Form 3u-Ip-034-99 - Underpayment Of Estimated Temporary Recycling Surcharge By Partnerships

ADVERTISEMENT

Form

3U

Underpayment of Estimated Temporary Recycling

Surcharge by Partnerships

1999

Name

Federal Employer ID Number

Wisconsin Department

of Revenue

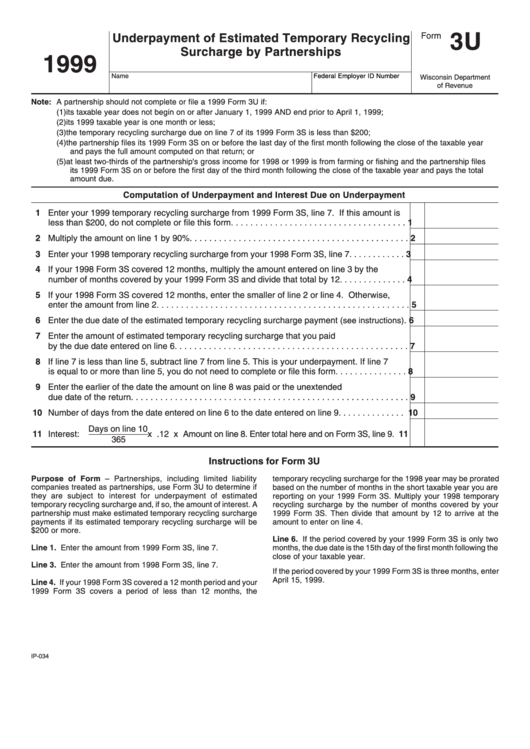

Note: A partnership should not complete or file a 1999 Form 3U if:

(1) its taxable year does not begin on or after January 1, 1999 AND end prior to April 1, 1999;

(2) its 1999 taxable year is one month or less;

(3) the temporary recycling surcharge due on line 7 of its 1999 Form 3S is less than $200;

(4) the partnership files its 1999 Form 3S on or before the last day of the first month following the close of the taxable year

and pays the full amount computed on that return; or

(5) at least two-thirds of the partnership's gross income for 1998 or 1999 is from farming or fishing and the partnership files

its 1999 Form 3S on or before the first day of the third month following the close of the taxable year and pays the total

amount due.

Computation of Underpayment and Interest Due on Underpayment

1 Enter your 1999 temporary recycling surcharge from 1999 Form 3S, line 7. If this amount is

less than $200, do not complete or file this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Multiply the amount on line 1 by 90% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3 Enter your 1998 temporary recycling surcharge from your 1998 Form 3S, line 7 . . . . . . . . . . . .

3

4 If your 1998 Form 3S covered 12 months, multiply the amount entered on line 3 by the

number of months covered by your 1999 Form 3S and divide that total by 12 . . . . . . . . . . . . . .

4

5 If your 1998 Form 3S covered 12 months, enter the smaller of line 2 or line 4. Otherwise,

enter the amount from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Enter the due date of the estimated temporary recycling surcharge payment (see instructions) .

6

7 Enter the amount of estimated temporary recycling surcharge that you paid

by the due date entered on line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 If line 7 is less than line 5, subtract line 7 from line 5. This is your underpayment. If line 7

is equal to or more than line 5, you do not need to complete or file this form . . . . . . . . . . . . . . .

8

9 Enter the earlier of the date the amount on line 8 was paid or the unextended

due date of the return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Number of days from the date entered on line 6 to the date entered on line 9 . . . . . . . . . . . . . . 10

Days on line 10

11 Interest:

x .12 x Amount on line 8. Enter total here and on Form 3S, line 9 . 11

365

Instructions for Form 3U

Purpose of Form – Partnerships, including limited liability

temporary recycling surcharge for the 1998 year may be prorated

companies treated as partnerships, use Form 3U to determine if

based on the number of months in the short taxable year you are

they are subject to interest for underpayment of estimated

reporting on your 1999 Form 3S. Multiply your 1998 temporary

temporary recycling surcharge and, if so, the amount of interest. A

recycling surcharge by the number of months covered by your

partnership must make estimated temporary recycling surcharge

1999 Form 3S. Then divide that amount by 12 to arrive at the

payments if its estimated temporary recycling surcharge will be

amount to enter on line 4.

$200 or more.

Line 6. If the period covered by your 1999 Form 3S is only two

Line 1. Enter the amount from 1999 Form 3S, line 7.

months, the due date is the 15th day of the first month following the

close of your taxable year.

Line 3. Enter the amount from 1998 Form 3S, line 7.

If the period covered by your 1999 Form 3S is three months, enter

April 15, 1999.

Line 4. If your 1998 Form 3S covered a 12 month period and your

1999 Form 3S covers a period of less than 12 months, the

IP-034

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1