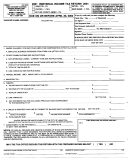

Form Ir - Individual Income Tax Return - Norwood - 2015 Page 2

ADVERTISEMENT

NORWOOD INCOME TAX FORM IR

SIDE TWO SCHEDULE

(Calculation for Line 2 Front Page)

19. Net profit(s)/loss from profession and/or business operation(s) Attach Federal Schedule C………………….

19. $__________

20. Net profit(s)/loss from rental property and/or partnership(s) Attach Federal Schedule E……………………..

20. $__________

21. Net profit(s)/loss from farm income Attach Federal Schedule F……………………………………………....

21. $__________

22. Total net profit(s)/losses from business activities (Total lines 19, 20 and 21)…………………………………. 22. $__________

23. Business losses from previous years’ tax returns (if available) Maximum of three (3) years carryover……….

23. $__________

24. Other taxable income from business activities (Total line 22 minus 23)……………………………………….

24. $__________

25. Other taxable income (see instructions – Lines 2 and 25)……………………………………………………… 25. $__________

26. Total other taxable income (report this amount on Line 2 – front page)……………………………………….

26. $__________

ADDITIONAL INFORMATION

If your tax status has changed, please complete applicable items below:

A. I permanently discontinued work and have no taxable income after:___________________________ (State reason in “C”

below)

B. I sold the following rental property subject to Norwood tax:

Purchaser’s Name and Address

Location Address

Date Sold:

____________________________

_________________

__________________________________________

____________________________

_________________

__________________________________________

C. Additional Notations:______________________________________________________________________________________

_____________________________________________________________________________________________________

FILING INSTRUCTIONS

MANDATORY FILING: All residents 16 years and older are required to file a return whether or not any tax is due and regardless if you rent or own. If for some

reason, you do not have any taxable income, please return your form with an explanation and applicable verification and documentation. If you do not respond, your

th

account will be considered delinquent. To avoid penalties and interest, your tax return and payment must be received on or before April 18

.

Line 13 Your overpayment may either be credited to next year’s taxes or

Line 1 Is to be grand total of all gross wages, salaries and compensation from

all W-2 forms for the year. Generally use box 5 on the W-2.

refunded to you.

Attach copies of W-2s and a copy of your Federal 1040 Form.

Line 14 through 18 – Calculate estimated tax due for 2016.

Line 2 Is for reporting such items as income from business activities, non-

Line 19 through 23 Self Explanatory – call office with further questions.

employee income listed on a 1099-MISC, sales commissions, fees,

gambling winnings and other 1099 income received not pursuant to

retirement and other taxable income. (See note for Line 24.)

Line 24 Total of other taxable income from business activities. NOTE:

Attach Federal Schedules.

LOSSES FROM BUSINESS, INCLUDING RENTALS, MAY

NOT BE OFFSET AGAINST PERSONAL SERVICES

Line 3 If during the tax year, you incurred expenses directly connected with

COMPENSATION. HOWEVER, LOSSES MAY BE CARRIED

your employment and essential to your earnings, they are allowable as a

OVER FOR A MAXIMUM OF THREE YEARS.

deduction from your gross earnings. Expenses are deductible only if

Line 25 Show other taxable income not from business activities – see items

recognized for Federal Income Tax purposes authorized by Norwood

Earnings Tax Regulations and required by your employer. Such items as

listed in Line 2 instructions.

clothing, lodging, transportation to and from place of employment are

not allowable. An itemized statement of all claimed expenses (copy of

Line 26 Total of other income. Add Line 24 and 25. This amount should

Federal travel expense sheet) must be furnished. All claimed expenses

be shown on front page, Line 2.

must be substantiated by actual records. Federal 2106 expenses are

allowed with accompanying Schedule A.

PENALTIES AND INTEREST : UNPAID TAXES ACCUMULATE

PENALTIES AND INTEREST AT 1% PER MONTH EACH (2% TOTAL

Line 4 Total taxable income for Norwood.

PER MONTH). MINIMUM LATE PENALTY IS $20.00.

Line 5 Tax due before credits – multiply Line 4 by 2%.

EXTENSION POLICY – A copy of your federal extension or other written

request must be filed with the Norwood Tax Office by the due date of the

Line 6 Estimated tax payments made to Norwood for tax year 2015.

Norwood return. An extension does not extend the time to pay taxes.

NOTES: Protection of Taxpayer Information – Any information gained

Line 7 Taxes withheld by employer and paid to Norwood.

as a result of returns, investigations, etc., shall be confidential. No

Line 8 Taxes withheld by employer and paid to other localities.

.

disclosures shall be made except for official purposes or as ordered by a

Credit is only allowed on income taxed in another city or county

court of competent jurisdiction or where disclosure is necessary to

conduct a hearing before the Board of Appeals.

Line 9 Overpayments from prior years’ tax returns.

Be sure to complete the 2016 Estimated Tax Form on the bottom of page 1

Line 10 Total credit for the tax year.

if tax will be more than $200.00.

RETIREES: If you no longer work at all, please attach a copy of your annual

Line 11 This is your tax due. Subtract Line 10 from Line 5. Balance must

Social Security statement and a copy of your annual 1099 Form for your

be remitted with this return.

pension received, if any. Also, indicate the date of your retirement on Line C

above OR provide a statement from your former employer showing your

Line 12 This is the amount you overpaid. Subtract Line 5 from Line 10.

retirement date. Please advise your date of birth on Line C above, also.

TAX FORMS ARE ALSO AVAILABLE AT - CLICK ON TAX DEPARTMENT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2