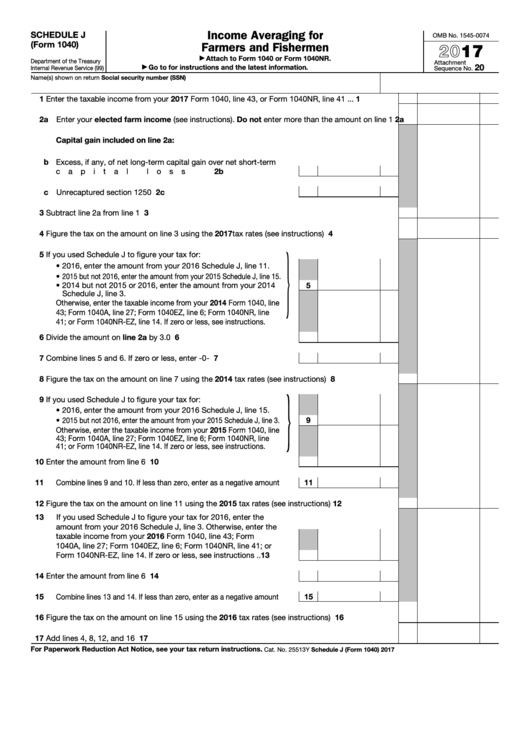

Income Averaging for

SCHEDULE J

OMB No. 1545-0074

(Form 1040)

Farmers and Fishermen

2017

Attach to Form 1040 or Form 1040NR.

▶

Department of the Treasury

Attachment

20

Go to for instructions and the latest information.

Internal Revenue Service (99)

▶

Sequence No.

Social security number (SSN)

Name(s) shown on return

1

Enter the taxable income from your 2017 Form 1040, line 43, or Form 1040NR, line 41

.

.

.

1

2a Enter your elected farm income (see instructions). Do not enter more than the amount on line 1

2a

Capital gain included on line 2a:

b Excess, if any, of net long-term capital gain over net short-term

capital loss

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2b

c Unrecaptured section 1250 gain

2c

.

.

.

.

.

.

.

.

.

.

3

Subtract line 2a from line 1 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Figure the tax on the amount on line 3 using the 2017 tax rates (see instructions) .

.

.

.

.

4

}

5

If you used Schedule J to figure your tax for:

• 2016, enter the amount from your 2016 Schedule J, line 11.

• 2015 but not 2016, enter the amount from your 2015 Schedule J, line 15.

• 2014 but not 2015 or 2016, enter the amount from your 2014

5

Schedule J, line 3.

Otherwise, enter the taxable income from your 2014 Form 1040, line

43; Form 1040A, line 27; Form 1040EZ, line 6; Form 1040NR, line

41; or Form 1040NR-EZ, line 14. If zero or less, see instructions.

6

Divide the amount on line 2a by 3.0 .

.

.

.

.

.

.

.

.

6

7

7

Combine lines 5 and 6. If zero or less, enter -0-

.

.

.

.

.

8

Figure the tax on the amount on line 7 using the 2014 tax rates (see instructions) .

.

.

.

.

8

}

9

If you used Schedule J to figure your tax for:

• 2016, enter the amount from your 2016 Schedule J, line 15.

• 2015 but not 2016, enter the amount from your 2015 Schedule J, line 3.

9

Otherwise, enter the taxable income from your 2015 Form 1040, line

43; Form 1040A, line 27; Form 1040EZ, line 6; Form 1040NR, line

41; or Form 1040NR-EZ, line 14. If zero or less, see instructions.

10

10

Enter the amount from line 6

.

.

.

.

.

.

.

.

.

.

.

11

Combine lines 9 and 10. If less than zero, enter as a negative amount

11

12

Figure the tax on the amount on line 11 using the 2015 tax rates (see instructions) .

.

.

.

.

12

13

If you used Schedule J to figure your tax for 2016, enter the

amount from your 2016 Schedule J, line 3. Otherwise, enter the

taxable income from your 2016 Form 1040, line 43; Form

1040A, line 27; Form 1040EZ, line 6; Form 1040NR, line 41; or

Form 1040NR-EZ, line 14. If zero or less, see instructions .

.

13

14

Enter the amount from line 6

.

.

.

.

.

.

.

.

.

.

.

14

15

15

Combine lines 13 and 14. If less than zero, enter as a negative amount

16

Figure the tax on the amount on line 15 using the 2016 tax rates (see instructions) .

.

.

.

.

16

17

17

Add lines 4, 8, 12, and 16

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

For Paperwork Reduction Act Notice, see your tax return instructions.

Schedule J (Form 1040) 2017

Cat. No. 25513Y

1

1 2

2