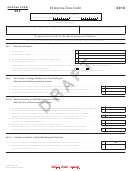

Arizona Form 334 Draft - Motion Picture Credits - 2009 Page 4

ADVERTISEMENT

Name:

TIN:

AZ Form 334 (2009)

Page 4 of 4

Part VIII Available Credit Carryover - Motion Picture Infrastructure Projects

Attach Form(s) 334-1 to detail lines 40 and/or 43.

(a)

(b)

(c)

(d)

(e)

(f)

Post-approval taxable year

38

- see instructions

Original credit amount

39

Credit transfers received -

40

attach schedule

Available credit - add lines 39

41

and 40

Amount previously used

42

Credit transferred to

other taxpayer(s) -

43

attach schedule

Amount unallowable - see

44

instructions

Available carryover - subtract

lines 42 through 44

45

from line 41

Total available carryover

46

Part IX Total Available Credit

47 Current year’s credit for motion picture production costs.

Individuals, corporations, or S corporations - enter the amount from Part IV, line 13.

S corporation shareholders - enter the amount from Part V, line 23.

Partners of a partnership - enter the amount from Part VI, line 27 ........................................................ 47

00

48 Available credit carryover - enter the amount from Part VII, line 37, column (f) ................................. 48

00

49 Available credit for motion picture production costs - add lines 47 and 48 ...................................................................................... 49

00

50 Current year’s credit for motion picture infrastructure projects.

Individuals, corporations, or S corporations - enter the amount from Part IV, line 18.

S corporation shareholders - enter the amount from Part V, line 24.

Partners of a partnership - enter the amount from Part VI, line 28 ........................................................ 50

00

51 Available credit carryover - enter the amount from Part VIII, line 46, column (f) ................................ 51

00

52 Available credit for motion picture infrastructure projects - add lines 50 and 51 .............................................................................. 52

00

53 Total available credit. Add lines 49 and 52. Corporations and S corporations - enter total here

and on Form 300, Part 1, line 14. Individuals - enter total here and on Form 301, Part I, line 20 .................................................. 53

00

ADOR 91-5523 (09)

DRAFT 09-14-09

DRAFT 09-14-09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5