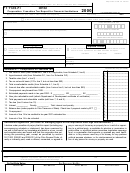

Form Ft 1120-Fi - 2001 Corporation Franchise Tax Report For Financial Institutions Page 2

ADVERTISEMENT

2001

Name

Franchise Tax ID Number

Schedule B — Balance Sheet

Attach to this report a balance sheet which reflects the books of the taxpayer as of the beginning and end of the taxable year.

Schedule C — Exempted Assets (Net Book Value)

00

1. Goodwill (attach explanation) ..........................................................................................................................

1.

___________________

00

2. Abandoned property (attach explanation) .......................................................................................................

2.

___________________

00

3. Appreciation (attach explanation) ....................................................................................................................

3.

___________________

00

4. Investments in Production Credit Associations ..............................................................................................

4.

___________________

00

5. Other (attach explanation) ...............................................................................................................................

5.

___________________

00

6. Total exempted assets (enter on Schedule E, line 7) ....................................................................................

6.

Schedule D — Apportionment Ratio (Carry to Six Decimal Places)

(1)

(2)

Sales Factor – ORC 5733.056(F)

Ohio

Everywhere

1. Receipts from the lease, sublease or rental of real property ........

_____________

______________

2. Receipts from the lease or rental of tangible personal property ...

_____________

______________

3. Interest from loans secured by real property .................................

_____________

______________

4. Interest from loans not secured by real property ...........................

_____________

______________

5. Net gains from the sale of loans secured by real property ...........

_____________

______________

6. Net gains from the sale of loans not secured by real property .....

_____________

______________

7. Interest and fees charged to credit card holders ...........................

_____________

______________

8. Net gains from the sale of credit card receivables ........................

_____________

______________

9. Credit card issuer’s reimbursement fees .....................................

_____________

______________

10. Receipts from merchant discount .................................................

_____________

______________

11. Loan servicing fees from loans secured by real property .............

_____________

______________

12. Loan servicing fees from loans not secured by real property .......

_____________

______________

13. Loan servicing fees for servicing the loans of others ....................

_____________

______________

14. Receipts from services not otherwise apportioned ......................

_____________

______________

15. Interest, dividends, net gains, and other income from both

investment assets and activities & trading assets and activities .

_____________

______________

c

c

Check method:

Avg. value method

Gross income method

16. All other receipts .............................................................................

_____________

______________

.

÷

=

________________

17. Total ................................................................................................

_____________

______________

(Ratio)

Property Factor – ORC 5733.056(D)

Ohio

Everywhere

18. Real property and tangible personal property owned ...................

_____________

______________

19. Real property and tangible personal property rented x 8 ..............

_____________

______________

20. Loans and credit card receivables ................................................

_____________

______________

.

÷

=

________________

21. Total ................................................................................................

_____________

______________

(Ratio)

Note: If the property factor is less than 1.00, please attach to this report a schedule which separately lists the

taxpayer’s Ohio and everywhere cost values at the beginning and the end of the taxpayer’s taxable year for the

following assets: (1) buildings and other depreciable assets, (2) land, (3) credit card receivables, (4) loans to

subsidiaries and (5) loans other than loans to subsidiaries.

Payroll Factor – ORC 5733.056(E)

Ohio

Everywhere

.

÷

=

________________

22. Compensation paid to employees ................................................

_____________

______________

(Ratio)

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4