Arizona Form 308 - Credit For Increased Research Activities - 2002

ADVERTISEMENT

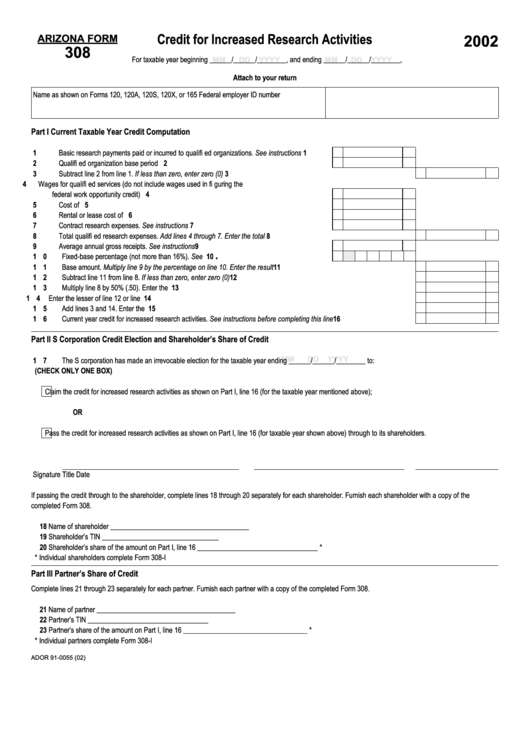

Credit for Increased Research Activities

ARIZONA FORM

2002

308

For taxable year beginning ______/______/________, and ending ______/______/________,

MM

MM

DD

DD

YYYY

YYYY

MM

MM

DD

DD

YYYY

YYYY

Attach to your return

Name as shown on Forms 120, 120A, 120S, 120X, or 165

Federal employer ID number

Part I

Current Taxable Year Credit Computation

1 Basic research payments paid or incurred to qualifi ed organizations. See instructions ...................

1

2 Qualifi ed organization base period amount ......................................................................................

2

3 Subtract line 2 from line 1. If less than zero, enter zero (0) .............................................................................................................

3

4 Wages for qualifi ed services (do not include wages used in fi guring the

federal work opportunity credit) ........................................................................................................

4

5 Cost of supplies ................................................................................................................................

5

6 Rental or lease cost of computers ....................................................................................................

6

7 Contract research expenses. See instructions .................................................................................

7

8 Total qualifi ed research expenses. Add lines 4 through 7. Enter the total .......................................................................................

8

9 Average annual gross receipts. See instructions..............................................................................

9

.

10 Fixed-base percentage (not more than 16%). See instructions........................................................

10

11 Base amount. Multiply line 9 by the percentage on line 10. Enter the result ...................................................................................

11

12 Subtract line 11 from line 8. If less than zero, enter zero (0) ...........................................................................................................

12

13 Multiply line 8 by 50% (.50). Enter the result ...................................................................................................................................

13

14 Enter the lesser of line 12 or line 13 ................................................................................................................................................

14

15 Add lines 3 and 14. Enter the total...................................................................................................................................................

15

16 Current year credit for increased research activities. See instructions before completing this line .................................................

16

Part II

S Corporation Credit Election and Shareholder’s Share of Credit

MM

MM

DD

DD

YYYY

YYYY

17 The S corporation has made an irrevocable election for the taxable year ending ______/______/________ to:

(CHECK ONLY ONE BOX)

Claim the credit for increased research activities as shown on Part I, line 16 (for the taxable year mentioned above);

OR

Pass the credit for increased research activities as shown on Part I, line 16 (for taxable year shown above) through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholder, complete lines 18 through 20 separately for each shareholder. Furnish each shareholder with a copy of the

completed Form 308.

18 Name of shareholder ______________________________________

19 Shareholder’s TIN ________________________________

20 Shareholder’s share of the amount on Part I, line 16 _________________________________ *

* Individual shareholders complete Form 308-I

Part III

Partner’s Share of Credit

Complete lines 21 through 23 separately for each partner. Furnish each partner with a copy of the completed Form 308.

21 Name of partner ______________________________________

22 Partner’s TIN _________________________________

23 Partner’s share of the amount on Part I, line 16 __________________________________ *

* Individual partners complete Form 308-I

ADOR 91-0055 (02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3