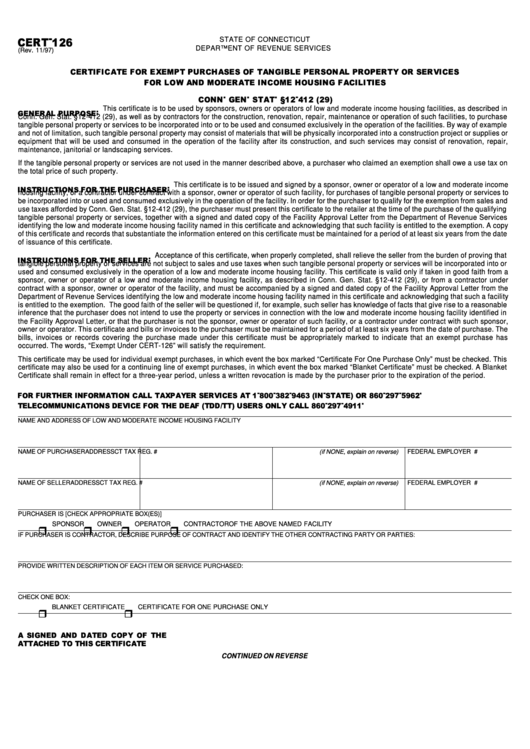

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

(Rev. 11/97)

This certificate is to be used by sponsors, owners or operators of low and moderate income housing facilities, as described in

Conn. Gen. Stat. §12-412 (29), as well as by contractors for the construction, renovation, repair, maintenance or operation of such facilities, to purchase

tangible personal property or services to be incorporated into or to be used and consumed exclusively in the operation of the facilities. By way of example

and not of limitation, such tangible personal property may consist of materials that will be physically incorporated into a construction project or supplies or

equipment that will be used and consumed in the operation of the facility after its construction, and such services may consist of renovation, repair,

maintenance, janitorial or landscaping services.

If the tangible personal property or services are not used in the manner described above, a purchaser who claimed an exemption shall owe a use tax on

the total price of such property.

This certificate is to be issued and signed by a sponsor, owner or operator of a low and moderate income

housing facility, or a contractor under contract with a sponsor, owner or operator of such facility, for purchases of tangible personal property or services to

be incorporated into or used and consumed exclusively in the operation of the facility. In order for the purchaser to qualify for the exemption from sales and

use taxes afforded by Conn. Gen. Stat. §12-412 (29), the purchaser must present this certificate to the retailer at the time of the purchase of the qualifying

tangible personal property or services, together with a signed and dated copy of the Facility Approval Letter from the Department of Revenue Services

identifying the low and moderate income housing facility named in this certificate and acknowledging that such facility is entitled to the exemption. A copy

of this certificate and records that substantiate the information entered on this certificate must be maintained for a period of at least six years from the date

of issuance of this certificate.

Acceptance of this certificate, when properly completed, shall relieve the seller from the burden of proving that

tangible personal property or services are not subject to sales and use taxes when such tangible personal property or services will be incorporated into or

used and consumed exclusively in the operation of a low and moderate income housing facility. This certificate is valid only if taken in good faith from a

sponsor, owner or operator of a low and moderate income housing facility, as described in Conn. Gen. Stat. §12-412 (29), or from a contractor under

contract with a sponsor, owner or operator of the facility, and must be accompanied by a signed and dated copy of the Facility Approval Letter from the

Department of Revenue Services identifying the low and moderate income housing facility named in this certificate and acknowledging that such a facility

is entitled to the exemption. The good faith of the seller will be questioned if, for example, such seller has knowledge of facts that give rise to a reasonable

inference that the purchaser does not intend to use the property or services in connection with the low and moderate income housing facility identified in

the Facility Approval Letter, or that the purchaser is not the sponsor, owner or operator of such facility, or a contractor under contract with such sponsor,

owner or operator. This certificate and bills or invoices to the purchaser must be maintained for a period of at least six years from the date of purchase. The

bills, invoices or records covering the purchase made under this certificate must be appropriately marked to indicate that an exempt purchase has

occurred. The words, “Exempt Under CERT-126” will satisfy the requirement.

This certificate may be used for individual exempt purchases, in which event the box marked “Certificate For One Purchase Only” must be checked. This

certificate may also be used for a continuing line of exempt purchases, in which event the box marked “Blanket Certificate” must be checked. A Blanket

Certificate shall remain in effect for a three-year period, unless a written revocation is made by the purchaser prior to the expiration of the period.

NAME AND ADDRESS OF LOW AND MODERATE INCOME HOUSING FACILITY

NAME OF PURCHASER

ADDRESS

CT TAX REG. # (if NONE, explain on reverse)

FEDERAL EMPLOYER I.D. #

CT TAX REG. # (if NONE, explain on reverse)

NAME OF SELLER

ADDRESS

FEDERAL EMPLOYER I.D. #

PURCHASER IS [CHECK APPROPRIATE BOX(ES)]

SPONSOR

OWNER

OPERATOR

CONTRACTOR

OF THE ABOVE NAMED FACILITY

IF PURCHASER IS CONTRACTOR, DESCRIBE PURPOSE OF CONTRACT AND IDENTIFY THE OTHER CONTRACTING PARTY OR PARTIES:

PROVIDE WRITTEN DESCRIPTION OF EACH ITEM OR SERVICE PURCHASED:

CHECK ONE BOX:

BLANKET CERTIFICATE

CERTIFICATE FOR ONE PURCHASE ONLY

CONTINUED ON REVERSE

1

1 2

2