Sales/use Tax Return - City Of Northglenn

ADVERTISEMENT

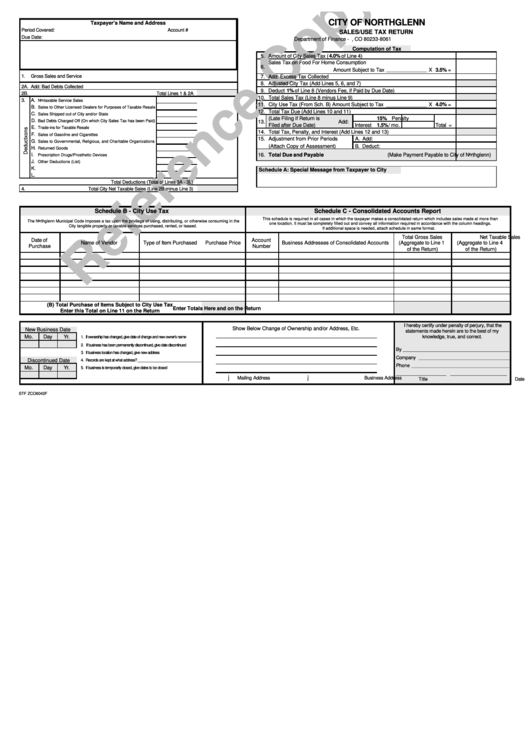

CITY OF NORTHGLENN

Taxpayer’s Name and Address

Period Covered:

Account #

SALES/USE TAX RETURN

Due Date:

Department of Finance - P.O. Box 330061 - Northglenn, CO 80233-8061

Computation of Tax

5. Amount of City Sales Tax (

4.0%

of Line 4)

Sales Tax on Food For Home Consumption

6.

X

=

Amount Subject to Tax

3.5%

__________________

1.

Gross Sales and Service

7. Add: Excess Tax Collected

8. Adjusted City Tax (Add Lines 5, 6, and 7)

2A. Add: Bad Debts Collected

9. Deduct

1%

of Line 8 (Vendors Fee, if Paid by Due Date)

2B.

Total Lines 1 & 2A

10. Total Sales Tax (Line 8 minus Line 9)

3.

A.

Nontaxable Service Sales

X

=

11. City Use Tax (From Sch. B) Amount Subject to Tax

4.0%

__________________

B.

Sales to Other Licensed Dealers for Purposes of Taxable Resale

12. Total Tax Due (Add Lines 10 and 11)

C.

Sales Shipped out of City and/or State

(Late Filing if Return is

Penalty

15%

D.

Bad Debts Charged Off (On which City Sales Tax has been Paid)

13.

Add:

=

Filed after Due Date)

Interest

1.5%

/ mo.

Total

E.

Trade-ins for Taxable Resale

14. Total Tax, Penalty, and Interest (Add Lines 12 and 13)

F.

Sales of Gasoline and Cigarettes

15. Adjustment from Prior Periods

A. Add:

G.

Sales to Governmental, Religious, and Charitable Organizations

(Attach Copy of Assessment)

B. Deduct:

H.

Returned Goods

I.

Prescription Drugs/Prosthetic Devices

16.

Total Due and Payable

(Make Payment Payable to City of Northglenn)

J.

Other Deductions (List)

K.

Schedule A: Special Message from Taxpayer to City

L.

Total Deductions (Total of Lines 3A - 3L)

4.

Total City Net Taxable Sales (Line 2B minus Line 3)

Schedule B - City Use Tax

Schedule C - Consolidated Accounts Report

This schedule is required in all cases in which the taxpayer makes a consolidated return which includes sales made at more than

The Northglenn Municipal Code imposes a tax upon the privilege of using, distributing, or otherwise consuming in the

one location. It must be completely filled out and convey all information required in accordance with the column headings.

City tangible property or taxable services purchased, rented, or leased.

If additional space is needed, attach schedule in same format.

Total Gross Sales

Net Taxable Sales

Date of

Account

Name of Vendor

Type of Item Purchased

Purchase Price

Business Addresses of Consolidated Accounts

(Aggregate to Line 1

(Aggregate to Line 4

Purchase

Number

of the Return)

of the Return)

(B) Total Purchase of Items Subject to City Use Tax

Enter Totals Here and on the Return

Enter this Total on Line 11 on the Return

I hereby certify under penalty of perjury, that the

Show Below Change of Ownership and/or Address, Etc.

New Business Date

statements made herein are to the best of my

Mo.

Day

Yr.

knowledge, true, and correct.

1. If ownership has changed, give date of change and new owner’s name

2.

If business has been permanently discontinued, give date discontinued

By

_______________________________________________

3. If business location has changed, give new address

Company

________________________________________

Discontinued Date

4. Records are kept at what address?

____________________________

Phone

___________________________________________

Mo.

Day

Yr.

5. If business is temporarily closed, give dates to be closed

______________________ _________________________

j

j

Mailing Address

Business Address

Title

Date

STF ZCO6042F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1