

Last Name

Second Last Name

Date of Birth (Day/Month/Year)

Contributed Amount

(02)

Social Security Number

Relationship

(Not to exceed from $500 each)

Account Number

Financial Institution

Employer Identification Number

00

(03)

Name, Initial

Last Name

Second Last Name

Date of Birth (Day/Month/Year)

Social Security Number

Contributed Amount

Relationship

(Not to exceed from $500 each)

Account Number

Financial Institution

Employer Identification Number

00

(10)

Total contributions (Add lines (01) through (03) and transfer to Part I, line 9 of this Schedule) ..................................................

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2