Form 106-Ep - Colorado Composite Nonresident Return Estimated Tax Payment Voucher - 2005

ADVERTISEMENT

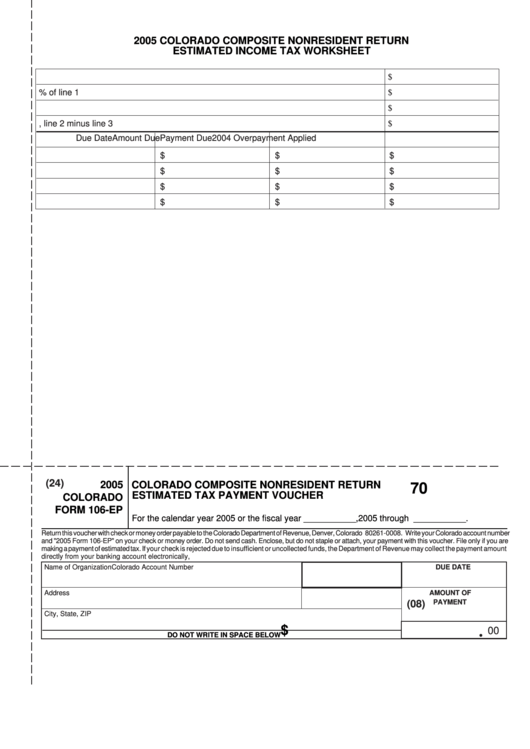

2005 COLORADO COMPOSITE NONRESIDENT RETURN

ESTIMATED INCOME TAX WORKSHEET

1.

Estimated 2005 Colorado taxable income

$

2.

Estimated 2005 Colorado income tax - 4.63% of line 1

$

3.

Estimated 2005 Form 106CR credits

$

4.

Net estimated tax, line 2 minus line 3

$

Due Date

Amount Due

2004 Overpayment Applied

Payment Due

$

$

$

$

$

$

$

$

$

$

$

$

(24)

2005

COLORADO COMPOSITE NONRESIDENT RETURN

70

ESTIMATED TAX PAYMENT VOUCHER

COLORADO

FORM 106-EP

For the calendar year 2005 or the fiscal year ___________,2005 through ___________.

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. Write your Colorado account number

and "2005 Form 106-EP" on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with this voucher. File only if you are

making a payment of estimated tax. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount

directly from your banking account electronically,

Name of Organization

Colorado Account Number

DUE DATE

AMOUNT OF

Address

F.E.I.N.

PAYMENT

(08)

City, State, ZIP

$

00

DO NOT WRITE IN SPACE BELOW

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2