Reset Form

STATE OF MICHIGAN

UIA 1110

Authorized by

(Rev 11/11)

MCL 421.1 et seq.

LICENSING AND REGULATORY AFFAIRS

UNEMPLOYMENT INSURANCE AGENCY

Cadillac Place - Tax Office - Suite 11-500

3024 W. Grand Blvd

Detroit, MI

48202

PHONE: (313) 456-2180

FAX: (313) 456-2130

INTERNET:

To obtain your credit faster, you can file this application on-line through EWAM (Employer Web Account Manager)

at , On-line Services for Employers.

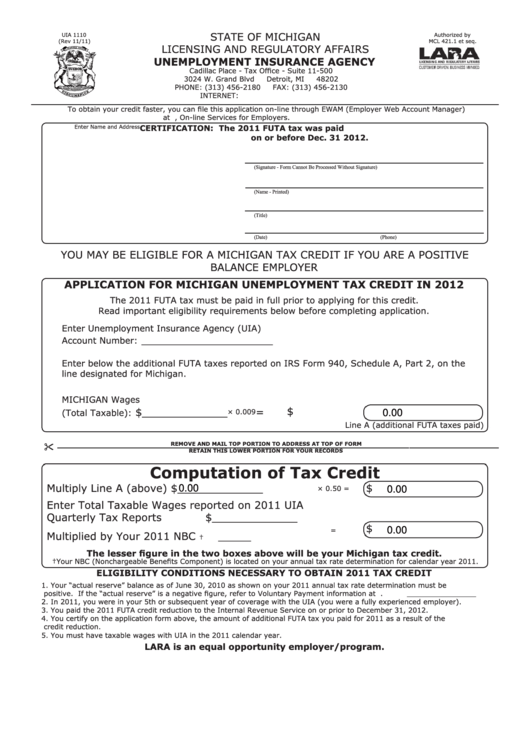

CERTIFICATION:

The 2011 FUTA tax was paid

Enter Name and Address

on or before Dec. 31 2012.

(Signature - Form Cannot Be Processed Without Signature)

(Name - Printed)

(Title)

(Date)

(Phone)

YOU MAY BE ELIGIBLE FOR A MICHIGAN TAX CREDIT IF YOU ARE A POSITIVE

BALANCE EMPLOYER

APPLICATION FOR MICHIGAN UNEMPLOYMENT TAX CREDIT IN 2012

The 2011 FUTA tax must be paid in full prior to applying for this credit.

Read important eligibility requirements below before completing application.

Enter Unemployment Insurance Agency (UIA)

____________________

Account Number:

Enter below the additional FUTA taxes reported on IRS Form 940, Schedule A, Part 2, on the

line designated for Michigan.

MICHIGAN Wages

$

=

$_____________

(Total Taxable):

× 0.009

0.00

Line A (additional FUTA taxes paid)

REMOVE AND MAIL TOP PORTION TO ADDRESS AT TOP OF FORM

&

RETAIN THIS LOWER PORTION FOR YOUR RECORDS

Computation of Tax Credit

$

Multiply Line A (above) $_____________

0.00

× 0.50 =

0.00

Enter Total Taxable Wages reported on 2011 UIA

Quarterly Tax Reports

$_____________

$

=

0.00

Multiplied by Your 2011 NBC

_____

†

The lesser figure in the two boxes above will be your Michigan tax credit.

†Your NBC (Nonchargeable Benefits Component) is located on your annual tax rate determination for calendar year 2011.

ELIGIBILITY CONDITIONS NECESSARY TO OBTAIN 2011 TAX CREDIT

1.

Your “actual reserve” balance as of June 30, 2010 as shown on your 2011 annual tax rate determination must be

positive. If the “actual reserve” is a negative figure, refer to Voluntary Payment information at

.

2.

In 2011, you were in your 5th or subsequent year of coverage with the UIA (you were a fully experienced employer).

3.

You paid the 2011 FUTA credit reduction to the Internal Revenue Service on or prior to December 31, 2012.

4.

You certify on the application form above, the amount of additional FUTA tax you paid for 2011 as a result of the

credit reduction.

5.

You must have taxable wages with UIA in the 2011 calendar year.

LARA is an equal opportunity employer/program.

1

1