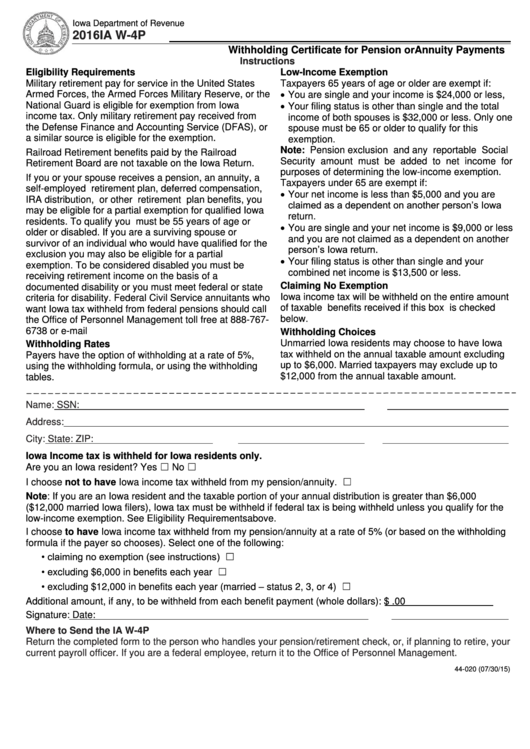

Iowa Department of Revenue

2016 IA W-4P

https://tax.iowa.gov

Withholding Certificate for Pension or Annuity Payments

Instructions

Eligibility Requirements

Low-Income Exemption

Military retirement pay for service in the United States

Taxpayers 65 years of age or older are exempt if:

You are single and your income is $24,000 or less,

Armed Forces, the Armed Forces Military Reserve, or the

Your filing status is other than single and the total

National Guard is eligible for exemption from Iowa

income tax. Only military retirement pay received from

income of both spouses is $32,000 or less. Only one

the Defense Finance and Accounting Service (DFAS), or

spouse must be 65 or older to qualify for this

a similar source is eligible for the exemption.

exemption.

Note: Pension exclusion and any reportable Social

Railroad Retirement benefits paid by the Railroad

Security amount must be added to net income for

Retirement Board are not taxable on the Iowa Return.

purposes of determining the low-income exemption.

If you or your spouse receives a pension, an annuity, a

Taxpayers under 65 are exempt if:

self-employed retirement plan, deferred compensation,

Your net income is less than $5,000 and you are

IRA distribution, or other retirement plan benefits, you

claimed as a dependent on another person’s Iowa

may be eligible for a partial exemption for qualified Iowa

return.

residents. To qualify you must be 55 years of age or

You are single and your net income is $9,000 or less

older or disabled. If you are a surviving spouse or

and you are not claimed as a dependent on another

survivor of an individual who would have qualified for the

person’s Iowa return.

exclusion you may also be eligible for a partial

Your filing status is other than single and your

exemption. To be considered disabled you must be

combined net income is $13,500 or less.

receiving

retirement

income

on

the

basis

of

a

Claiming No Exemption

documented disability or you must meet federal or state

Iowa income tax will be withheld on the entire amount

criteria for disability. Federal Civil Service annuitants who

of taxable benefits received if this box is checked

want Iowa tax withheld from federal pensions should call

below.

the Office of Personnel Management toll free at 888-767-

6738 or e-mail retire@opm.gov.

Withholding Choices

Unmarried Iowa residents may choose to have Iowa

Withholding Rates

tax withheld on the annual taxable amount excluding

Payers have the option of withholding at a rate of 5%,

up to $6,000. Married taxpayers may exclude up to

using the withholding formula, or using the withholding

$12,000 from the annual taxable amount.

tables.

Name:

SSN:

Address:

City:

State:

ZIP:

Iowa Income tax is withheld for Iowa residents only.

Are you an Iowa resident? Yes ☐ No ☐

I choose not to have Iowa income tax withheld from my pension/annuity. ............................................................ ☐

Note: If you are an Iowa resident and the taxable portion of your annual distribution is greater than $6,000

($12,000 married Iowa filers), Iowa tax must be withheld if federal tax is being withheld unless you qualify for the

low-income exemption. See Eligibility Requirements above.

I choose to have Iowa income tax withheld from my pension/annuity at a rate of 5% (or based on the withholding

formula if the payer so chooses). Select one of the following:

• claiming no exemption (see instructions) ....................................................................................................... ☐

• excluding $6,000 in benefits each year .......................................................................................................... ☐

• excluding $12,000 in benefits each year (married – status 2, 3, or 4) ............................................................ ☐

Additional amount, if any, to be withheld from each benefit payment (whole dollars): $

.00

Signature:

Date:

Where to Send the IA W-4P

Return the completed form to the person who handles your pension/retirement check, or, if planning to retire, your

current payroll officer. If you are a federal employee, return it to the Office of Personnel Management.

44-020 (07/30/15)

1

1