Instructions For Form 8582 Draft - 2011

ADVERTISEMENT

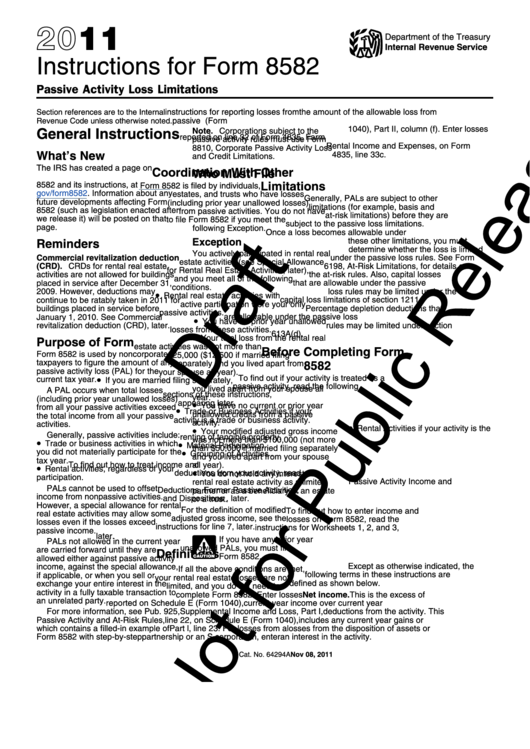

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form 8582

Passive Activity Loss Limitations

instructions for reporting losses from

the amount of the allowable loss from

Section references are to the Internal

passive activities.

Schedule K-1 in Schedule E (Form

Revenue Code unless otherwise noted.

1040), Part II, column (f). Enter losses

General Instructions

Note. Corporations subject to the

reported on line 32 of Form 4835, Farm

passive activity rules must use Form

Rental Income and Expenses, on Form

8810, Corporate Passive Activity Loss

What’s New

4835, line 33c.

and Credit Limitations.

The IRS has created a page on

Coordination With Other

Who Must File

IRS.gov for information about Form

Limitations

8582 and its instructions, at

Form 8582 is filed by individuals,

gov/form8582. Information about any

estates, and trusts who have losses

Generally, PALs are subject to other

future developments affecting Form

(including prior year unallowed losses)

limitations (for example, basis and

8582 (such as legislation enacted after

from passive activities. You do not have

at-risk limitations) before they are

we release it) will be posted on that

to file Form 8582 if you meet the

subject to the passive loss limitations.

page.

following Exception.

Once a loss becomes allowable under

Exception

these other limitations, you must

Reminders

determine whether the loss is limited

You actively participated in rental real

Commercial revitalization deduction

under the passive loss rules. See Form

estate activities (see Special Allowance

(CRD). CRDs for rental real estate

6198, At-Risk Limitations, for details on

for Rental Real Estate Activities, later),

activities are not allowed for buildings

the at-risk rules. Also, capital losses

and you meet all of the following

placed in service after December 31,

that are allowable under the passive

conditions.

2009. However, deductions may

loss rules may be limited under the

•

Rental real estate activities with

capital loss limitations of section 1211.

continue to be ratably taken in 2011 for

active participation were your only

buildings placed in service before

Percentage depletion deductions that

passive activities.

January 1, 2010. See Commercial

are allowable under the passive loss

•

You have no prior year unallowed

revitalization deduction (CRD), later.

rules may be limited under section

losses from these activities.

613A(d).

•

Your total loss from the rental real

Purpose of Form

estate activities was not more than

Before Completing Form

Form 8582 is used by noncorporate

$25,000 ($12,500 if married filing

taxpayers to figure the amount of any

separately and you lived apart from

8582

passive activity loss (PAL) for the

your spouse all year).

To find out if your activity is treated as a

•

current tax year.

If you are married filing separately,

passive activity, read the following

you lived apart from your spouse all

A PAL occurs when total losses

sections of these instructions,

year.

(including prior year unallowed losses)

appearing later.

•

You have no current or prior year

from all your passive activities exceed

•

Trade or Business Activities if your

unallowed credits from a passive

the total income from all your passive

activity is a trade or business activity.

activity.

activities.

•

Rental Activities if your activity is the

•

Your modified adjusted gross income

Generally, passive activities include:

renting of tangible property.

was not more than $100,000 (not more

•

•

Trade or business activities in which

Material Participation .

than $50,000 if married filing separately

•

you did not materially participate for the

Grouping of Activities .

and you lived apart from your spouse

tax year.

To find out how to treat income and

all year).

•

Rental activities, regardless of your

•

deductions from your activity, read

You do not hold any interest in a

participation.

Passive Activity Income and

rental real estate activity as a limited

PALs cannot be used to offset

Deductions, Former Passive Activities,

partner or as a beneficiary of an estate

income from nonpassive activities.

and Dispositions , later.

or a trust.

However, a special allowance for rental

For the definition of modified

To find out how to enter income and

real estate activities may allow some

adjusted gross income, see the

losses on Form 8582, read the

losses even if the losses exceed

instructions for line 7, later.

instructions for Worksheets 1, 2, and 3,

passive income.

later.

If you have any prior year

PALs not allowed in the current year

!

unallowed PALs, you must file

are carried forward until they are

Definitions

Form 8582.

allowed either against passive activity

CAUTION

Except as otherwise indicated, the

income, against the special allowance,

If all the above conditions are met,

following terms in these instructions are

if applicable, or when you sell or

your rental real estate losses are not

defined as shown below.

exchange your entire interest in the

limited, and you do not need to

activity in a fully taxable transaction to

complete Form 8582. Enter losses

Net income. This is the excess of

an unrelated party.

reported on Schedule E (Form 1040),

current year income over current year

For more information, see Pub. 925,

Supplemental Income and Loss, Part I,

deductions from the activity. This

Passive Activity and At-Risk Rules,

line 22, on Schedule E (Form 1040),

includes any current year gains or

which contains a filled-in example of

Part l, line 23. For losses from a

losses from the disposition of assets or

Form 8582 with step-by-step

partnership or an S corporation, enter

an interest in the activity.

Nov 08, 2011

Cat. No. 64294A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13