Form Clt-4s - Montana Small Business Corporation Information Return - 2002 Page 2

ADVERTISEMENT

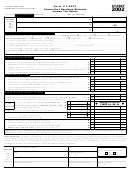

Form CLT-4S (2002)

FEIN:

Schedule K

Apportionment Factors for Multistate Taxpayers

A. Everywhere

B. Montana

C. Factor

1. Property Factor:

(B divided by A = C)

Use average value for real and tangible personal property

Land

Buildings

Machinery and equipment

Furniture and fixtures

Inventories

Supplies and other

Rents multiplied by 8

Total property

%

2. Payroll Factor:

Compensation of officers

Salaries and wages

Payroll included in:

Cost of goods sold

Repairs

Other deductions

%

Total payroll

3. Sales (Gross Receipts) Factor:

Gross sales, less returns

Other (attach schedule)

Total sales

%

4. Sum of factors (add lines 1, 2, and 3)

%

5. Apportionment factor (1/3 of line 4; if less than 3 factors exist, see instructions)

(Enter here and on line 16, page 1)

%

Declaration

The return must be signed by one of the following: president, vice-president, treasurer, assistant treasurer, or chief accounting

officer. I, the undersigned officer of the corporation for which this return is made, hereby declare that this return, including all

accompanying schedules and statements, is to the best of my knowledge and belief, a true, correct and complete return, made in

good faith for the income period stated, pursuant to the Montana statutes and regulations.

Signature of Officer

Date

Name of Person or Firm Preparing Return

Date

Title

Telephone Number

Address

Zip Code

Telephone Number

Check here to authorize the Montana Department of Revenue to discuss your return with the individual/preparer listed above.

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3