Instructions For Preparing The Nontitled Personal Property Use Tax Return

ADVERTISEMENT

B

ACCOUNTNUMBER

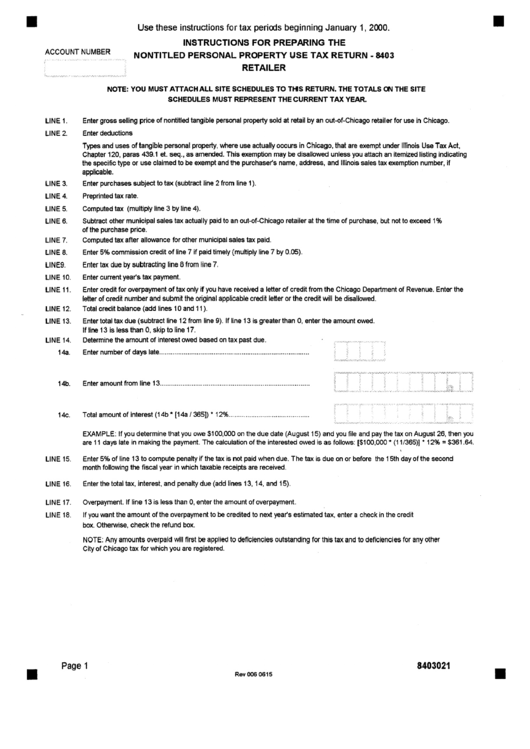

Use these instructions for tax periods beginning January 1,2000.

INSTRUCTIONS FOR PREPARING THE

NONTITLED PERSONAL PROPERTY USE TAX RETURN - 8403

RETAILER

NOTE: YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE

SCHEDULES MUST REPRESENT THE CURRENT TAX YEAR.

LINE 1.

LINE 2.

LINE 3.

LINE 4.

LINE 5.

LINE 6.

LINE 7.

LINE 8.

LINE9.

LINE 10.

LINE 11.

LINE 12.

LINE 13.

LINE 14.

14a.

Enter gross selling price of nontitled tangible personal property sold at retail by an out-of-Chicago retailer for use in Chicago.

Enter deductions

Types and uses of tangible personal property, where use actually occurs in Chicago, that are exempt under Illinois Use Tax Act,

Chapter 120, paras 439.1 et. seq., as amended. This exemption may be disallowed unless you attach an itemized listing indicating

the specific type or use claimed to be exempt and the purchaser's name, address, and Illinois sales tax exemption number, if

applicable.

Enter purchases subject to tax (subtract line 2 from line 1).

Preprinted tax rate.

Computed tax (multiply line 3 by line 4).

Subtract other municipal sales tax actually paid to an out-of-Chicago retailer at the time of purchase, but not to exceed 1%

of the purchase price.

Computed tax after allowance for other municipal sales tax paid.

Enter 5% commission credit of line 7 if paid timely (multiply line 7 by 0.05).

Enter tax due by subtracting line 8 from line 7.

Enter current years tax payment.

Enter credit for overpayment of tax only if you have received a letter of credit from the Chicago Department of Revenue. Enter the

letter of credit number and submit the original applicable credit letter or the credit will be disallowed.

Total credit balance (add lines 10 and 11 ).

Enter total tax due (subtract line 12 from line 9). If line 13 is greater than 0, enter the amount owed.

If line 13 is less than 0, skip to line 17.

Determine the amount of interest owed based on tax past due.

~ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter number of days late ................................................................................

14b.

Enter amount from line 13

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14c.

LINE 15.

LINE 16.

LINE 17.

LINE 16.

:,:

- . : .

• : , . . . . . . , . . . . . .

. . . . . . .

.

. . . . : . . . ,

. . . . . . . . , . . . . . ; . , . . . . . . , . . . . , : . . .

, . . . .

Total amount of interest (14b * [14a / 365]) * 12% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

. . . . . , . . . . . , . , . , , . . . . . . . , . . . . . , . , , . . . . . . . . . .

EXAMPLE: If you determine that you owe $100,000 on the due date (August 15) and you file and pay the tax on August 26, then you

are 11 days late in making the payment. The calculation of the interested owed is as follows: [$100,000 * (11/365)] * 12% = $361.64.

Enter 5% of line 13 to compute penalty if the tax is not paid when due. The tax is due on or before the 15th day of the second

month following the fiscal year in which taxable receipts are received.

Enter the total tax, interest, and penalty due (add lines 13, 14, and 15).

Overpayment. If line 13 is less than 0, enter the amount of overpayment.

If you want the amount of the overpayment to be credited to next years estimated tax, enter a check in the credit

box. Otherwise, check the refund box.

NOTE: Any amounts overpaid will first be applied to deficiencies outstanding for this tax and to deficiencies for any other

City of Chicago tax for which you are registered.

B

Page 1

8403021

B

Rev 006 0615

B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1