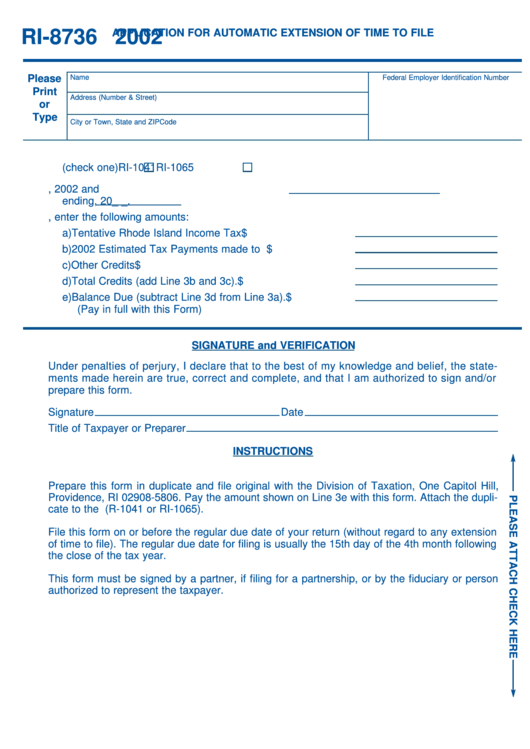

Form Ri-8736 - Application For Automatic Extension Of Time To File R.i. Partnership Or R.i. Fiduciary Income Tax Return - 2002

ADVERTISEMENT

2002

RI-8736

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE

R.I. PARTNERSHIP OR R.I. FIDUCIARY INCOME TAX RETURN

Please

Name

Federal Employer Identification Number

Print

Address (Number & Street)

or

Type

City or Town, State and ZIP Code

1. An automatic extension of time for 4 months is requested in which to file

(check one)

RI-1041

RI-1065

2. For calendar year 2002 or fiscal year beginning

, 2002 and

ending

, 20_ _.

3. If this extension is requested for Form RI-1041, enter the following amounts:

a) Tentative Rhode Island Income Tax

$

b) 2002 Estimated Tax Payments made to R.I.

$

c) Other Credits

$

d) Total Credits (add Line 3b and 3c).

$

e) Balance Due (subtract Line 3d from Line 3a).

$

(Pay in full with this Form)

SIGNATURE and VERIFICATION

Under penalties of perjury, I declare that to the best of my knowledge and belief, the state-

ments made herein are true, correct and complete, and that I am authorized to sign and/or

prepare this form.

Signature

Date

Title of Taxpayer or Preparer

INSTRUCTIONS

Prepare this form in duplicate and file original with the Division of Taxation, One Capitol Hill,

Providence, RI 02908-5806. Pay the amount shown on Line 3e with this form. Attach the dupli-

cate to the R.I. form you file (R-1041 or RI-1065).

File this form on or before the regular due date of your return (without regard to any extension

of time to file). The regular due date for filing is usually the 15th day of the 4th month following

the close of the tax year.

This form must be signed by a partner, if filing for a partnership, or by the fiduciary or person

authorized to represent the taxpayer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1