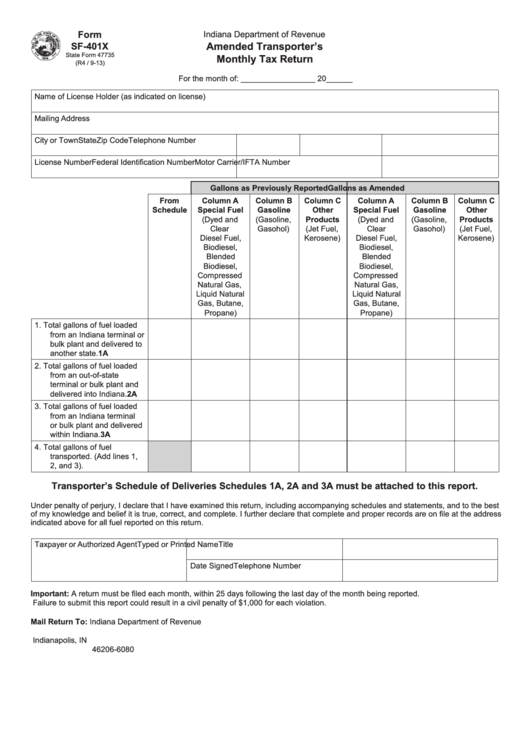

Form

Indiana Department of Revenue

Amended Transporter’s

SF-401X

State Form 47735

Monthly Tax Return

(R4 / 9-13)

For the month of: _________________ 20______

Name of License Holder (as indicated on license)

Mailing Address

City or Town

State

Zip Code

Telephone Number

License Number

Federal Identification Number

Motor Carrier/IFTA Number

Gallons as Previously Reported

Gallons as Amended

From

Column A

Column B

Column C

Column A

Column B

Column C

Schedule

Special Fuel

Gasoline

Other

Special Fuel

Gasoline

Other

(Dyed and

(Gasoline,

Products

(Dyed and

(Gasoline,

Products

Clear

Gasohol)

(Jet Fuel,

Clear

Gasohol)

(Jet Fuel,

Diesel Fuel,

Kerosene)

Diesel Fuel,

Kerosene)

Biodiesel,

Biodiesel,

Blended

Blended

Biodiesel,

Biodiesel,

Compressed

Compressed

Natural Gas,

Natural Gas,

Liquid Natural

Liquid Natural

Gas, Butane,

Gas, Butane,

Propane)

Propane)

1.

Total gallons of fuel loaded

from an Indiana terminal or

bulk plant and delivered to

another state.

1A

2.

Total gallons of fuel loaded

from an out-of-state

terminal or bulk plant and

delivered into Indiana.

2A

3.

Total gallons of fuel loaded

from an Indiana terminal

or bulk plant and delivered

within Indiana.

3A

4.

Total gallons of fuel

transported. (Add lines 1,

2, and 3).

Transporter’s Schedule of Deliveries Schedules 1A, 2A and 3A must be attached to this report.

Under penalty of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best

of my knowledge and belief it is true, correct, and complete. I further declare that complete and proper records are on file at the address

indicated above for all fuel reported on this return.

Taxpayer or Authorized Agent

Typed or Printed Name

Title

Date Signed

Telephone Number

Important: A return must be filed each month, within 25 days following the last day of the month being reported.

Failure to submit this report could result in a civil penalty of $1,000 for each violation.

Mail Return To: Indiana Department of Revenue

P.O. Box 6080

Indianapolis, IN

46206-6080

1

1 2

2