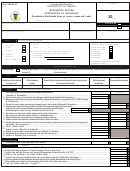

Form 480.60 Se - Informative Return Special Partnership - Partner'S Distributable Share On Income, Losses And Credits Page 5

ADVERTISEMENT

Instructions Informative Return - Special Partnership

Line 9 - Interest income from deposits in financial institutions

PART IV – NONRESIDENT ALIEN PARTNERS

Enter on this line the partner's distributable share on the income

Enter on line 1 of this Part IV the distributable share of a nonresident

derived by the special partnership from interest on investments or

alien partner on the special partnership’s net income and

deposits in cooperatives, savings associations authorized by the

corresponding withholding.

Federal Government or by the Puerto Rico Government, commercial

and mutual banks or in banking organizations established in Puerto

PART V - CREDITS

Rico, as well as the 10% amount withheld, if the election was made.

Line 1 - Credit for investment in a Capital Investment Fund,

Line 10 - Distributable share on income, gain or loss from a

other funds or direct investments

partnership or special partnership owned by the special

partnership

In order to claim this credit you must complete Schedule Q, available

in the Forms and Publications Division of the Department of the

The special partnership can be a partner in other special partnership

Treasury, and include it with Form 480.10(E).

(inferior partnership) or in a partnership.

Line 2 - Credit attributable to losses in a Capital Investment

This line will reflect the distributable share on income or loss from the

Fund or other funds

inferior partnership or from partnerships attributable to the special

partnership.

See instructions of Schedule Q and Q1 related with the allowable

credits for losses in investment funds.

Line 11 - Others

Line 3 - Credit for tax withheld at source from Industrial

Enter on this line the partner's distributable share on the total of other

Development dividends (Act No. 8 of 1987)

income not included on the preceding lines. If this line includes income

from different concepts, you must submit a schedule showing a

The partners of a special partnership will be entitled to claim,

breakdown of such income.

according to the percentage applicable to the distributable share on

the special partnership, a credit as established in Section 4(a) of the

Line 12 - Exempt income

Incentives Act, against the tax due for the year in which the special

partnership received as an investor a distribution from industrial

Enter on this line the partner’s distributable share on the total amount

development income.

of exempt income derived by the special partnership.

Enter on this line the partner’s distributable share on the tax withheld

Line 13 - Exempt income subject to alternate basic tax

at source to the special partnership on dividends from industrial

development income.

Enter on this line the individual partner’s distributable share on the total

amount of exempt income subject to alternate basic tax.

Line 4 - Credit for the purchase of tax credits

Line 14 - Adjustment for purposes of the alternate basic tax

Enter here the partner’s distributable share on the tax credits

acquired by the special partnership during the year through the

Enter here the partner’s distributable share in any adjustment to the

purchase, exchange or transfer from the primary investor.

income from the special partnership that, at the special partnership’s

individual partner level, are considered income subject to alternate

In order to claim this credit, the conveyor and the cessionary will

basic tax, including but not limited to, the adjustment for the

submit with the income tax return in the year of the cession, a sworn

determination of the share in the profit or loss from certain special

statement notifying the same to the Secretary.

partnerships under the percentage of completion method. Refer to

Regulation No. 8329 of January 9, 2013.

Line 5 - Credit for the payment of additional duties on luxury

vehicles under Act 42-2005

Line 15 - Adjustment for purposes of the alternative minimum tax

Enter on this line the partner’s distributable share on the credit for the

Enter here the partner’s distributable share in any adjustment to the

payment of additional duties on luxury vehicles. The amount of the credit

income from the special partnership that, at the special partnership’s

to be claimed will be equal to the amount of the duty paid by the special

corporate partner level, are considered income subject to alternative

partnership for the government label (marbete) for the luxury vehicle

minimum tax, including but not limited to, the adjustment for the

plus 5% annual interest on that amount from March 16, 2007 to December

determination of the share in the profit or loss from certain special

31, 2011, minus 33% for attorney’s fees. People who were part of the

partnerships under the percentage of completion method.

first list claimed 50% of the credit in the 2011 return and the remaining 50%

will be claimed in the 2012 return. On the other hand, people who were

Line 16 - Volume of business

identified for the second list will claim 50% of the credit in the 2012 return

and the remaining 50% in the 2013 return.

Enter here the partner’s distributable share on the special

partnership’s total volume of business for purposes of financial

Line 6 – Returning Heroes and Wounded Warriors work

statements filing requirement.

opportunity tax credit

Enter the partner’s distributable share on the credit determined by the

special partnership on Schedule B4 Flow-through Entity. This new

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6