Publication 527- Residential Rental Property - 2002 Page 13

ADVERTISEMENT

Conventions

If you elect to use the straight line method for

How to use the tables. The following section

5-, 7-, or 15-year property, or the 150% declining

explains how to use the optional tables.

Under MACRS, conventions establish when the

balance method for 5- or 7-year property, use

Figure the depreciation deduction by multi-

recovery period begins and ends. The conven-

the tables in Appendix A of Publication 946.

plying your unadjusted basis in the property by

tion you use determines the number of months

Figure any special depreciation allow-

the percentage shown in the appropriate table.

for which you can claim depreciation in the year

!

ance on qualified property before using

Your unadjusted basis is your depreciable basis

you place property in service and in the year you

Table 4 – A, 4 – B, and 4 – C, or the 5 – ,

CAUTION

without reduction for MACRS depreciation pre-

dispose of the property.

7 – , or 15 – year property tables in Appendix A of

viously claimed.

Mid-month convention.

A mid-month con-

Publication 946.

Once you begin using an optional table to

vention is used for all residential rental property

figure depreciation, you must continue to use it

and nonresidential real property. Under this con-

for the entire recovery period unless there is an

vention, you treat all property placed in service,

or disposed of, during any month as placed in

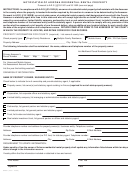

Table 4.

Optional MACRS Tables

service, or disposed of, at the midpoint of that

month.

Table 4–A. MACRS 5-Year Property

Mid-quarter convention. A mid-quarter con-

Half-year convention

Mid-quarter convention

vention must be used if the mid-month conven-

Year

First

Second

Third

Fourth

tion does not apply and the total depreciable

quarter

quarter

quarter

quarter

basis of MACRS property placed in service in

the last 3 months of a tax year (excluding non-

1

20.00%

35.00%

25.00%

15.00%

5.00%

residential real property, residential rental prop-

2

32.00

26.00

30.00

34.00

38.00

erty, and property placed in service and

3

19.20

15.60

18.00

20.40

22.80

disposed of in the same year) is more than 40%

4

11.52

11.01

11.37

12.24

13.68

of the total basis of all such property you place in

5

11.52

11.01

11.37

11.30

10.94

service during the year.

6

5.76

1.38

4.26

7.06

9.58

Under this convention, you treat all property

placed in service, or disposed of, during any

quarter of a tax year as placed in service, or

Table 4–B. MACRS 7-Year Property

disposed of, at the midpoint of the quarter.

Half-year convention

Mid-quarter convention

Example. During the tax year, Tom Martin

Year

First

Second

Third

Fourth

purchased the following items to use in his rental

quarter

quarter

quarter

quarter

property. He elects not to claim the special de-

preciation allowance, discussed earlier.

1

14.29%

25.00%

17.85%

10.71%

3.57%

•

A dishwasher for $400 that he placed in

2

24.49

21.43

23.47

25.51

27.55

service in January.

3

17.49

15.31

16.76

18.22

19.68

•

4

12.49

10.93

11.97

13.02

14.06

Used furniture for $100 that he placed in

5

8.93

8.75

8.87

9.30

10.04

service in September.

6

8.92

8.74

8.87

8.85

8.73

•

A refrigerator for $500 that he placed in

service in October.

Table 4–C. MACRS 15-Year Property

Tom uses the calendar year as his tax year. The

Half-year convention

Mid-quarter convention

total basis of all property placed in service that

year is $1,000. The $500 basis of the refrigerator

Year

First

Second

Third

Fourth

placed in service during the last 3 months of his

tax year exceeds $400 (40% × $1,000). Tom

quarter

quarter

quarter

quarter

must use the mid-quarter convention instead of

1

5.00%

8.75%

6.25%

3.75%

1.25%

the half-year convention for all three items.

2

9.50

9.13

9.38

9.63

9.88

3

8.55

8.21

8.44

8.66

8.89

Half-year convention.

The half-year conven-

4

7.70

7.39

7.59

7.80

8.00

tion is used if neither the mid-quarter convention

5

6.93

6.65

6.83

7.02

7.20

nor the mid-month convention applies. Under

6

6.23

5.99

6.15

6.31

6.48

this convention, you treat all property placed in

service, or disposed of, during a tax year as

placed in service, or disposed of, at the midpoint

Table 4–D. Residential Rental Property (27.5-year)

of that tax year.

Use the row for the month of the taxable year placed in service.

If this convention applies, you deduct a

half-year of depreciation for the first year and the

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

last year that you depreciate the property. You

Jan.

3.485%

3.636%

3.636%

3.636%

3.636%

3.636%

deduct a full year of depreciation for any other

Feb.

3.182

3.636

3.636

3.636

3.636

3.636

year during the recovery period.

March

2.879

3.636

3.636

3.636

3.636

3.636

Apr.

2.576

3.636

3.636

3.636

3.636

3.636

Optional Tables

May

2.273

3.636

3.636

3.636

3.636

3.636

You can use the tables in Table 4 to compute

June

1.970

3.636

3.636

3.636

3.636

3.636

annual depreciation under MACRS. The tables

July

1.667

3.636

3.636

3.636

3.636

3.636

show the percentages for the first 6 years. See

Aug.

1.364

3.636

3.636

3.636

3.636

3.636

Appendix A of Publication 946 for complete ta-

Sept.

1.061

3.636

3.636

3.636

3.636

3.636

bles. The percentages in Tables 4 – A, 4 – B, and

Oct.

0.758

3.636

3.636

3.636

3.636

3.636

4 – C make the change from declining balance to

Nov.

0.455

3.636

3.636

3.636

3.636

3.636

straight line in the year that straight line will yield

Dec.

0.152

3.636

3.636

3.636

3.636

3.636

a larger deduction. See Declining Balance

Method, earlier.

Page 13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19