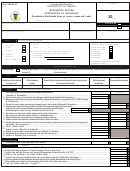

Form 480.60 S - Informative Return Partnership, Partner'S Distributable Share On Income, Losses And Credits Page 5

ADVERTISEMENT

Instructions Informative Return - Partnership

Line 10 - Distributable share on income, gain or loss from a

contributions or donations are used exclusively for public

.

partnership or special partnership owned by the partnership

purposes;

The partnership can be a partner in other partnership (inferior

university level accredited educational institutions established in

.

partnership) or in a special partnership.

Puerto Rico;

.

This line will reflect the partner's distributable share on income or loss

the José Jaime Pierluisi Foundation;

from the inferior partnership or from the special partnership attributable

.

to the partnership.

the Fund for the Financing of Cultural Affairs of Puerto Rico;

.

Line 11 - Others

the Puerto Rico Communitarian Foundation;

.

Enter the total of other income not included on the preceding lines.

the Corporation of the Symphonic Orchestra of Puerto Rico;

If this line includes income from different concepts, you must submit

a schedule showing a breakdown of such income.

the Fund for Services Against Remediable Catastrophic

Illnesses.

Line 12 - Exempt income

Include also the partner’s distributable share on the contributions made

Enter the partner’s distributable share on the total amount of exempt

to a municipality that conducts an activity or event of cultural or historic

income derived by the partnership.

value, as certified by the Institute of Puerto Rican Culture or the Cultural

Center of each municipality, or that makes possible the realization of any

Line 13 - Exempt income subject to alternate basic tax

cultural or historic work, in connection with the celebration of the centennial

foundation of said municipalities. If this type of contributions are included

Enter the individual partner’s distributable share on the total amount

on this line, you must submit a schedule itemizing those contributions.

of exempt income subject to alternate basic tax.

Line 17 - Volume of business

Line 14 - Adjustment for purposes of the alternate basic tax

Enter here the partner’s distributable share on the partnership’s total

Enter here the partner’s distributable share in any adjustment to the

volume of business for purposes of financial statements filing requirement.

income from the partnership that, at the partnership’s individual

partner level, are considered income subject to alternate basic tax,

PART IV - CREDITS

such as non deductible expenses for purposes of the alternate basic

tax at the individual partner level.

Line 1 - Credit for investment in a Capital Investment Fund,

other funds or direct investments

Line 15 - Adjustment for purposes of the alternative minimum

tax

In order to claim this credit you must complete Schedule Q, available in

the Forms and Publications Division of the Department of the Treasury.

Enter here the corporate partner’s distributable share in any

adjustment to the income from the partnership that, at the partner level,

Line 2 - Credit attributable to losses in a Capital Investment

are considered income subject to alternative minimum tax, including

Fund or other funds

but not limited to, expenses paid or accrued for services received by

related parties not engaged in trade or business in Puerto Rico.

See instructions of Schedule Q and Q1 related with the allowable

credits for losses in investment funds.

Line 16 – Charitable contributions

Line 3 - Credit for tax withheld at source from Industrial

Enter here the partner’s distributable share on the total charitable

Development dividends (Act No. 8 of 1987)

contributions paid during the taxable year, by the partnership, to a

nonprofit religious, charitable, scientific, literary, educational or

The partners of a partnership will be entitled to claim, according to

museological organizations, or to organizations for the prevention of

the percentage applicable to the distributable share on the

cruelty or abuse of children, the elderly or disabled, or to animals,

partnership, a credit as established in Section 4(a) of the Incentives

organizations for the prevention of domestic violence or hate crimes,

Act, against the tax due for the year in which the partnership received

or to organizations of war veterans in the United States or Puerto Rico.

as an investor a distribution from industrial development income.

However, no part of the net earnings of any organization to which you

contribute may benefit any private partner.

Enter on this line the partner’s distributable share on the tax withheld

at source to the partnership on dividends from industrial development

Enter here, also, the partner’s distributable share on the deduction for

income.

.

contributions paid to:

Line 4 - Credit for the purchase of tax credits

the Commonwealth of Puerto Rico, the United States

Government, or any of its states, territories or possessions, or any

Enter here the partner’s distributable share on the tax credits

political subdivision thereof, or the District of Columbia, when the

acquired by the partnership during the year through the purchase,

exchange or transfer from the primary investor.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6