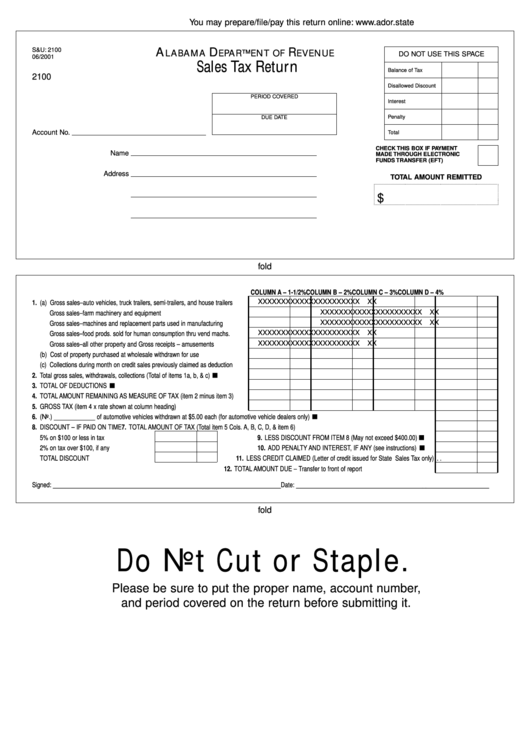

Form 2100 - Sales Tax Return - Alabama Department Of Revenue 2001

ADVERTISEMENT

You may prepare/file/pay this return online:

S&U: 2100

A

D

R

LABAMA

EPARTMENT OF

EVENUE

DO NOT USE THIS SPACE

06/2001

Sales Tax Return

Balance of Tax

2100

Disallowed Discount

PERIOD COVERED

Interest

Penalty

DUE DATE

Account No.

Total

CHECK THIS BOX IF PAYMENT

Name

MADE THROUGH ELECTRONIC

FUNDS TRANSFER (EFT)

Address

TOTAL AMOUNT REMITTED

.

$

fold

COLUMN A – 1-1/2%

COLUMN B – 2%

COLUMN C – 3%

COLUMN D – 4%

XXXXXX

XX

XXXXXX

XX

XXXXXX

XX

1. (a) Gross sales–auto vehicles, truck trailers, semi-trailers, and house trailers. . . .

XXXXXX

XX

XXXXXX

XX

XXXXXX

XX

Gross sales–farm machinery and equipment . . . . . . . . . . . . . . . . . . . . . . . . . .

XXXXXX

XX

XXXXXX

XX

XXXXXX

XX

Gross sales–machines and replacement parts used in manufacturing . . . . . . .

XXXXXX

XX

XXXXXX

XX

XXXXXX

XX

Gross sales–food prods. sold for human consumption thru vend machs.. . . . .

XXXXXX

XX

XXXXXX

XX

XXXXXX

XX

Gross sales–all other property and Gross receipts – amusements. . . . . . . . . .

(b) Cost of property purchased at wholesale withdrawn for use. . . . . . . . . . . . . . .

(c) Collections during month on credit sales previously claimed as deduction. . . .

2. Total gross sales, withdrawals, collections (Total of items 1a, b, & c) . . . . . . . . .

3. TOTAL OF DEDUCTIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. TOTAL AMOUNT REMAINING AS MEASURE OF TAX (item 2 minus item 3) . . . .

5. GROSS TAX (item 4 x rate shown at column heading) . . . . . . . . . . . . . . . . . . . . . .

6. (No.) _____________ of automotive vehicles withdrawn at $5.00 each (for automotive vehicle dealers only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. DISCOUNT – IF PAID ON TIME

7. TOTAL AMOUNT OF TAX (Total item 5 Cols. A, B, C, D, & item 6) . . . . . . . . .

5% on $100 or less in tax . . . . . . . . . . . . . .

9. LESS DISCOUNT FROM ITEM 8 (May not exceed $400.00) . . . . . . . . . . . .

2% on tax over $100, if any . . . . . . . . . . . .

10. ADD PENALTY AND INTEREST, IF ANY (see instructions) . . . . . . . . . . . . .

TOTAL DISCOUNT . . . . . . . . . . . . . . . . . . .

11. LESS CREDIT CLAIMED (Letter of credit issued for State Sales Tax only) . .

12. TOTAL AMOUNT DUE – Transfer to front of report. . . . . . . . . . . . . . . . . . . . . .

Signed: ________________________________________________________________________

Date: _____________________________________________________________

fold

Do Not Cut or Staple.

Please be sure to put the proper name, account number,

and period covered on the return before submitting it.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1