Arizona Form 304 Draft - Enterprise Zone Credit - 2010

ADVERTISEMENT

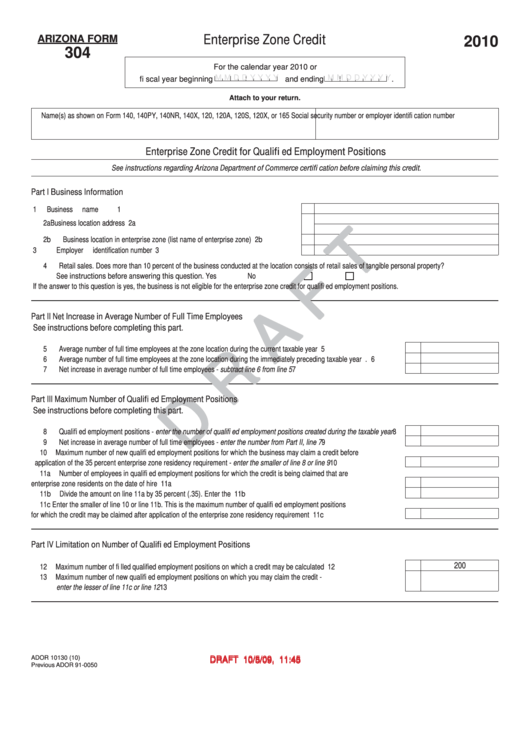

Enterprise Zone Credit

ARIZONA FORM

2010

304

For the calendar year 2010 or

M M D D Y Y Y Y

M M D D Y Y Y Y

fi scal year beginning

and ending

.

Attach to your return.

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X, or 165

Social security number or employer identifi cation number

Enterprise Zone Credit for Qualifi ed Employment Positions

See instructions regarding Arizona Department of Commerce certifi cation before claiming this credit.

Part I

Business Information

1

Business name ..............................................................................................................

1

2a Business location address .............................................................................................

2a

2b Business location in enterprise zone (list name of enterprise zone) .............................

2b

3

Employer identifi cation number .....................................................................................

3

4

Retail sales. Does more than 10 percent of the business conducted at the location consists of retail sales of tangible personal property?

See instructions before answering this question.

Yes

No

If the answer to this question is yes, the business is not eligible for the enterprise zone credit for qualifi ed employment positions.

Part II

Net Increase in Average Number of Full Time Employees

See instructions before completing this part.

5

Average number of full time employees at the zone location during the current taxable year ................................................

5

6

Average number of full time employees at the zone location during the immediately preceding taxable year .......................

6

7

Net increase in average number of full time employees - subtract line 6 from line 5 ..............................................................

7

Part III

Maximum Number of Qualifi ed Employment Positions

See instructions before completing this part.

8

Qualifi ed employment positions - enter the number of qualifi ed employment positions created during the taxable year .......

8

9

Net increase in average number of full time employees - enter the number from Part II, line 7 .............................................

9

10

Maximum number of new qualifi ed employment positions for which the business may claim a credit before

application of the 35 percent enterprise zone residency requirement - enter the smaller of line 8 or line 9 ...........................

10

11a Number of employees in qualifi ed employment positions for which the credit is being claimed that are

enterprise zone residents on the date of hire ..........................................................................................................................

11a

11b Divide the amount on line 11a by 35 percent (.35). Enter the quotient....................................................................................

11b

11c Enter the smaller of line 10 or line 11b. This is the maximum number of qualifi ed employment positions

for which the credit may be claimed after application of the enterprise zone residency requirement .....................................

11c

Part IV Limitation on Number of Qualifi ed Employment Positions

200

12

Maximum number of fi lled qualifi ed employment positions on which a credit may be calculated ...........................................

12

13

Maximum number of new qualifi ed employment positions on which you may claim the credit -

enter the lesser of line 11c or line 12 .......................................................................................................................................

13

ADOR 10130 (10)

DRAFT 10/5/09, 11:45 a.m.

DRAFT 10/5/09, 11:45 a.m.

Previous ADOR 91-0050

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5