Clear This Page

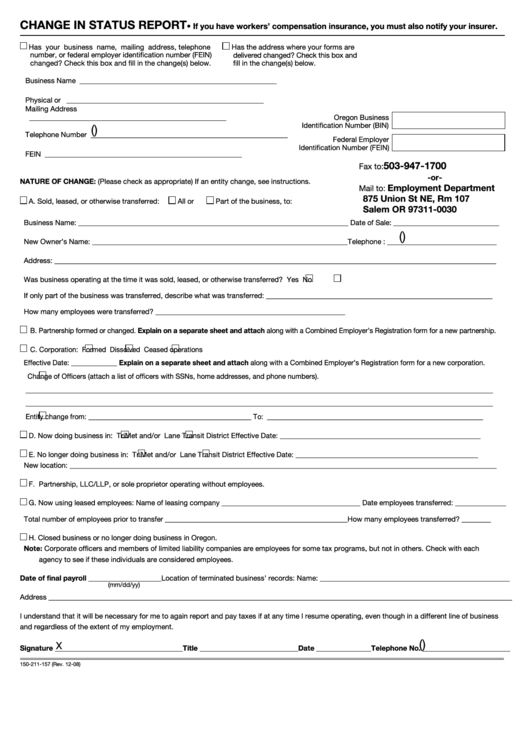

CHANGE IN STATUS REPORT

Has your business name, mailing address, telephone

Has the address where your forms are

number, or federal employer identification number (FEIN)

delivered changed? Check this box and

changed? Check this box and fill in the change(s) below.

fill in the change(s) below.

Business Name

______________________________________________________

Physical or

______________________________________________________

Mailing Address

______________________________________________________

Oregon Business

Identification Number (BIN)

(

)

Telephone Number ______________________________________________________

Federal Employer

Identification Number (FEIN)

FEIN

______________________________________________________

503-947-1700

Fax to:

-or-

NATURE OF CHANGE: (Please check as appropriate) If an entity change, see instructions.

Mail to:

A. Sold, leased, or otherwise transferred:

All or

Part of the business, to:

Business Name: __________________________________________________________________________ Date of Sale: _____________________________

(

)

New Owner’s Name: ______________________________________________________________________ Telephone : ______________________________

Address: _________________________________________________________________________________________________________________________

Was business operating at the time it was sold, leased, or otherwise transferred?

Yes

No

If only part of the business was transferred, describe what was transferred: ______________________________________________________________

How many employees were transferred? ____________________________________________________

B. Partnership formed or changed. Explain on a separate sheet and attach along with a Combined Employer’s Registration form for a new partnership.

C. Corporation:

Formed

Dissolved

Ceased operations

Effective Date: _____________ Explain on a separate sheet and attach along with a Combined Employer’s Registration form for a new corporation.

Change of Officers (attach a list of officers with SSNs, home addresses, and phone numbers).

____________________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________________

Entity change from: ______________________________________________ To: _____________________________________________________________

D. Now doing business in:

TriMet and/or

Lane Transit District Effective Date: _______________________________________________________

E. No longer doing business in:

TriMet and/or

Lane Transit District Effective Date: __________________________________________________

New location: _____________________________________________________________________________________________________________________

F. Partnership, LLC/LLP, or sole proprietor operating without employees.

G. Now using leased employees: Name of leasing company ______________________________________ Date employees transferred: ______________

Total number of employees prior to transfer __________________________________________________ How many employees transferred? ________

H. Closed business or no longer doing business in Oregon.

Note: Corporate officers and members of limited liability companies are employees for some tax programs, but not in others. Check with each

agency to see if these individuals are considered employees.

Date of final payroll ____________________ Location of terminated business’ records: Name: ____________________________________________________

(mm/dd/yy)

Address _______________________________________________________________________________________________________________________________

I understand that it will be necessary for me to again report and pay taxes if at any time I resume operating, even though in a different line of business

and regardless of the extent of my employment.

(

)

X

Signature ___________________________________Title ___________________________ Date _______________Telephone No. ________________________

150-211-157 (Rev. 12-08)

1

1