Form 150-102-032 - Dependent Care Credits For Employers - Oregon Department Of Revenue Page 2

ADVERTISEMENT

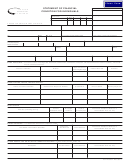

DEPENDENT CARE FACILITY CREDIT

This credit is allowed to employers who acquire, construct, or renovate real property located in Oregon to provide a dependent care

facility for use by their employees.

1. Location of the facility. City

State

2. Date the facility was placed in operation.

3. How many miles from the work site is the facility?

4. Number of children that can be cared for in the facility

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5. Number of employees who used the facility during the tax year

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6. Number of nonemployees who used the facility during the tax year

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7. Do you have a written dependent care assistance plan?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

7

8. Were dependent care services provided in the facility on the last day of your business operations?

(See OAR 150-315.208(2)(e))

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

8

9. Did the facility operator hold a valid certificate of approval from the Department of Human Resources,

Services to Children and Families, on the last day of the tax year?

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

9

Attach a copy of the certificate if this is the first year the credit is claimed, or if the facility

operator is new this year.

10. Total cost of the facility (or your share of the cost if several employers join in building a facility)

. . . . . . . . . . .

10

× .50

11. Multiply line 10 by 50 percent

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Potential credit based on cost (line 10 multiplied by line 11)

12

13. Number of full-time equivalent (FTE) employees on any date during the two-year period

ending on the last day of this tax year (only employees who work within two miles of the

facility can be included)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

× $2,500

14. Multiply line 13 by $2,500

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15. Potential credit based on FTE employees (line 13 multiplied by line 14)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

$100,000

16. Statutory limitation of $100,000

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

17. Total available credit (lesser of line 12, 15, or 16)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

× .10

18. Multiply line 17 by 10 percent

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19. Annual Dependent Care Facility Credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

Each year, your Oregon depreciation deduction for the facility must be reduced by the annual credit claimed (line 19), until it has been

absorbed. Enter this reduction on your Oregon personal income tax return or corporate excise tax return as an “Other Addition.”

150-102-032 (Rev. 9-99) (back)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2