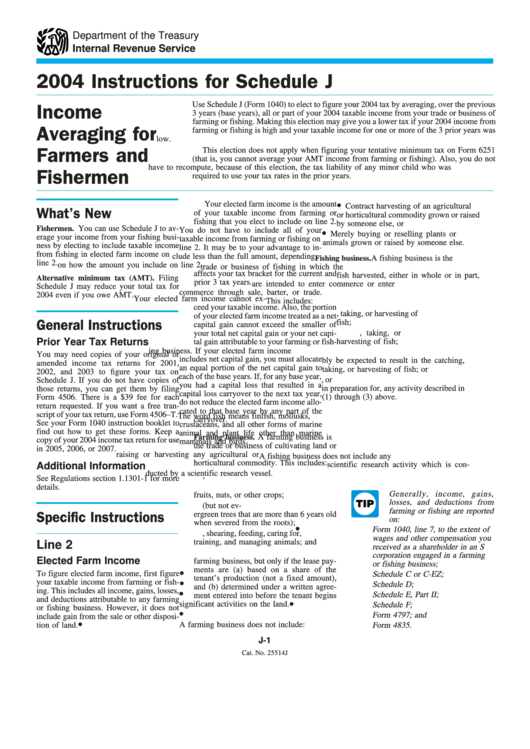

Instructions For Schedule J - Income Averaging For Farmers And Fishermen - 2004

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

2004 Instructions for Schedule J

Use Schedule J (Form 1040) to elect to figure your 2004 tax by averaging, over the previous

Income

3 years (base years), all or part of your 2004 taxable income from your trade or business of

farming or fishing. Making this election may give you a lower tax if your 2004 income from

Averaging for

farming or fishing is high and your taxable income for one or more of the 3 prior years was

low.

This election does not apply when figuring your tentative minimum tax on Form 6251

Farmers and

(that is, you cannot average your AMT income from farming or fishing). Also, you do not

have to recompute, because of this election, the tax liability of any minor child who was

Fishermen

required to use your tax rates in the prior years.

•

Your elected farm income is the amount

Contract harvesting of an agricultural

What’s New

of your taxable income from farming or

or horticultural commodity grown or raised

fishing that you elect to include on line 2.

by someone else, or

You can use Schedule J to av-

Fishermen.

•

You do not have to include all of your

Merely buying or reselling plants or

erage your income from your fishing busi-

taxable income from farming or fishing on

animals grown or raised by someone else.

ness by electing to include taxable income

line 2. It may be to your advantage to in-

from fishing in elected farm income on

clude less than the full amount, depending

A fishing business is the

Fishing business.

line 2.

on how the amount you include on line 2

trade or business of fishing in which the

affects your tax bracket for the current and

fish harvested, either in whole or in part,

Alternative minimum tax (AMT).

Filing

prior 3 tax years.

are intended to enter commerce or enter

Schedule J may reduce your total tax for

commerce through sale, barter, or trade.

2004 even if you owe AMT.

Your elected farm income cannot ex-

This includes:

ceed your taxable income. Also, the portion

1. The catching, taking, or harvesting of

of your elected farm income treated as a net

fish;

General Instructions

capital gain cannot exceed the smaller of

2. The attempted catching, taking, or

your total net capital gain or your net capi-

Prior Year Tax Returns

harvesting of fish;

tal gain attributable to your farming or fish-

ing business. If your elected farm income

3. Any other activity which can reasona-

You may need copies of your original or

includes net capital gain, you must allocate

bly be expected to result in the catching,

amended income tax returns for 2001,

an equal portion of the net capital gain to

taking, or harvesting of fish; or

2002, and 2003 to figure your tax on

each of the base years. If, for any base year,

4. Any operations at sea in support of, or

Schedule J. If you do not have copies of

you had a capital loss that resulted in a

in preparation for, any activity described in

those returns, you can get them by filing

capital loss carryover to the next tax year,

(1) through (3) above.

Form 4506. There is a $39 fee for each

do not reduce the elected farm income allo-

return requested. If you want a free tran-

cated to that base year by any part of the

script of your tax return, use Form 4506 – T.

The word fish means finfish, mollusks,

carryover.

See your Form 1040 instruction booklet to

crustaceans, and all other forms of marine

find out how to get these forms. Keep a

animal and plant life other than marine

A farming business is

Farming business.

copy of your 2004 income tax return for use

mammals and birds.

the trade or business of cultivating land or

in 2005, 2006, or 2007.

raising or harvesting any agricultural or

A fishing business does not include any

horticultural commodity. This includes:

scientific research activity which is con-

Additional Information

ducted by a scientific research vessel.

1. Operating a nursery or sod farm;

See Regulations section 1.1301-1 for more

2. Raising or harvesting of trees bearing

details.

Generally, income, gains,

fruits, nuts, or other crops;

losses, and deductions from

TIP

3. Raising ornamental trees (but not ev-

farming or fishing are reported

ergreen trees that are more than 6 years old

Specific Instructions

on:

when severed from the roots);

•

Form 1040, line 7, to the extent of

4. Raising, shearing, feeding, caring for,

wages and other compensation you

training, and managing animals; and

Line 2

received as a shareholder in an S

5. Leasing land to a tenant engaged in a

corporation engaged in a farming

Elected Farm Income

farming business, but only if the lease pay-

or fishing business;

ments are (a) based on a share of the

•

To figure elected farm income, first figure

Schedule C or C-EZ;

tenant’s production (not a fixed amount),

•

your taxable income from farming or fish-

Schedule D;

and (b) determined under a written agree-

•

ing. This includes all income, gains, losses,

Schedule E, Part II;

ment entered into before the tenant begins

and deductions attributable to any farming

•

significant activities on the land.

Schedule F;

or fishing business. However, it does not

•

Form 4797; and

include gain from the sale or other disposi-

•

tion of land.

A farming business does not include:

Form 4835.

J-1

Cat. No. 25514J

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8