Form Pit-X - New Mexico Personal Income Tax - 2012 Page 2

ADVERTISEMENT

*120170200*

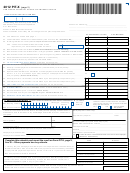

2012 PIT-X

(page 2)

NEW MEXICO PERSONAL INCOME TAX AMENDED RETURN

YOUR SOCIAL SECURITY NUMBER

If submitting this return by mail, send to:

Reason for amending:______________________________________

NM Taxation and Revenue Department

________________________________________________________

P. O. Box 25122

Santa Fe, New Mexico 87504-5122

________________________________________________________

Attach schedules even if they did not change from the previously filed return.

AS PREVIOUSLY FILED

AS AMENDED

23. The amount on line 22 from page 1............................................................................................

23

24. Total claimed on rebate and credit schedule (Line 27 of PIT-RC; attach PIT-RC) .....................

24

25. Working families tax credit (

)...............

You must complete both lines 25 and 25a or the deduction will be denied.

25

25a. The amount of Federal Earned Income Credit

25a

reported on your 2012 federal income tax return...........

26

26. New Mexico income tax withheld (

) ...........................

Attach annual statements of income & withholding

27

27. New Mexico income tax withheld from oil & gas proceeds (Attach 1099-Misc or RPD-41285)

28

28. New Mexico income tax withheld from a pass-through entity (Attach 1099-Misc or RPD-41359)

29

29. 2012 estimated income tax payments (See PIT-1 instructions) ................................................

30. Other payments less any refunds from schedule below. ............................................................

30

31.

TOTAL PAYMENTS AND CREDITS

(Add lines 24 through 30).................................................

31

32.

TAX DUE

(If line 23 is greater than line 31, enter the difference here.)....................................

32

33. Penalty on underpayment of estimated tax (Leave blank if you want penalty

33

computed for you.)......................................................................................................................

34. Special method allowed for calculation of underpayment of estimated tax penalty.

34

Enter 1, 2, 3, 4 or 5 in the box if you owe penalty on underpayment of estimated tax

and you qualify. (Attach RPD-41272) ........................................................................................

35. Penalty (See PIT-1 instructions. Leave blank if you want penalty computed for you.) ...............

35

36. Interest (See PIT-1 instructions. Leave blank if you want interest computed for you.) ...............

36

37.

TAX, PENALTY AND INTEREST DUE

(Add lines 32, 33, 35 and 36) .......................................

37

38

38.

OVERPAYMENT

(If line 23 is less than line 31, enter the difference here.) .............................

39. Refund donations (Line 11 of PIT-D; attach PIT-D) ...................................................................

39

40. Amount from line 38 you want applied to your 2013 Estimated Tax .......................................

40

41.

AMOUNT TO BE REFUNDED TO YOU

(Line 38 minus lines 39 and 40)................................

41

REQUIRED: WILL THIS REFUND GO TO OR

!! REFUND EXPRESS !!

RE.4

HAVE IT DIRECTLY DEPOSITED! SEE INSTRUCTIONS AND FILL IN 1, 2, 3 AND 4.

THROUGH AN ACCOUNT LOCATED OUTSIDE

Type: Checking

Savings

RE.3

THE UNITED STATES?

If yes, you may not use this refund

Routing number:

RE.1

Enter "X"

Enter "X"

delivery option. See instructions.

You must answer

Y E S

N O

Account number:

this question.

RE.2

I declare I have examined this return, including accompanying schedules and

Paid preparer's use only:

statements, and to the best of my knowledge and belief it is true, correct and

_______________________________________ ___________

complete.

Signature of preparer

Date

Your signature

Date

Firm's name (or yours if self-employed)

P.1

NM CRS identification number_________________________

P.2

Spouse's signature

Date

Preparer's PTIN________________________________

P.3

(If filing jointly, BOTH must sign even if only one had income.)

FEIN______________________________________________

P.4

Preparer's phone number ______________________________

P.5

Taxpayer's phone number

Check this box if Form RPD-41338 is on file for this taxpayer.

P.6

Taxpayer's E-mail address ___________________________________________

(See PIT-1 instructions.)

Complete this schedule and report the result on Form PIT-X, page 2,

Date

Amount

line 30 -- Other payments less any refunds.

1. List any tax year 2012 payments made prior to or separate from the submission of

this amended return. Also, enter the date of the payment. Do not include any estimated

or carryforward payments reported on line 29, Form PIT-X. If you have made more

than four payments, attach a schedule.

1a Sum of payments

2. List any refunds received from a previously filed 2012 New Mexico personal

income tax return. Do not include any interest the New Mexico Taxation and

Revenue Department paid, if any, on your refund.

2a Sum of refunds

3. Subtract the sum of refunds reported on line 2a from the sum of payments reported on line 1a.

Enter here and on line 30, Form PIT-X, page 2. (May be a negative number)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2