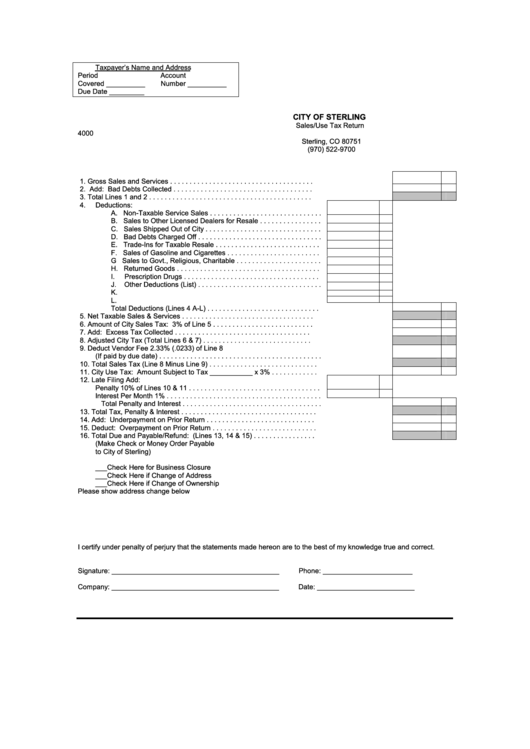

Sales/use Tax Return - City Of Sterling

ADVERTISEMENT

Taxpayer’s Name and Address

Period

Account

Covered __________

Number __________

Due Date _________

CITY OF STERLING

Sales/Use Tax Return

P.O. Box 4000

Sterling, CO 80751

(970) 522-9700

1.

Gross Sales and Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

Add: Bad Debts Collected . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Total Lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Deductions:

A. Non-Taxable Service Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B. Sales to Other Licensed Dealers for Resale . . . . . . . . . . . . . . . .

C. Sales Shipped Out of City . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D. Bad Debts Charged Off . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

E. Trade-Ins for Taxable Resale . . . . . . . . . . . . . . . . . . . . . . . . . . .

F. Sales of Gasoline and Cigarettes . . . . . . . . . . . . . . . . . . . . . . . .

G Sales to Govt., Religious, Charitable . . . . . . . . . . . . . . . . . . . . . .

H. Returned Goods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I.

Prescription Drugs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

J.

Other Deductions (List) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

K.

L.

Total Deductions (Lines 4 A-L) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

Net Taxable Sales & Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

Amount of City Sales Tax: 3% of Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

Add: Excess Tax Collected . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Adjusted City Tax (Total Lines 6 & 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

Deduct Vendor Fee 2.33% (.0233) of Line 8

(If paid by due date) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Total Sales Tax (Line 8 Minus Line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. City Use Tax: Amount Subject to Tax ___________ x 3% . . . . . . . . . . . .

12. Late Filing Add:

Penalty 10% of Lines 10 & 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest Per Month 1% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Penalty and Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Total Tax, Penalty & Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Add: Underpayment on Prior Return . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Deduct: Overpayment on Prior Return . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Total Due and Payable/Refund: (Lines 13, 14 & 15) . . . . . . . . . . . . . . . .

(Make Check or Money Order Payable

to City of Sterling)

___Check Here for Business Closure

___Check Here if Change of Address

___Check Here if Change of Ownership

Please show address change below

I certify under penalty of perjury that the statements made hereon are to the best of my knowledge true and correct.

Signature: ___________________________________________

Phone: _______________________

Company: ___________________________________________

Date: _________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1