Form 720-Amended Draft - Income Tax And Llet Return - 2007-2008

ADVERTISEMENT

20 _ _

__ __ __ __ __ __

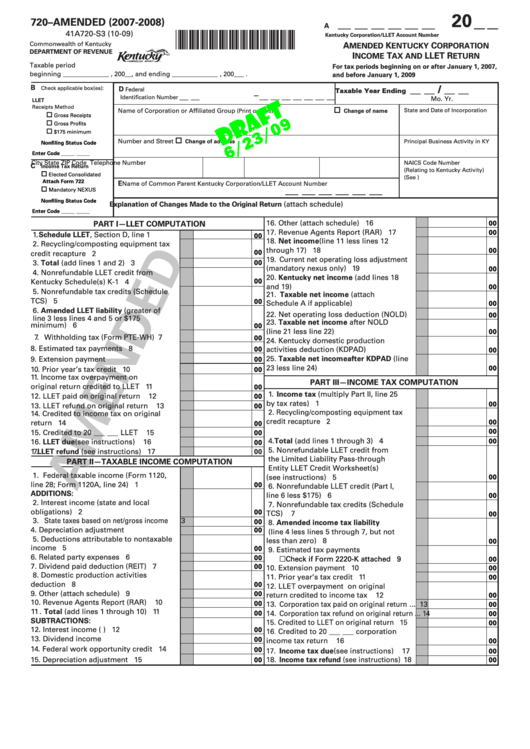

720–AMENDED (2007-2008)

A

41A720-S3 (10-09)

*0900010276*

Kentucky Corporation/LLET Account Number

Commonwealth of Kentucky

A

K

C

MENDED

ENTUCKY

ORPORATION

DEPARTMENT OF REVENUE

I

T

LLET R

NCOME

AX AND

ETURN

Taxable period

For tax periods beginning on or after January 1, 2007,

beginning ______________ , 200__, and ending ______________ , 200___ .

and before January 1, 2009

__ __ / __ __

B

D

Check applicable box(es):

Federal

Taxable Year Ending

__ __ – __ __ __ __ __ __ __

Identification Number

Mo.

Yr.

LLET

Receipts Method

State and Date of Incorporation

Name of Corporation or Affiliated Group

(Print or type)

Change of name

Gross Receipts

Gross Profits

$175 minimum

Number and Street

Principal Business Activity in KY

Change of address

Nonfiling Status Code

Enter Code

_____ _____

City

State

ZIP Code

Telephone Number

NAICS Code Number

C

Income Tax Return

(Relating to Kentucky Activity)

Elected Consolidated

(See )

Attach Form 722

E

Name of Common Parent

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

Mandatory NEXUS

Nonfiling Status Code

(attach schedule)

Explanation of Changes Made to the Original Return

Enter Code

_____ _____

16. Other (attach schedule) .......................... 16

PART I—LLET COMPUTATION

00

17. Revenue Agents Report (RAR) ............... 17

00

1. Schedule LLET, Section D, line 1 ........... 1

00

18. Net income (line 11 less lines 12

2. Recycling/composting equipment tax

through 17) ............................................. 18

00

00

credit recapture ...................................... 2

19. Current net operating loss adjustment

3. Total (add lines 1 and 2) ......................... 3

00

(mandatory nexus only) .......................... 19

00

4. Nonrefundable LLET credit from

20. Kentucky net income (add lines 18

00

Kentucky Schedule(s) K-1 ...................... 4

and 19) ..................................................... 20

00

5. Nonrefundable tax credits (Schedule

21. Taxable net income (attach

TCS) ......................................................... 5

00

Schedule A if applicable) ....................... 21

00

6. Amended LLET liability (greater of

22. Net operating loss deduction (NOLD) ..... 22

00

line 3 less lines 4 and 5 or $175

23. Taxable net income after NOLD

minimum) ............................................... 6

00

(line 21 less line 22) ................................ 23

00

7. Withholding tax (Form PTE-WH) .......... 7

00

24. Kentucky domestic production

8. Estimated tax payments ........................ 8

00

activities deduction (KDPAD) ................. 24

00

25. Taxable net income after KDPAD (line

9. Extension payment ................................ 9

00

23 less line 24) ........................................ 25

00

10. Prior year’s tax credit ............................. 10

00

11. Income tax overpayment on

PART III—INCOME TAX COMPUTATION

original return credited to LLET ............ 11

00

1. Income tax (multiply Part II, line 25

12. LLET paid on original return .................. 12

00

by tax rates) ............................................. 1

00

13. LLET refund on original return .............. 13

00

2. Recycling/composting equipment tax

14. Credited to income tax on original

credit recapture ....................................... 2

00

return ....................................................... 14

00

3. Tax installment on LIFO recapture ........ 3

00

15. Credited to 20 ___ ___ LLET ................... 15

00

4. Total (add lines 1 through 3) .................. 4

00

16. LLET due (see instructions) ................... 16

00

5. Nonrefundable LLET credit from

17. LLET refund (see instructions)............... 17

00

the Limited Liability Pass-through

PART II—TAXABLE INCOME COMPUTATION

Entity LLET Credit Worksheet(s)

1. Federal taxable income (Form 1120,

(see instructions) .................................... 5

00

line 28; Form 1120A, line 24) .................. 1

00

6. Nonrefundable LLET credit (Part I,

ADDITIONS:

line 6 less $175) ...................................... 6

00

2. Interest income (state and local

7. Nonrefundable tax credits (Schedule

obligations) ............................................. 2

00

TCS) ........................................................ 7

00

3. State taxes based on net/gross income ..... 3

00

8. Amended income tax liability

4. Depreciation adjustment ........................ 4

00

(line 4 less lines 5 through 7, but not

5. Deductions attributable to nontaxable

less than zero) ......................................... 8

00

income ..................................................... 5

00

9. Estimated tax payments

6. Related party expenses .......................... 6

00

Check if Form 2220-K attached ......... 9

00

7. Dividend paid deduction (REIT) ............ 7

00

10. Extension payment ................................ 10

00

8. Domestic production activities

11. Prior year’s tax credit ............................. 11

00

deduction ................................................ 8

00

12. LLET overpayment on original

9. Other (attach schedule) .......................... 9

00

return credited to income tax ................ 12

00

10. Revenue Agents Report (RAR) ............... 10

00

13. Corporation tax paid on original return ... 13

00

11. Total (add lines 1 through 10) ................ 11

00

14. Corporation tax refund on original return ... 14

00

SUBTRACTIONS:

15. Credited to LLET on original return ......... 15

00

12. Interest income (U.S. obligations) ........ 12

00

16. Credited to 20 ___ ___ corporation

13. Dividend income .................................... 13

00

income tax return ................................... 16

00

14. Federal work opportunity credit ............ 14

00

17. Income tax due (see instructions) ......... 17

00

15. Depreciation adjustment ....................... 15

18. Income tax refund (see instructions) ...... 18

00

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3