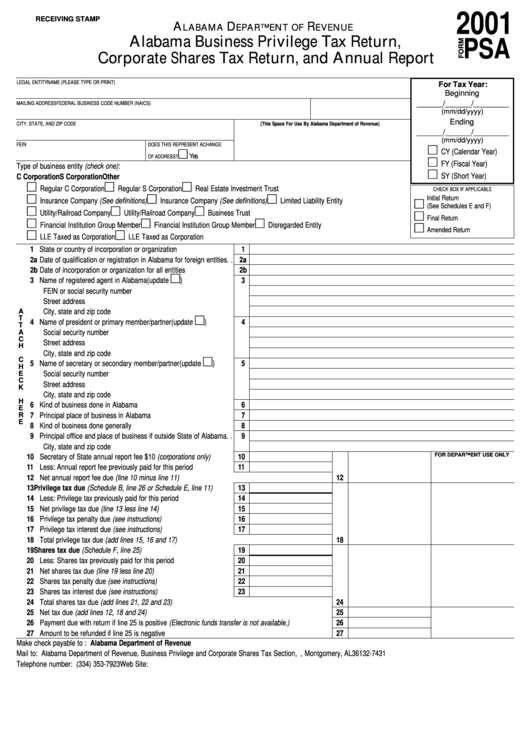

Form Psa - Alabama Business Privilege Tax Return, Corporate Shares Tax Return, And Annual Report - 2001

ADVERTISEMENT

2001

RECEIVING STAMP

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Alabama Business Privilege Tax Return,

PSA

Corporate Shares Tax Return, and Annual Report

LEGAL ENTITY NAME (PLEASE TYPE OR PRINT)

For Tax Year:

Beginning

______/______/________

MAILING ADDRESS

FEDERAL BUSINESS CODE NUMBER (NAICS)

(mm/dd/yyyy)

Ending

CITY, STATE, AND ZIP CODE

(This Space For Use By Alabama Department of Revenue)

______/______/________

(mm/dd/yyyy)

FEIN

DOES THIS REPRESENT A CHANGE

CY (Calendar Year)

Yes

OF ADDRESS?

FY (Fiscal Year)

Type of business entity (check one):

SY (Short Year)

C Corporation

S Corporation

Other

Regular C Corporation

Regular S Corporation

Real Estate Investment Trust

CHECK BOX IF APPLICABLE

Initial Return

Insurance Company (See definitions)

Insurance Company (See definitions)

Limited Liability Entity

(See Schedules E and F)

Utility/Railroad Company

Utility/Railroad Company

Business Trust

Final Return

Financial Institution Group Member

Financial Institution Group Member

Disregarded Entity

Amended Return

LLE Taxed as Corporation

LLE Taxed as Corporation

1 State or country of incorporation or organization . . . . . . . . . . . . . . .

1

2a Date of qualification or registration in Alabama for foreign entities. .

2a

2b Date of incorporation or organization for all entities . . . . . . . . . . . . .

2b

3 Name of registered agent in Alabama. . . . . . . . . . . . . . (update

)

3

FEIN or social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

T

4 Name of president or primary member/partner . . . . . . . (update

)

4

T

A

Social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C

Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

H

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C

5 Name of secretary or secondary member/partner . . . . (update

)

5

H

E

Social security number . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

C

Street address . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

K

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

H

6 Kind of business done in Alabama . . . . . . . . . . . . . . . . . . . . . . . . . .

6

E

R

7 Principal place of business in Alabama. . . . . . . . . . . . . . . . . . . . . . .

7

E

8 Kind of business done generally . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Principal office and place of business if outside State of Alabama. .

9

City, state and zip code . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

FOR DEPARTMENT USE ONLY

10 Secretary of State annual report fee $10 (corporations only) . . . . . .

10

11 Less: Annual report fee previously paid for this period . . . . . . . . . . .

11

12 Net annual report fee due (line 10 minus line 11). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Privilege tax due (Schedule B, line 26 or Schedule E, line 11). . . .

13

14 Less: Privilege tax previously paid for this period . . . . . . . . . . . . . . .

14

15 Net privilege tax due (line 13 less line 14) . . . . . . . . . . . . . . . . . . . .

15

16 Privilege tax penalty due (see instructions). . . . . . . . . . . . . . . . . . . .

16

17 Privilege tax interest due (see instructions) . . . . . . . . . . . . . . . . . . .

17

18 Total privilege tax due (add lines 15, 16 and 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 Shares tax due (Schedule F, line 25). . . . . . . . . . . . . . . . . . . . . . . .

19

20 Less: Shares tax previously paid for this period . . . . . . . . . . . . . . . .

20

21 Net shares tax due (line 19 less line 20). . . . . . . . . . . . . . . . . . . . . .

21

22 Shares tax penalty due (see instructions) . . . . . . . . . . . . . . . . . . . . .

22

23 Shares tax interest due (see instructions). . . . . . . . . . . . . . . . . . . . .

23

24 Total shares tax due (add lines 21, 22 and 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Net tax due (add lines 12, 18 and 24) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26 Payment due with return if line 25 is positive (Electronic funds transfer is not available.). . . . . . . . . . . .

26

27 Amount to be refunded if line 25 is negative . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

Make check payable to : Alabama Department of Revenue

Mail to: Alabama Department of Revenue, Business Privilege and Corporate Shares Tax Section, P.O. Box 327431, Montgomery, AL 36132-7431

Telephone number: (334) 353-7923

Web Site:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4