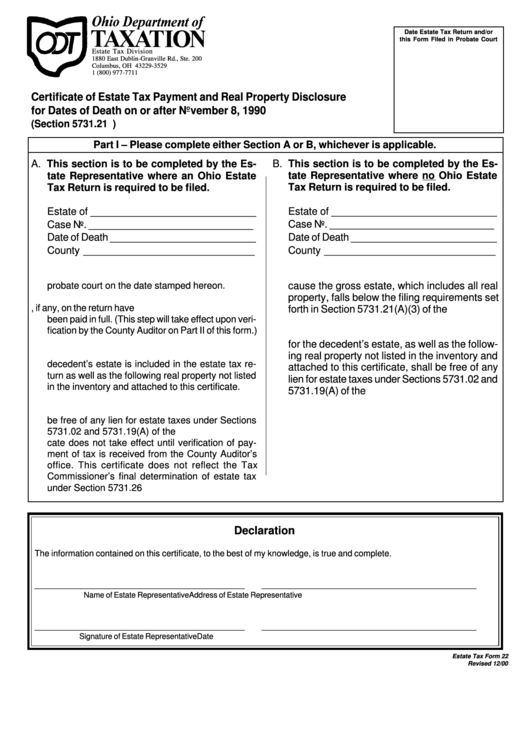

Estate Tax Form 22 - Certificate Of Estate Tax Payment And Real Property Disclosure For Dates Of Death On Or After November 8, 1990

ADVERTISEMENT

Date Estate Tax Return and/or

this Form Filed in Probate Court

Estate Tax Division

1880 East Dublin-Granville Rd., Ste. 200

Columbus, OH 43229-3529

1 (800) 977-7711

Certificate of Estate Tax Payment and Real Property Disclosure

for Dates of Death on or after November 8, 1990

(Section 5731.21 O.R.C.)

Part I – Please complete either Section A or B, whichever is applicable.

A. This section is to be completed by the Es-

B. This section is to be completed by the Es-

tate Representative where no Ohio Estate

tate Representative where an Ohio Estate

Tax Return is required to be filed.

Tax Return is required to be filed.

Estate of _____________________________

Estate of _____________________________

Case No. _____________________________

Case No. _____________________________

Date of Death __________________________

Date of Death __________________________

County ______________________________

County ______________________________

1. The estate tax return due for this estate was filed in

1. No estate tax return is required to be filed be-

probate court on the date stamped hereon.

cause the gross estate, which includes all real

property, falls below the filing requirements set

2. All estate taxes shown due, if any, on the return have

forth in Section 5731.21(A)(3) of the O.R.C.

been paid in full. (This step will take effect upon veri-

fication by the County Auditor on Part II of this form.)

2. All real property listed in the attached inventory

for the decedent’s estate, as well as the follow-

3. All real property listed in the inventory for the

ing real property not listed in the inventory and

decedent’s estate is included in the estate tax re-

attached to this certificate, shall be free of any

turn as well as the following real property not listed

lien for estate taxes under Sections 5731.02 and

in the inventory and attached to this certificate.

5731.19(A) of the O.R.C.

4. The real property attached to this certificate shall

be free of any lien for estate taxes under Sections

5731.02 and 5731.19(A) of the O.R.C. This certifi-

cate does not take effect until verification of pay-

ment of tax is received from the County Auditor’s

office. This certificate does not reflect the Tax

Commissioner’s final determination of estate tax

under Section 5731.26 O.R.C.

Declaration

The information contained on this certificate, to the best of my knowledge, is true and complete.

______________________________________________

_______________________________________________

Name of Estate Representative

Address of Estate Representative

______________________________________________

_______________________________________________

Signature of Estate Representative

Date

Estate Tax Form 22

Revised 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2