Form Cd Lo-14b - Statement Of Financial Condition For Individuals - Georgia Department Of Revenue Page 4

ADVERTISEMENT

CD LO-14B (Rev. 11/99)

Page 4

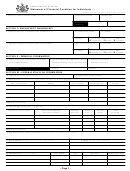

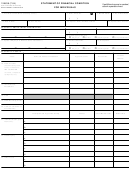

SECTION VIII – INCOME & EXPENSE ANALYSIS

42. Monthly Household Disposable Income

Gross Monthly Income

Monthly Living Expenses

Source

Taxpayer

Spouse

Source

Amount

Salary, Wages, Commissions, Tips

$

$

House or Rent Payment

$

Self-Employment Income

Income Taxes (Federal, State, FICA)

Pensions, Disability & Social Security

Estimated Tax (If Applicable)

Dividends & Interest

Groceries

Gift or Loan Proceeds

Medical Expenses & Prescriptions

Rental Income

Utilities:

Estate, Trust & Royalty Income

Electric $_______ +

Gas $________+

Workers’ Comp. & Unemployment

Water

$_______+ P hone $________=

Alimony & Child Support

Insurance:

Other (Specify)

Life

$_______+ Health $ _______+

Auto

$_______+ Home $________=

Court Ordered Payment

Personal Loan Payment

Religious & Charitable Donations

Clothing & Personal Grooming

Entertainment & Recreation

Legal Fees

Transportation Expense

Vehicle Loan Payment

Vehicle Lease Payment

Property & Ad Valorem Taxes

Child Care

Installment & Credit Card Payments

Tuition Payment

Other (Specify)

Subtotal

$

$

Combined Monthly Income $

Total Monthly Living Expenses

$

43. Net Monthly Household Disposable Income (“Combined Monthly Income” Minus “Total Monthly Living Expenses”) $

I/we have examined this Statement of Financial Condition for Individuals and hereby affirm that to the best of my/our knowledge

and belief, it is true, correct and complete.

Taxpayer’ s Signature

_______________________________________________________ Date __________________________

Spouse’ s Signature

_______________________________________________________ Date __________________________

POA Signature

_______________________________________________________ Date __________________________

(Attach Power of Attorney - Use Department of Revenue Form RD-1061 Only)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4