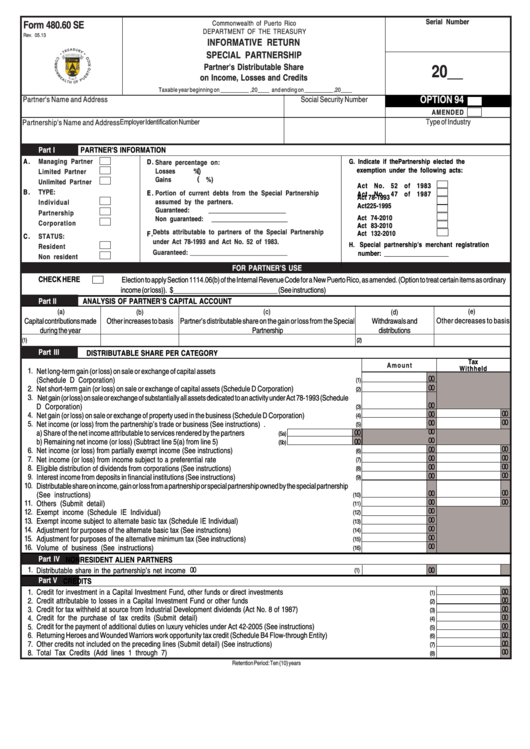

Form 480.60 Se - Informative Return Special Partnership - Partner'S Distributable Share On Income, Losses And Credits

ADVERTISEMENT

Serial Number

Form 480.60 SE

Commonwealth of Puerto Rico

DEPARTMENT OF THE TREASURY

Rev. 05.13

INFORMATIVE RETURN

SPECIAL PARTNERSHIP

20__

Partner's Distributable Share

on Income, Losses and Credits

Taxable year beginning on __________ ,20____ and ending on __________ ,20____

OPTION 94

Partner's Name and Address

Social Security Number

AMENDED

Type of Industry

Employer Identification Number

Partnership's Name and Address

Part I

PARTNER'S INFORMATION

A .

Managing Partner

D .

G. Indicate if the Partnership elected the

Share percentage on:

exemption under the following acts:

Losses

%)

Limited Partner

(

Gains

%)

(

Unlimited Partner

Act No. 52 of 1983

B .

TYPE:

E .

Portion of current debts from the Special Partnership

Act No. 47 of 1987

assumed by the partners.

Act 78-1993

Individual

Act 225-1995

Guaranteed:

________________________

Partnership

Act 74-2010

Non guaranteed:

________________________

Corporation

Act 83-2010

Debts attributable to partners of the Special Partnership

F .

Act 132-2010

C .

STATUS:

under Act 78-1993 and Act No. 52 of 1983.

H. Special partnership's merchant registration

Resident

Guaranteed: ______________________________

number: ____________________

Non resident

FOR PARTNER’S USE

CHECK HERE

Election to apply Section 1114.06(b) of the Internal Revenue Code for a New Puerto Rico, as amended. (Option to treat certain items as ordinary

income (or loss)). $______________________________ (See instructions)

Part II

ANALYSIS OF PARTNER’S CAPITAL ACCOUNT

(a)

(c)

(e)

(b)

(d)

Capital contributions made

Other increases to basis

Partner’s distributable share on the gain or loss from the Special

Withdrawals and

Other decreases to basis

during the year

Partnership

distributions

(1)

(2)

Part III

DISTRIBUTABLE SHARE PER CATEGORY

Tax

Amount

Withheld

1.

Net long-term gain (or loss) on sale or exchange of capital assets

00

(Schedule D Corporation) .........................................................................................................................

(1)

02

00

2.

Net short-term gain (or loss) on sale or exchange of capital assets (Schedule D Corporation) .............................

(2)

3.

Net gain (or loss) on sale or exchange of substantially all assets dedicated to an activity under Act 78-1993 (Schedule

00

D Corporation) .......................................................................................................................................

(3)

00

00

4.

Net gain (or loss) on sale or exchange of property used in the business (Schedule D Corporation) .......................

(4)

00

00

5.

Net income (or loss) from the partnership’s trade or business (See instructions) ...............................................

(5)

00

00

a) Share of the net income attributable to services rendered by the partners ...............

(5a)

00

00

b) Remaining net income (or loss) (Subtract line 5(a) from line 5) ..............................

(5b)

00

00

6.

Net income (or loss) from partially exempt income (See instructions) ..............................................................

(6)

00

00

7.

Net income (or loss) from income subject to a preferential rate .......................................................................

(7)

00

00

8.

Eligible distribution of dividends from corporations (See instructions) ...............................................................

(8)

00

00

9.

Interest income from deposits in financial institutions (See instructions) .............................................................

(9)

10.

Distributable share on income, gain or loss from a partnership or special partnership owned by the special partnership

00

00

(See instructions) ...................................................................................................................................

(10)

00

00

11.

Others (Submit detail) ..............................................................................................................................

(11)

00

12.

Exempt income (Schedule IE Individual) ..................................................................................................

(12)

00

13.

Exempt income subject to alternate basic tax (Schedule IE Individual) ...........................................................

(13)

00

14.

Adjustment for purposes of the alternate basic tax (See instructions) ...............................................................

(14)

00

15.

Adjustment for purposes of the alternative minimum tax (See instructions) .......................................................

(15)

00

16.

Volume of business (See instructions) .......................................................................................................

(16)

Part IV

NONRESIDENT ALIEN PARTNERS

1. Distributable share in the partnership’s net income .......................................................................................

00

00

(1)

Part V

CREDITS

00

1.

Credit for investment in a Capital Investment Fund, other funds or direct investments ............................................................................

(1)

00

2.

Credit attributable to losses in a Capital Investment Fund or other funds ...............................................................................................

(2)

00

3.

Credit for tax withheld at source from Industrial Development dividends (Act No. 8 of 1987) ....................................................................

(3)

00

4.

Credit for the purchase of tax credits (Submit detail) ..........................................................................................................................

(4)

00

5.

Credit for the payment of additional duties on luxury vehicles under Act 42-2005 (See instructions) ...........................................................

(5)

00

6.

Returning Heroes and Wounded Warriors work opportunity tax credit (Schedule B4 Flow-through Entity) ....................................................

(6)

00

7.

Other credits not included on the preceding lines (Submit detail) (See instructions) ..................................................................................

(7)

00

8.

Total Tax Credits (Add lines 1 through 7) .........................................................................................................................................

(8)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6