Form Nys-202ein - Unincorporated Business Tax Return - 2013

ADVERTISEMENT

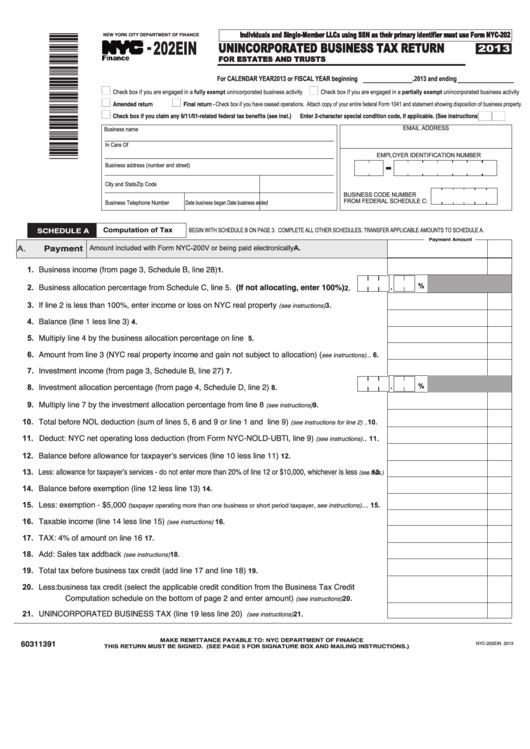

- 202EIN

Individuals and Single-Member LLCs using SSN as their primary identifier must use Form NYC-202

UNINCORPORATED BUSINESS TAX RETURN

nEw york City dEpArtmEnt oF FinAnCE

2013

FOR ESTATES AND TRUSTS

For CALENDAR YEAR 2013 or FISCAL YEAR beginning ______________ , 2013 and ending ________________

n

n

Check box if you are engaged in a fully exempt unincorporated business activity

Check box if you are engaged in a partially exempt unincorporated business activity

n

n

Amended return

Final return - Check box if you have ceased operations. Attach copy of your entire federal Form 1041 and statement showing disposition of business property.

nn

n

Check box if you claim any 9/11/01-related federal tax benefits (see inst.)

Enter 2‑character special condition code, if applicable. (See instructions):

EMAIL ADDRESS

Business name

In Care Of

EMPLOYER IDENTIFICATION NUMBER

Business address (number and street)

City and State

Zip Code

BUSINESS CODE NUMBER

FROM FEDERAL SCHEDULE C:

Business Telephone Number

Date business began

Date business ended

Computation of tax

SCHEdULE A

BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

payment Amount

payment

A.

Amount included with Form NYC-200V or being paid electronically

A.

1. Business income (from page 3, Schedule B, line 28)

................................................................................ 1.

.

2. Business allocation percentage from Schedule C, line 5. (if not allocating, enter 100%) ....

%

2.

3. If line 2 is less than 100%, enter income or loss on NYC real property

....................

(see instructions)

3.

4. Balance (line 1 less line 3)................................................................................................................

4.

5. Multiply line 4 by the business allocation percentage on line 2........................................................

5.

6. Amount from line 3 (NYC real property income and gain not subject to allocation) (

see instructions)...

6.

7. Investment income (from page 3, Schedule B, line 27)....................................................................

7.

.

8. Investment allocation percentage (from page 4, Schedule D, line 2).................................

%

8.

9. Multiply line 7 by the investment allocation percentage from line 8

...........................

(see instructions)

9.

10. Total before NOL deduction (sum of lines 5, 6 and 9 or line 1 and line 9)

(see instructions for line 2) ..

10.

11. Deduct: NYC net operating loss deduction (from Form NYC-NOLD-UBTI, line 9)

..

(see instructions)

11.

12. Balance before allowance for taxpayer’s services (line 10 less line 11).........................................

12.

13. Less: allowance for taxpayer’s services - do not enter more than 20% of line 12 or $10,000, whichever is less

(see instr.) ..

13.

14. Balance before exemption (line 12 less line 13) .............................................................................

14.

15. Less: exemption - $5,000

...

15.

(taxpayer operating more than one business or short period taxpayer, see instructions)

16. Taxable income (line 14 less line 15)

.......................................................................

(see instructions)

16.

17. TAX: 4% of amount on line 16

..................................................................................................................... 17.

18. Add: Sales tax addback

....................................................................................................... 18.

(see instructions)

19. Total tax before business tax credit (add line 17 and line 18) ........................................................

19.

20. Less: business tax credit (select the applicable credit condition from the Business Tax Credit

Computation schedule on the bottom of page 2 and enter amount)

...........

(see instructions)

20.

21. UNINCORPORATED BUSINESS TAX (line 19 less line 20)

..................................

(see instructions)

21.

60311391

mAkE rEmittAnCE pAyABLE to: nyC dEpArtmEnt oF FinAnCE

NYC-202EIN 2013

tHiS rEtUrn mUSt BE SiGnEd. (SEE pAGE 5 For SiGnAtUrE BoX And mAiLinG inStrUCtionS.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5