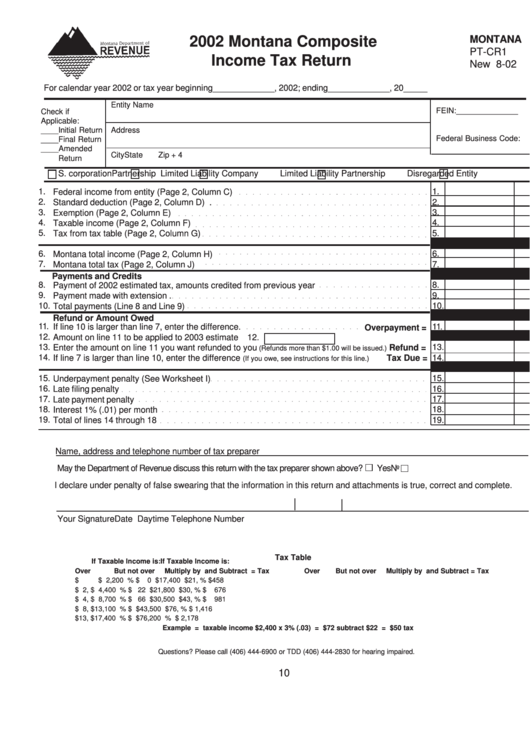

Form Pt-Cr1 - 2002 Montana Composite Income Tax Return

ADVERTISEMENT

MONTANA

2002 Montana Composite

PT-CR1

Income Tax Return

New 8-02

For calendar year 2002 or tax year beginning_____________, 2002; ending_____________, 20_____

Entity Name

FEIN:______________

Check if

Applicable:

____Initial Return

Address

Federal Business Code:

____Final Return

____Amended

City

State

Zip + 4

Return

S. corporation

Partnership

Limited Liability Company

Limited Liability Partnership

Disregarded Entity

1.

1.

Federal income from entity (Page 2, Column C)

2.

2.

Standard deduction (Page 2, Column D)

.

3.

3.

Exemption (Page 2, Column E)

4.

Taxable income (Page 2, Column F)

4.

5.

5.

Tax from tax table (Page 2, Column G)

6.

Montana total income (Page 2, Column H)

6.

7.

7.

Montana total tax (Page 2, Column J)

Payments and Credits

8.

8.

Payment of 2002 estimated tax, amounts credited from previous year

9.

9.

Payment made with extension

.

10.

Total payments (Line 8 and Line 9)

10.

Refund or Amount Owed

11.

11.

If line 10 is larger than line 7, enter the difference.

Overpayment =

12.

Amount on line 11 to be applied to 2003 estimate

12.

13.

13.

Enter the amount on line 11 you want refunded to you

Refund =

(Refunds more than $1.00 will be issued.)

14.

14.

If line 7 is larger than line 10, enter the difference

Tax Due =

(If you owe, see instructions for this line.)

15.

15.

Underpayment penalty (See Worksheet I)

16.

Late filing penalty

16.

17.

17.

Late payment penalty

18.

18.

Interest 1% (.01) per month

19.

Total of lines 14 through 18

19.

Name, address and telephone number of tax preparer

May the Department of Revenue discuss this return with the tax preparer shown above?

Yes

No

I declare under penalty of false swearing that the information in this return and attachments is true, correct and complete.

Your Signature

Date

Daytime Telephone Number

Tax Table

If Taxable Income is:

If Taxable Income is:

Over

But not over

Multiply by and Subtract = Tax

Over

But not over

Multiply by and Subtract = Tax

$

0 ..........

$ 2,200 .... X .... 2 % ........ $

0 ..............

$17,400 .... $21,800 .... X ...... 7 % .............. $

458

$ 2,200 ..........

$ 4,400 .... X .... 3 % ........ $ 22 .............

$21,800 .... $30,500 .... X ...... 8 % .............. $

676

$ 4,400 ..........

$ 8,700 .... X .... 4 % ........ $ 66 .............

$30,500 .... $43,500 .... X ...... 9 % .............. $

981

$ 8,700 ..........

$13,100 .... X .... 5 % ........ $ 153 .............

$43,500 .... $76,200 .... X ...... 10 % .............. $ 1,416

$13,100 ..........

$17,400 .... X .... 6 % ........ $ 284 .............

$76,200 ...................... X ...... 11 % .............. $ 2,178

Example = taxable income $2,400 x 3% (.03) = $72 subtract $22 = $50 tax

Questions? Please call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired.

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2