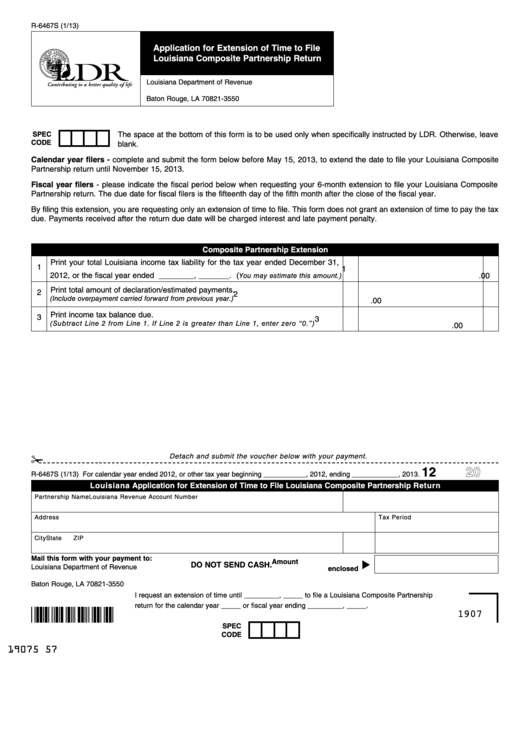

R-6467S (1/13)

Application for Extension of Time to File

Louisiana Composite Partnership Return

Louisiana Department of Revenue

P.O. Box 3550

Baton Rouge, LA 70821-3550

SPEC

The space at the bottom of this form is to be used only when specifically instructed by LDR. Otherwise, leave

CODE

blank.

Calendar year filers - complete and submit the form below before May 15, 2013, to extend the date to file your Louisiana Composite

Partnership return until November 15, 2013.

Fiscal year filers - please indicate the fiscal period below when requesting your 6-month extension to file your Louisiana Composite

Partnership return. The due date for fiscal filers is the fifteenth day of the fifth month after the close of the fiscal year.

By filing this extension, you are requesting only an extension of time to file. This form does not grant an extension of time to pay the tax

due. Payments received after the return due date will be charged interest and late payment penalty.

Composite Partnership Extension

Print your total Louisiana income tax liability for the tax year ended December 31,

1

1

2012, or the fiscal year ended ________, _______. (

.00

You may estimate this amount.)

Print total amount of declaration/estimated payments.

2

2

(Include overpayment carried forward from previous year.)

.00

Print income tax balance due.

3

3

(Subtract Line 2 from Line 1. If Line 2 is greater than Line 1, enter zero “0.”)

.00

Detach and submit the voucher below with your payment.

12

R-6467S (1/13)

For calendar year ended 2012, or other tax year beginning ___________, 2012, ending ____________, 2013.

Louisiana Application for Extension of Time to File Louisiana Composite Partnership Return

Partnership Name

Louisiana Revenue Account Number

Address

Tax Period

City

State

ZIP

Mail this form with your payment to:

Amount

u

DO nOT SEnD CASh.

Louisiana Department of Revenue

enclosed

P.O. Box 3550

Baton Rouge, LA 70821-3550

I request an extension of time until _________, _____ to file a Louisiana Composite Partnership

return for the calendar year _____ or fiscal year ending _________, _____.

1907

SPEC

CODE

19075

57

1

1