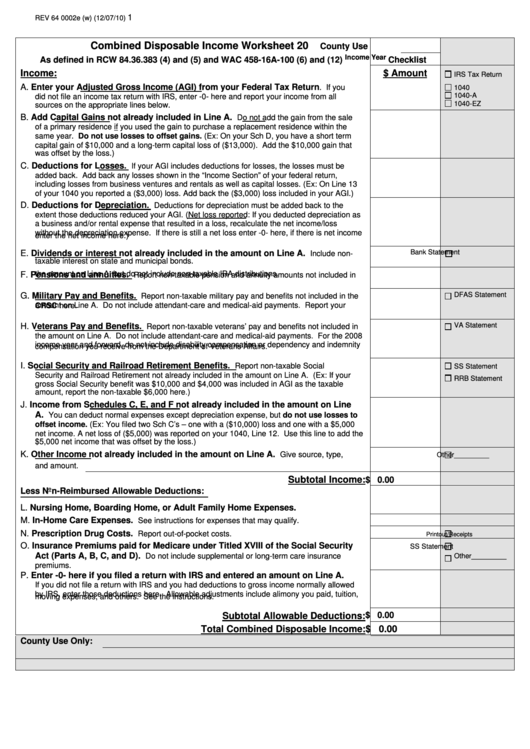

Combined Disposable Income Worksheet

ADVERTISEMENT

1

REV 64 0002e (w)

(12/07/10)

Combined Disposable Income Worksheet

20

County Use

Income Year

As defined in RCW 84.36.383 (4) and (5) and WAC 458-16A-100 (6) and (12)

Checklist

Income:

$ Amount

IRS Tax Return

A. Enter your Adjusted Gross Income (AGI) from your Federal Tax Return

. If you

1040

1040-A

did not file an income tax return with IRS, enter -0- here and report your income from all

1040-EZ

sources on the appropriate lines below.

B. Add Capital Gains not already included in Line A.

Do not add the gain from the sale

of a primary residence if you used the gain to purchase a replacement residence within the

same year. Do not use losses to offset gains. (Ex: On your Sch D, you have a short term

capital gain of $10,000 and a long-term capital loss of ($13,000). Add the $10,000 gain that

was offset by the loss.)

C. Deductions for Losses.

If your AGI includes deductions for losses, the losses must be

added back. Add back any losses shown in the “Income Section” of your federal return,

including losses from business ventures and rentals as well as capital losses. (Ex: On Line 13

of your 1040 you reported a ($3,000) loss. Add back the ($3,000) loss included in your AGI.)

D. Deductions for Depreciation.

Deductions for depreciation must be added back to the

extent those deductions reduced your AGI. (Net loss reported: If you deducted depreciation as

a business and/or rental expense that resulted in a loss, recalculate the net income/loss

without the depreciation expense. If there is still a net loss enter -0- here, if there is net income

enter the net income here.)

E. Dividends or interest not already included in the amount on Line A.

Include non-

Bank Statement

taxable interest on state and municipal bonds.

F. Pensions and annuities.

Report non-taxable pension and annuity amounts not included in

the amount on Line A, but do not include non-taxable IRA distributions.

G. Military Pay and Benefits.

Report non-taxable military pay and benefits not included in the

DFAS Statement

amount on Line A. Do not include attendant-care and medical-aid payments. Report your

CRSC here.

H. Veterans Pay and Benefits.

Report non-taxable veterans’ pay and benefits not included in

VA Statement

the amount on Line A. Do not include attendant-care and medical-aid payments. For the 2008

income year and forward, do not include disability compensation or dependency and indemnity

compensation you receive from the Department of Veterans Affairs.

I.

Social Security and Railroad Retirement Benefits.

Report non-taxable Social

SS Statement

Security and Railroad Retirement not already included in the amount on Line A. (Ex: If your

RRB Statement

gross Social Security benefit was $10,000 and $4,000 was included in AGI as the taxable

amount, report the non-taxable $6,000 here.)

J. Income from Schedules C, E, and F not already included in the amount on Line

A.

You can deduct normal expenses except depreciation expense, but do not use losses to

offset income. (Ex: You filed two Sch C’s – one with a ($10,000) loss and one with a $5,000

net income. A net loss of ($5,000) was reported on your 1040, Line 12. Use this line to add the

$5,000 net income that was offset by the loss.)

K. Other Income not already included in the amount on Line A.

Give source, type,

Other_________

and amount.

Subtotal Income:

$ 0.00

Less Non-Reimbursed Allowable Deductions:

L. Nursing Home, Boarding Home, or Adult Family Home Expenses.

M. In-Home Care Expenses.

See instructions for expenses that may qualify.

N. Prescription Drug Costs.

Report out-of-pocket costs.

Printout/Receipts

O. Insurance Premiums paid for Medicare under Titled XVIII of the Social Security

SS Statement

Act (Parts A, B, C, and D).

Do not include supplemental or long-term care insurance

Other_________

premiums.

P. Enter -0- here if you filed a return with IRS and entered an amount on Line A.

If you did not file a return with IRS and you had deductions to gross income normally allowed

by IRS, enter those deductions here. Allowable adjustments include alimony you paid, tuition,

moving expenses, and others. See the instructions.

$ 0.00

Subtotal Allowable Deductions:

Total Combined Disposable Income: $ 0.00

County Use Only:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4