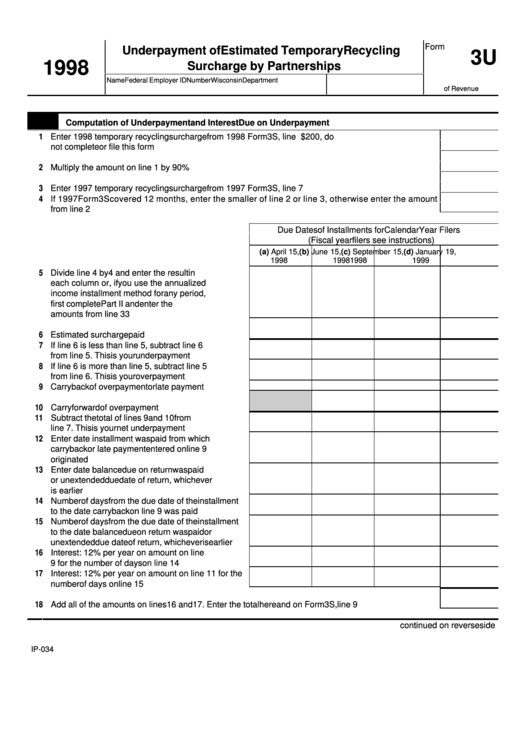

Form

Underpayment of Estimated Temporary Recycling

3U

1998

Surcharge by Partnerships

Name

Federal Employer ID Number

Wisconsin Department

of Revenue

Part I

Computation of Underpayment and Interest Due on Underpayment

1 Enter 1998 temporary recycling surcharge from 1998 Form 3S, line 7. If less than $200, do

not complete or file this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Multiply the amount on line 1 by 90% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Enter 1997 temporary recycling surcharge from 1997 Form 3S, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 If 1997 Form 3S covered 12 months, enter the smaller of line 2 or line 3, otherwise enter the amount

from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Due Dates of Installments for Calendar Year Filers

(Fiscal year filers see instructions)

(a) April 15,

(b) June 15,

(c) September 15, (d) January 19,

1998

1998

1998

1999

5 Divide line 4 by 4 and enter the result in

each column or, if you use the annualized

income installment method for any period,

first complete Part II and enter the

amounts from line 33 . . . . . . . . . . . . . . . . . . . . . . . .

6 Estimated surcharge paid . . . . . . . . . . . . . . . . . . . . .

7 If line 6 is less than line 5, subtract line 6

from line 5. This is your underpayment . . . . . . . . . .

8 If line 6 is more than line 5, subtract line 5

from line 6. This is your overpayment . . . . . . . . . . .

9 Carryback of overpayment or late payment . . . . . .

10 Carryforward of overpayment . . . . . . . . . . . . . . . . . .

11 Subtract the total of lines 9 and 10 from

line 7. This is your net underpayment . . . . . . . . . . .

12 Enter date installment was paid from which

carryback or late payment entered on line 9

originated . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Enter date balance due on return was paid

or unextended due date of return, whichever

is earlier . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 Number of days from the due date of the installment

to the date carryback on line 9 was paid . . . . . . . . .

15 Number of days from the due date of the installment

to the date balance due on return was paid or

unextended due date of return, whichever is earlier

16 Interest: 12% per year on amount on line

9 for the number of days on line 14 . . . . . . . . . . . . .

17 Interest: 12% per year on amount on line 11 for the

number of days on line 15 . . . . . . . . . . . . . . . . . . . . .

18 Add all of the amounts on lines 16 and 17. Enter the total here and on Form 3S, line 9 . . . . . . . . . . . . .

continued on reverse side

IP-034

1

1 2

2