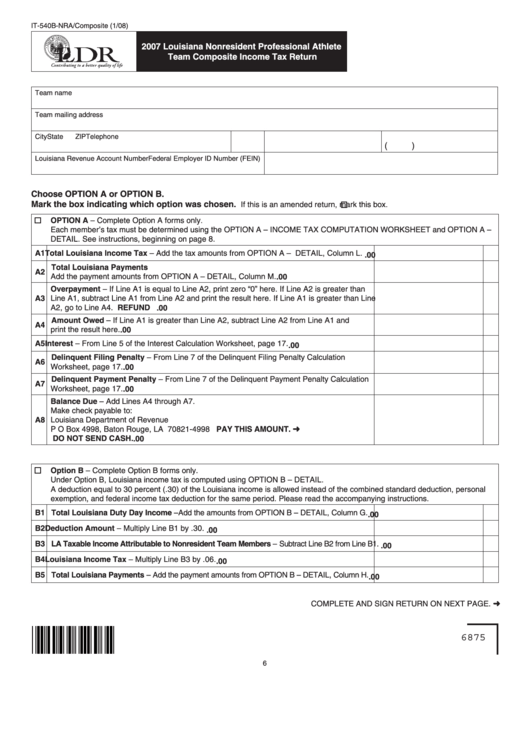

IT-540B-NRA/Composite (1/08)

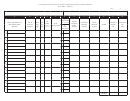

2007 Louisiana Nonresident Professional Athlete

Team Composite Income Tax Return

Team name

Team mailing address

City

State

ZIP

Telephone

(

)

Louisiana Revenue Account Number

Federal Employer ID Number (FEIN)

Choose OPTION A or OPTION B.

Mark the box indicating which option was chosen.

If this is an amended return, mark this box.

OPTION A – Complete Option A forms only.

Each member’s tax must be determined using the OPTION A – INCOME TAx COMPuTATION WORkSHEET and OPTION A –

DETAIL. See instructions, beginning on page 8.

A1 Total Louisiana Income Tax – Add the tax amounts from OPTION A – DETAIL, Column L.

.00

Total Louisiana Payments

A2

Add the payment amounts from OPTION A – DETAIL, Column M.

.00

Overpayment – If Line A1 is equal to Line A2, print zero “0” here. If Line A2 is greater than

A3

Line A1, subtract Line A1 from Line A2 and print the result here. If Line A1 is greater than Line

REFUND

A2, go to Line A4.

.00

Amount Owed – If Line A1 is greater than Line A2, subtract Line A2 from Line A1 and

A4

print the result here.

.00

A5 Interest – From Line 5 of the Interest Calculation Worksheet, page 17.

.00

Delinquent Filing Penalty – From Line 7 of the Delinquent Filing Penalty Calculation

A6

Worksheet, page 17.

.00

Delinquent Payment Penalty – From Line 7 of the Delinquent Payment Penalty Calculation

A7

Worksheet, page 17.

.00

Balance Due – Add Lines A4 through A7.

Make check payable to:

A8

Louisiana Department of Revenue

PAY ThIS AMOUNT. ➜

P O Box 4998, Baton Rouge, LA 70821-4998

DO NOT SEND CASh.

.00

Option B – Complete Option B forms only.

under Option B, Louisiana income tax is computed using OPTION B – DETAIL.

A deduction equal to 30 percent (.30) of the Louisiana income is allowed instead of the combined standard deduction, personal

exemption, and federal income tax deduction for the same period. Please read the accompanying instructions.

B1 Total Louisiana Duty Day Income – Add the amounts from OPTION B – DETAIL, Column G.

.00

B2 Deduction Amount – Multiply Line B1 by .30.

.00

B3 LA Taxable Income Attributable to Nonresident Team Members – Subtract Line B2 from Line B1.

.00

B4 Louisiana Income Tax – Multiply Line B3 by .06.

.00

B5 Total Louisiana Payments – Add the payment amounts from OPTION B – DETAIL, Column H.

.00

COMPLETE AND SIGN RETuRN ON NExT PAGE. ➜

6875

6

1

1 2

2 3

3 4

4 5

5