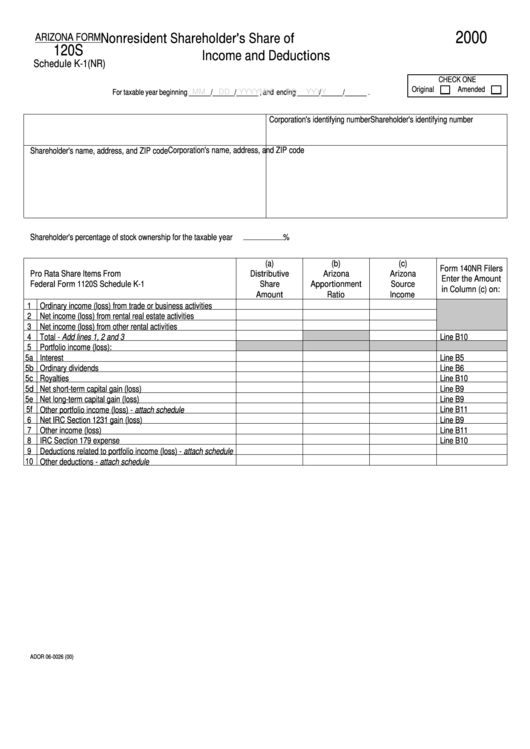

Arizona Form 120s - Nonresident Shareholder'S Share Of Income And Deductions - 2000

ADVERTISEMENT

2000

Nonresident Shareholder's Share of

ARIZONA FORM

120S

Income and Deductions

Schedule K-1(NR)

CHECK ONE

Original

Amended

For taxable year beginning ______/______/______ , and ending ______/______/______ .

MM

DD

YYYY

MM

DD

YYYY

Shareholder's identifying number

Corporation's identifying number

Corporation's name, address, and ZIP code

Shareholder's name, address, and ZIP code

Shareholder's percentage of stock ownership for the taxable year

%

(a)

(b)

(c)

Form 140NR Filers

Pro Rata Share Items From

Distributive

Arizona

Arizona

Enter the Amount

Federal Form 1120S Schedule K-1

Share

Apportionment

Source

in Column (c) on:

Amount

Ratio

Income

1

Ordinary income (loss) from trade or business activities

2

Net income (loss) from rental real estate activities

3

Net income (loss) from other rental activities

4

Total - Add lines 1, 2 and 3

Line B10

5

Portfolio income (loss):

5a Interest

Line B5

5b

Ordinary dividends

Line B6

5c

Royalties

Line B10

5d

Net short-term capital gain (loss)

Line B9

5e

Net long-term capital gain (loss)

Line B9

5f

Line B11

Other portfolio income (loss) - attach schedule

6

Net IRC Section 1231 gain (loss)

Line B9

7

Other income (loss)

Line B11

8

IRC Section 179 expense

Line B10

9

Deductions related to portfolio income (loss) - attach schedule

10

Other deductions - attach schedule

ADOR 06-0026 (00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1