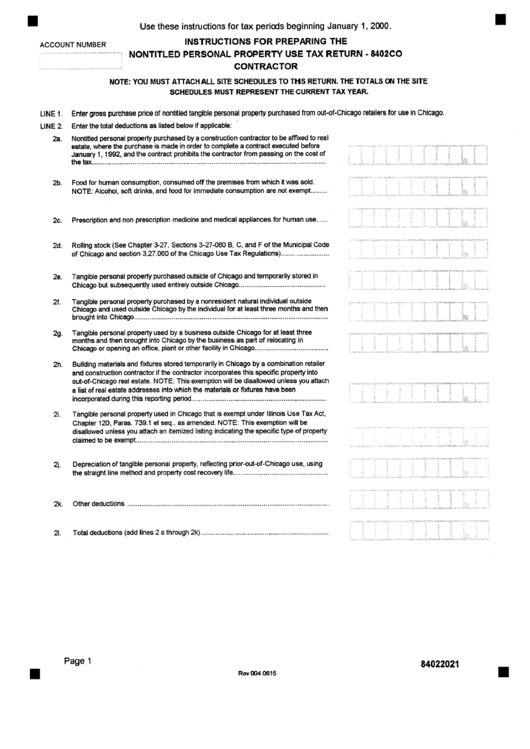

Instructions For Preparing The Nontitled Personal Property Use Tax Return - 8402co Contractor

ADVERTISEMENT

B

ACCOUNTNUMBER

Use these instructions for tax periods beginning January 1,2000.

INSTRUCTIONS FOR PREPARING THE

NONTITLED PERSONAL PROPERTY USE TAX RETURN - 8402CO

C O N T R A C T O R

NOTE: YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE

SCHEDULES MUST REPRESENT THE CURRENT TAX YEAR.

LINE 1.

LINE 2.

2a.

Enter gross purchase price of nontitled tangible personal property purchased from out-of-Chicago retailers for use in Chicago.

Enter the total deductions as listed below if applicable:

Nontitled personal property purchased by a construction contractor to be affixed to real

estate, where the purchase is made in order to complete a contract executed before

......................

January 1,1992, and the contract prohibits the contractor from passing on the cost of

the tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2b.

Food for human consumption, consumed off the premises from which it was sold.

NOTE: Alcohol, soft drinks, and food for immediate consumption are not exempt .........

:...:.....

:.........:....

:......... :...,...:......,+.........+....,...+::.:...<..,.......

2c.

Prescription and non prescription medicine and medical appliances for human use ......

2d.

Rolling stock (See Chapter 3-27, Sections 3-27-060 B, C, and F of the Municipal Code

of Chicago and section 3.27.060 of the Chicago Use Tax Regulations) ..........................

2e.

Tangible personal property purchased outside of Chicago and temporarily stored in

Chicago but subsequently used entirely outside Chicago ..............................................

2f.

Tangible personal property purchased by a nonresident natural individual outside

Chicago and used outside Chicago by the individual for at least three months and then

brought into Chicago

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2g.

Tangible personal property used by a business outside Chicago for at least three

months and then brought into Chicago by the business as part of relocating in

Chicago or opening an office, plant or other facility in Chicago .......................................

2h.

Building materials and fixtures stored temporarily in Chicago by a combination retailer

and construction contractor if the contractor incorporates this specific property into

out-of-Chicago real estate. NOTE: This exemption will be disallowed unless you attach

a list of real estate addresses into which the materials or fixtures have been

incorporated during this reporting period ........................................................................

2i.

Tangible personal property used in Chicago that is exempt under Illinois Use Tax Act,

Chapter 120, Paras. 739.1 et seq., as amended. NOTE: This exemption will be

disallowed unless you attach an itemized listing indicating the specific type of property

claimed to be exempt ......................................................................................................

.

.

.

.

.

'"

"

]

"

. . . . . . . . . . . . . .

•

. . . . .

"" '<" "" "'7" "'" ".!v "'"' :.

• . . . . . . . . .

:

.................................. ............ ............................ ............ i ............. il .............

_ ..........

2j.

Depreciation of tangible personal property, reflecting prior-out-of-Chicago use, using

the straight line method and property cost recovery life ..................................................

2k.

Other deductions ............................................................................................................

21.

Total deductions (add lines 2 a through 2k) ....................................................................

.

"

B

P a g e

1

84022021

B

Rev 004 0615

B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2