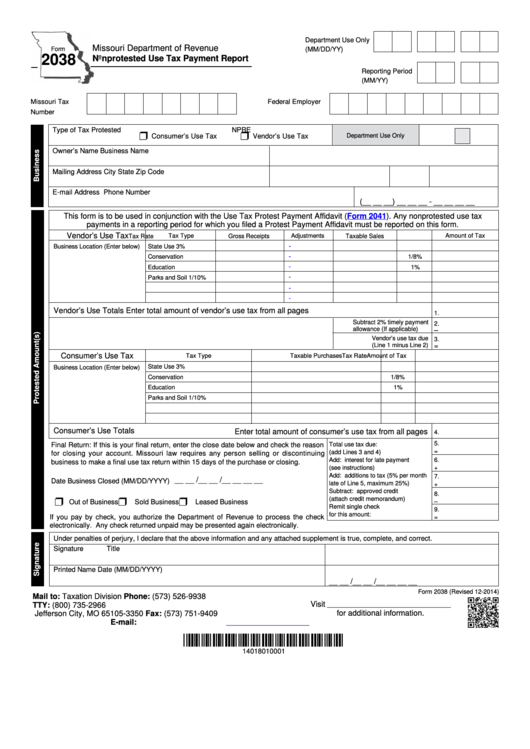

Reset Form

Print Form

Department Use Only

Missouri Department of Revenue

Form

(MM/DD/YY)

2038

Nonprotested Use Tax Payment Report

Reporting Period

(MM/YY)

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Type of Tax Protested

NPRE

r

r

Department Use Only

Consumer’s Use Tax

Vendor’s Use Tax

Owner’s Name

Business Name

Mailing Address

City

State

Zip Code

E-mail Address

Phone Number

(__ __ __) __ __ __ - __ __ __ __

This form is to be used in conjunction with the Use Tax Protest Payment Affidavit

(Form

2041). Any nonprotested use tax

payments in a reporting period for which you filed a Protest Payment Affidavit must be reported on this form.

Vendor’s Use Tax

Amount of Tax

Tax Type

Gross Receipts

Adjustments

Taxable Sales

Tax Rate

-

Business Location (Enter below)

State Use

3%

-

Conservation

1/8%

-

Education

1%

-

Parks and Soil

1/10%

-

Reset This Section Only

-

Vendor’s Use Totals

Enter total amount of vendor’s use tax from all pages

1.

Subtract 2% timely payment

2.

allowance (If applicable)

–

Vendor’s use tax due

3.

(Line 1 minus Line 2)

=

Consumer’s Use Tax

Tax Type

Taxable Purchases

Tax Rate

Amount of Tax

State Use

3%

Business Location (Enter below)

Conservation

1/8%

Education

1%

Parks and Soil

1/10%

Reset This Section Only

Consumer’s Use Totals

Enter total amount of consumer’s use tax from all pages

4.

5.

Final Return: If this is your final return, enter the close date below and check the reason

Total use tax due:

=

(add Lines 3 and 4).............................

for closing your account. Missouri law requires any person selling or discontinuing

Add: interest for late payment

6.

business to make a final use tax return within 15 days of the purchase or closing.

(see instructions) ................................

+

Add: additions to tax (5% per month

7.

__ __ /__ __ /__ __ __ __

Date Business Closed (MM/DD/YYYY)

late of Line 5, maximum 25%) ...........

+

Subtract: approved credit

8.

(attach credit memorandum) ..............

r

r

r

Out of Business

Sold Business

Leased Business

–

Remit single check

9.

for this amount: ...................................

If you pay by check, you authorize the Department of Revenue to process the check

=

electronically. Any check returned unpaid may be presented again electronically.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Signature

Title

Printed Name

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

Form 2038 (Revised 12-2014)

Mail to:

Taxation Division

Phone: (573) 526-9938

Visit

P.O. Box 3350

TTY: (800) 735-2966

for additional information.

Jefferson City, MO 65105-3350

Fax: (573) 751-9409

E-mail:

salesuse@dor.mo.gov

*14018010001*

14018010001

1

1 2

2