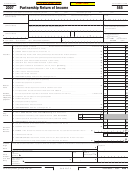

Form It-565 - Partnership Return Of Income Page 3

ADVERTISEMENT

Page 3

Schedule E — Gain or loss from sale of property other than capital assets (See instructions for Line 10.)

5. Depreciation allowed

6. Cost or other basis and

8. Gain or loss

(or allowable) since

2. Date

3. Date

cost of improvements

7. Expense of

(Column 4 plus Column

1. Description of property

4. Gross sales price

acquisition or Jan. 1,

acquired

sold

subsequent to acquisition or

sale

5, less the sum of

1934 (Attach schedule.)

Jan. 1, 1934

Columns 6 and 7)

Total (Transfer net gain or loss to Line 10, Page 1.)

$

Schedule F — Bad debts (See instructions for Line 19.)

If organization carried a reserve

1. Current

and 3 prior

2. Net profit from business

3. Sales on account

4. Bad debts (See instructions

5. Gross amount added

6. Amount charged

years

for Line 19.)

to reserve

against reserve

Schedule G — Depreciation (See instructions for Line 21.)

4. Depreciation allowed

5. Method of

1. Kind of property (If buildings, state materials of which

2. Date

3. Cost or other

6. Rate (%) or

7. Depreciation

(or allowable) in prior

computing

constructed.) Exclude land and other nondepreciable property.

acquired

basis (Exclude

life (years)

for this year

years

depreciation

land.)

1. Total ....................................................................................................................................................................... $

2. Less: amount of depreciation claimed in Schedules A and B and elsewhere on return ......................................

3. Balance (Print here and on Line 21, Page 1.) ....................................................................................................... $

Schedule H — Other deductions (See instructions for Line 24.)

Explanation

Amount

Explanation

Amount

Total (Print here and on Line 24, Page 1.) ............. $

6045

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4