Corporation Estimated Tax Payments Instructions For Form 355-Es Payment Vouchers - 2005

ADVERTISEMENT

2005

Corporation Estimated Tax Payments

Massachusetts

Instructions for Form 355-ES

Department of

Payment Vouchers

Revenue

General Information

What if the corporation credited its 2004 overpayment to its

2005 tax? If the corporation reported an overpayment on its 2004

What is the purpose of the estimated tax payment vouchers?

corporate excise tax return and elected to apply it as a credit to its

The purpose of the estimated tax payment vouchers is to pro-

2005 estimated tax, the amount of the credit must be applied to

vide a means for paying any current taxes due under Chapter 63

the first installment due after the overpayment is determined. Any

of the Massachusetts General Laws.

excess must be applied to succeeding installments. No credit

Who must make estimated payments? All corporations that rea-

may be applied to any estimated tax other than 2005. Be sure to

sonably estimate their corporation excise to be in excess of $1,000

enter the total overpayment credit in item b of your first voucher

for the taxable year are required to make estimated payments.

and in column (c) of the Record of Estimated Tax Payments.

Are there penalties for failing to pay estimated taxes? Yes.

Specific Instructions

An additional charge is imposed on the underpayment of any

1. Complete the Corporation Estimated Tax Worksheet.

corporate estimated tax for the period of that underpayment. Use

Form M-2220 when filing your annual return to determine any

2. Enter your name, address, identification number, taxable year

penalty due.

and installment due dates in the spaces provided on the vouchers.

When and where are estimated tax vouchers filed? Esti-

3. Enter in item a of the first voucher your total tax for the prior

mated taxes may be paid in full on or before the 15th day of the

year, if any, from item a of the worksheet.

third month of the corporation’s taxable year or according to the

4. Enter in item b of the first voucher any overpayment from last

following installment amount schedule, on or before the 15th day

year to be credited to estimated tax this year from item b of the

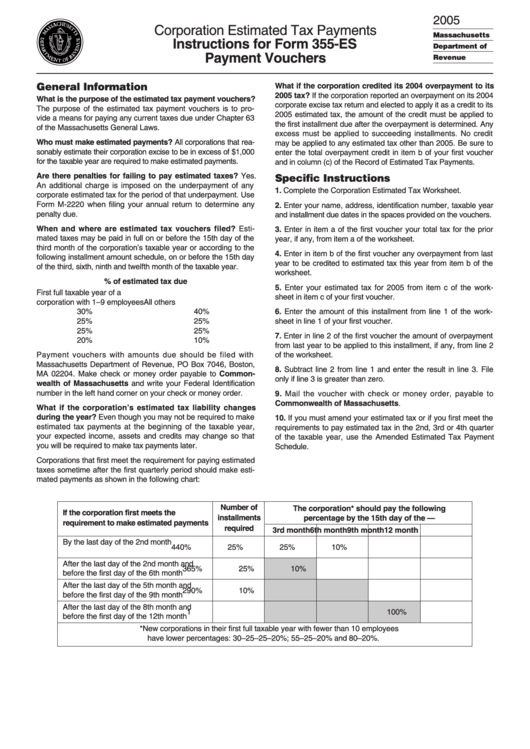

of the third, sixth, ninth and twelfth month of the taxable year.

worksheet.

% of estimated tax due

5. Enter your estimated tax for 2005 from item c of the work-

First full taxable year of a

sheet in item c of your first voucher.

corporation with 1–9 employees

All others

30%

40%

6. Enter the amount of this installment from line 1 of the work-

25%

25%

sheet in line 1 of your first voucher.

25%

25%

7. Enter in line 2 of the first voucher the amount of overpayment

20%

10%

from last year to be applied to this installment, if any, from line 2

Payment vouchers with amounts due should be filed with

of the worksheet.

Massachusetts Department of Revenue, PO Box 7046, Boston,

8. Subtract line 2 from line 1 and enter the result in line 3. File

MA 02204. Make check or money order payable to Common-

only if line 3 is greater than zero.

wealth of Massachusetts and write your Federal Identification

number in the left hand corner on your check or money order.

9. Mail the voucher with check or money order, payable to

Commonwealth of Massachusetts.

What if the corporation’s estimated tax liability changes

during the year? Even though you may not be required to make

10. If you must amend your estimated tax or if you first meet the

estimated tax payments at the beginning of the taxable year,

requirements to pay estimated tax in the 2nd, 3rd or 4th quarter

your expected income, assets and credits may change so that

of the taxable year, use the Amended Estimated Tax Payment

you will be required to make tax payments later.

Schedule.

Corporations that first meet the requirement for paying estimated

taxes sometime after the first quarterly period should make esti-

mated payments as shown in the following chart:

Number of

The corporation* should pay the following

If the corporation first meets the

installments

percentage by the 15th day of the —

requirement to make estimated payments

required

3rd month

6th month

9th month

12 month

By the last day of the 2nd month

4

40%

25%

25%

10%

After the last day of the 2nd month and

3

65%

25%

10%

before the first day of the 6th month

After the last day of the 5th month and

2

90%

10%

before the first day of the 9th month

After the last day of the 8th month and

1

100%

before the first day of the 12th month

*New corporations in their first full taxable year with fewer than 10 employees

have lower percentages: 30–25–25–20%; 55–25–20% and 80–20%.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2