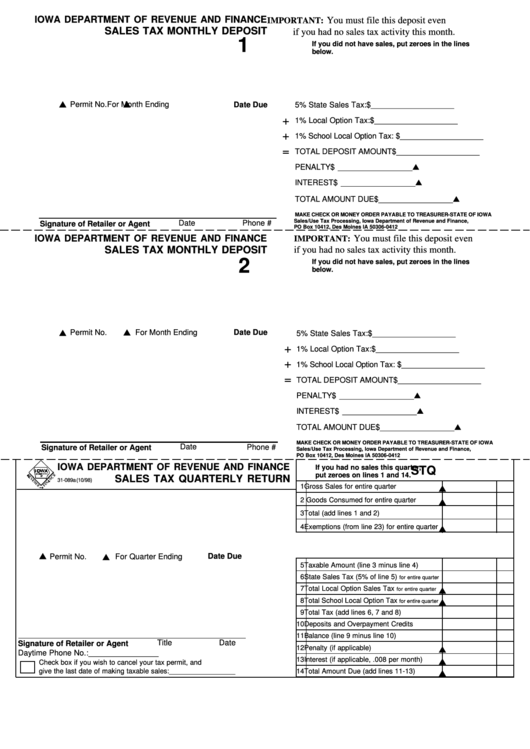

IOWA DEPARTMENT OF REVENUE AND FINANCE

You must file this deposit even

IMPORTANT:

SALES TAX MONTHLY DEPOSIT

if you had no sales tax activity this month.

1

If you did not have sales, put zeroes in the lines

below.

Permit No.

For Month Ending

Date Due

5% State Sales Tax:

$ ___________________

+

1% Local Option Tax:

$ ___________________

+

1% School Local Option Tax: $ ___________________

=

TOTAL DEPOSIT AMOUNT $ ___________________

PENALTY

$ _________________

INTEREST

$ _________________

TOTAL AMOUNT DUE

$ _________________

MAKE CHECK OR MONEY ORDER PAYABLE TO TREASURER-STATE OF IOWA

Sales/Use Tax Processing, Iowa Department of Revenue and Finance,

Date

Phone #

Signature of Retailer or Agent

PO Box 10412, Des Moines IA 50306-0412

IOWA DEPARTMENT OF REVENUE AND FINANCE

You must file this deposit even

IMPORTANT:

SALES TAX MONTHLY DEPOSIT

if you had no sales tax activity this month.

2

If you did not have sales, put zeroes in the lines

below.

Permit No.

For Month Ending

Date Due

5% State Sales Tax:

$ ___________________

+

1% Local Option Tax:

$ ___________________

+

1% School Local Option Tax: $ ___________________

=

TOTAL DEPOSIT AMOUNT $ ___________________

PENALTY

$ _________________

INTEREST

$ _________________

TOTAL AMOUNT DUE

$ _________________

MAKE CHECK OR MONEY ORDER PAYABLE TO TREASURER-STATE OF IOWA

Date

Phone #

Signature of Retailer or Agent

Sales/Use Tax Processing, Iowa Department of Revenue and Finance,

PO Box 10412, Des Moines IA 50306-0412

IOWA DEPARTMENT OF REVENUE AND FINANCE

If you had no sales this quarter,

STQ

put zeroes on lines 1 and 14.

SALES TAX QUARTERLY RETURN

31-089a (10/98)

1 Gross Sales for entire quarter

2 Goods Consumed for entire quarter

3 Total (add lines 1 and 2)

4 Exemptions (from line 23) for entire quarter

Date Due

Permit No.

For Quarter Ending

5 Taxable Amount (line 3 minus line 4)

6 State Sales Tax (5% of line 5)

for entire quarter

7 Total Local Option Sales Tax

for entire quarter

8 Total School Local Option Tax

for entire quarter

9 Total Tax (add lines 6, 7 and 8)

10 Deposits and Overpayment Credits

11 Balance (line 9 minus line 10)

Title

Date

Signature of Retailer or Agent

12 Penalty (if applicable)

Daytime Phone No.: ________________

13 Interest (if applicable, .008 per month)

Check box if you wish to cancel your tax permit, and

give the last date of making taxable sales: _________________

14 Total Amount Due (add lines 11-13)

1

1 2

2