Instructions For Form L-1040 - 2013-2014

ADVERTISEMENT

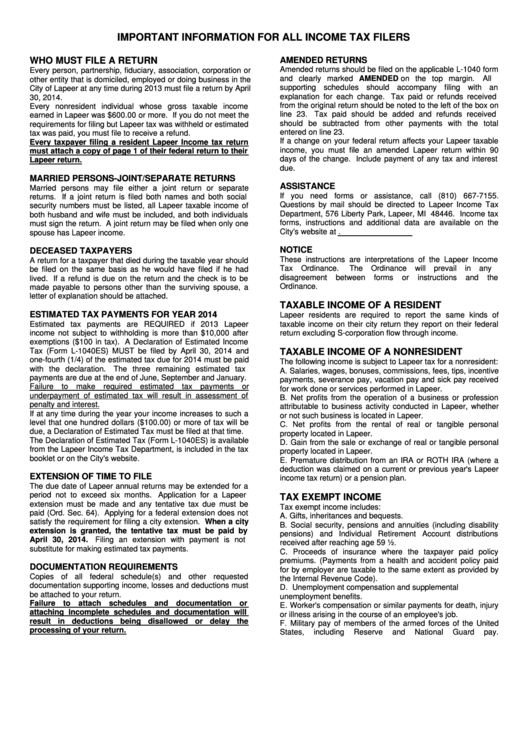

IMPORTANT INFORMATION FOR ALL INCOME TAX FILERS

WHO MUST FILE A RETURN

AMENDED RETURNS

Amended returns should be filed on the applicable L-1040 form

Every person, partnership, fiduciary, association, corporation or

and clearly marked AMENDED on the top margin.

All

other entity that is domiciled, employed or doing business in the

supporting schedules should accompany filing with an

City of Lapeer at any time during 2013 must file a return by April

explanation for each change. Tax paid or refunds received

30, 2014.

from the original return should be noted to the left of the box on

Every nonresident individual whose gross taxable income

line 23.

Tax paid should be added and refunds received

earned in Lapeer was $600.00 or more. If you do not meet the

should be subtracted from other payments with the total

requirements for filing but Lapeer tax was withheld or estimated

entered on line 23.

tax was paid, you must file to receive a refund.

If a change on your federal return affects your Lapeer taxable

Every taxpayer filing a resident Lapeer Income tax return

income, you must file an amended Lapeer return within 90

must attach a copy of page 1 of their federal return to their

days of the change. Include payment of any tax and interest

Lapeer return.

due.

MARRIED PERSONS-JOINT/SEPARATE RETURNS

ASSISTANCE

Married persons may file either a joint return or separate

If you need forms or assistance, call (810) 667-7155.

returns. If a joint return is filed both names and both social

Questions by mail should be directed to Lapeer Income Tax

security numbers must be listed, all Lapeer taxable income of

Department, 576 Liberty Park, Lapeer, MI 48446. Income tax

both husband and wife must be included, and both individuals

forms, instructions and additional data are available on the

must sign the return. A joint return may be filed when only one

City's website at

spouse has Lapeer income.

NOTICE

DECEASED TAXPAYERS

These instructions are interpretations of the Lapeer Income

A return for a taxpayer that died during the taxable year should

Tax

Ordinance.

The

Ordinance

will

prevail

in

any

be filed on the same basis as he would have filed if he had

disagreement

between

forms

or

instructions

and

the

lived. If a refund is due on the return and the check is to be

Ordinance.

made payable to persons other than the surviving spouse, a

letter of explanation should be attached.

TAXABLE INCOME OF A RESIDENT

ESTIMATED TAX PAYMENTS FOR YEAR 2014

Lapeer residents are required to report the same kinds of

Estimated tax payments are REQUIRED if 2013 Lapeer

taxable income on their city return they report on their federal

income not subject to withholding is more than $10,000 after

return excluding S-corporation flow through income.

exemptions ($100 in tax). A Declaration of Estimated Income

Tax (Form L-1040ES) MUST be filed by April 30, 2014 and

TAXABLE INCOME OF A NONRESIDENT

one-fourth (1/4) of the estimated tax due for 2014 must be paid

The following income is subject to Lapeer tax for a nonresident:

with the declaration.

The three remaining estimated tax

A. Salaries, wages, bonuses, commissions, fees, tips, incentive

payments are due at the end of June, September and January.

payments, severance pay, vacation pay and sick pay received

Failure to make required estimated tax payments or

for work done or services performed in Lapeer.

underpayment of estimated tax will result in assessment of

B. Net profits from the operation of a business or profession

penalty and interest.

attributable to business activity conducted in Lapeer, whether

If at any time during the year your income increases to such a

or not such business is located in Lapeer.

level that one hundred dollars ($100.00) or more of tax will be

C. Net profits from the rental of real or tangible personal

due, a Declaration of Estimated Tax must be filed at that time.

property located in Lapeer.

The Declaration of Estimated Tax (Form L-1040ES) is available

D. Gain from the sale or exchange of real or tangible personal

from the Lapeer Income Tax Department, is included in the tax

property located in Lapeer.

booklet or on the City's website.

E. Premature distribution from an IRA or ROTH IRA (where a

deduction was claimed on a current or previous year's Lapeer

EXTENSION OF TIME TO FILE

income tax return) or a pension plan.

The due date of Lapeer annual returns may be extended for a

period not to exceed six months.

Application for a Lapeer

TAX EXEMPT INCOME

extension must be made and any tentative tax due must be

Tax exempt income includes:

paid (Ord. Sec. 64). Applying for a federal extension does not

A. Gifts, inheritances and bequests.

satisfy the requirement for filing a city extension. When a city

B. Social security, pensions and annuities (including disability

extension is granted, the tentative tax must be paid by

pensions) and Individual Retirement Account distributions

April 30, 2014.

Filing an extension with payment is not

received after reaching age 59 ½.

substitute for making estimated tax payments.

C. Proceeds of insurance where the taxpayer paid policy

premiums. (Payments from a health and accident policy paid

DOCUMENTATION REQUIREMENTS

for by employer are taxable to the same extent as provided by

Copies of all federal schedule(s) and other requested

the Internal Revenue Code).

documentation supporting income, losses and deductions must

D. Unemployment compensation and supplemental

be attached to your return.

unemployment benefits.

Failure to attach schedules and documentation or

E. Worker's compensation or similar payments for death, injury

attaching incomplete schedules and documentation will

or illness arising in the course of an employee's job.

result in deductions being disallowed or delay the

F. Military pay of members of the armed forces of the United

processing of your return.

States,

including

Reserve

and

National

Guard

pay.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5