Form I-7 Short Form - Cleveland Heights Individual Income Tax Return - 2000

ADVERTISEMENT

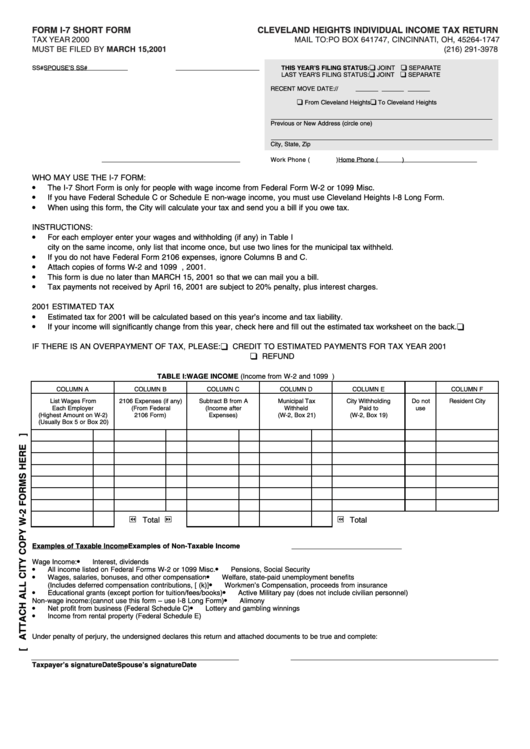

FORM I-7 SHORT FORM

CLEVELAND HEIGHTS INDIVIDUAL INCOME TAX RETURN

TAX YEAR 2000

MAIL TO: PO BOX 641747, CINCINNATI, OH, 45264-1747

MUST BE FILED BY MARCH 15, 2001

(216) 291-3978

❑

❑

SS#

SPOUSE’S SS#

THIS YEAR’S FILING STATUS:

JOINT

SEPARATE

❑

❑

LAST YEAR’S FILING STATUS:

JOINT

SEPARATE

RECENT MOVE DATE:

/

/

❑

❑

From Cleveland Heights

To Cleveland Heights

Previous or New Address (circle one)

City, State, Zip

Home Phone (

)

Work Phone (

)

WHO MAY USE THE I-7 FORM:

•

The I-7 Short Form is only for people with wage income from Federal Form W-2 or 1099 Misc.

•

If you have Federal Schedule C or Schedule E non-wage income, you must use Cleveland Heights I-8 Long Form.

•

When using this form, the City will calculate your tax and send you a bill if you owe tax.

INSTRUCTIONS:

•

For each employer enter your wages and withholding (if any) in Table I below. If your employer withheld for more than one

city on the same income, only list that income once, but use two lines for the municipal tax withheld.

•

If you do not have Federal Form 2106 expenses, ignore Columns B and C.

•

Attach copies of forms W-2 and 1099 Misc. and mail between January 1 and March 15, 2001.

•

This form is due no later than MARCH 15, 2001 so that we can mail you a bill.

•

Tax payments not received by April 16, 2001 are subject to 20% penalty, plus interest charges.

2001 ESTIMATED TAX

•

Estimated tax for 2001 will be calculated based on this year’s income and tax liability.

❑

•

If your income will significantly change from this year, check here and fill out the estimated tax worksheet on the back.

❑

IF THERE IS AN OVERPAYMENT OF TAX, PLEASE:

CREDIT TO ESTIMATED PAYMENTS FOR TAX YEAR 2001

❑

REFUND

TABLE I: WAGE INCOME (Income from W-2 and 1099 Misc. Forms)

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

List Wages From

2106 Expenses (if any)

Subtract B from A

Municipal Tax

City Withholding

Do not

Resident City

Each Employer

(From Federal

(Income after

Withheld

Paid to

use

(Highest Amount on W-2)

2106 Form)

Expenses)

(W-2, Box 21)

(W-2, Box 19)

(Usually Box 5 or Box 20)

Total

Total

Examples of Taxable Income

Examples of Non-Taxable Income

•

Wage Income:

Interest, dividends

•

•

All income listed on Federal Forms W-2 or 1099 Misc.

Pensions, Social Security

•

•

Wages, salaries, bonuses, and other compensation

Welfare, state-paid unemployment benefits

•

(Includes deferred compensation contributions, [e.g. 401(k)]

Workmen’s Compensation, proceeds from insurance

•

•

Educational grants (except portion for tuition/fees/books)

Active Military pay (does not include civilian personnel)

•

Non-wage income: (cannot use this form – use I-8 Long Form)

Alimony

•

•

Net profit from business (Federal Schedule C)

Lottery and gambling winnings

•

Income from rental property (Federal Schedule E)

Under penalty of perjury, the undersigned declares this return and attached documents to be true and complete:

Taxpayer’s signature

Date

Spouse’s signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1