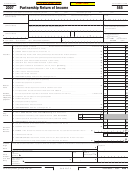

Form It-565 - Partnership Return Of Income Page 2

ADVERTISEMENT

Page 2

❑

❑

Schedule A — Cost of goods sold

1. Method of inventory valuation — cost

; lower of cost or market

;

❑

❑

LIFO

; other

. (If other, attach explanation.)

1. Opening inventory* ...................................................

$ _________________

2. Was the method of inventory valuation indicated above the same

❑

❑

2. Purchases .............

$ _______________________

method used for last year?

Yes

No

(If “No” attach explanation.)

Less: Cost of items

3. If inventory is valued at lower of cost or market, print total cost

$

withdrawn for

personal use .........

$ _________________

$ ____________

_______________ and total market valuation $_______________ of

those items valued at market.

3. Cost of labor, supplies, etc. ......................................

$ _________________

4. If closing inventory was taken by physical count, print date inventory

4. Total of Lines 1, 2, and 3 ..........................................

$ _________________

was taken _______________. If not at end of year, attach an

explanation of how the end of the year count was determined.

5. Less: Closing inventory ............................................

$ _________________

5. If closing inventory was not taken by a physical count, attach an

6. Cost of goods sold. (Print here and on Line 2,

Page 1.) ....................................................................

$ _________________

explanation of how inventory items were counted or measured.

*If different from last year's closing inventory, attach explanation.

Schedule B — Income from rents and royalties

3. Depreciation

4. Repairs

5. Other expenses

1. Kind and location of property

2. Amount

(Explain on Sch. G.)

(Explain on Sch. B-1.)

(Explain on Sch. B-1.)

1. Total .....................................................................................

$

2. Net income (or loss) (Column 2 less the sum of Columns 3, 4, and 5. Print on Line 7, Page 1.) ..............................

Schedule B-1 — Explanation of Columns 4 and 5 of Schedule B

Column

Explanation

Amount

Column

Explanation

Amount

Schedule C — Explanation of interest and taxes (Lines 16 and 17, Page 1)

Explanation

Amount

Explanation

Amount

Schedule D — Gain from sale of capital assets (See instructions for Line 9.)

5. Depreciation allowed

6. Cost or other basis and

8. Gain or loss

2. Date

3. Date

(or allowable) since

cost of improvements

7. Expense of

(Column 4 plus Column

1. Description of property

4. Gross sales price

acquired

sold

acquisition or Jan. 1,

subsequent to acquisition or

sale

5, less the sum of

1934 (Attach schedule.)

Jan. 1, 1934

Columns 6 and 7)

Total (Transfer net gain to Line 9, Page 1.)

$

6044

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4