Press Here To Print This Form

Save Form

Reset Form

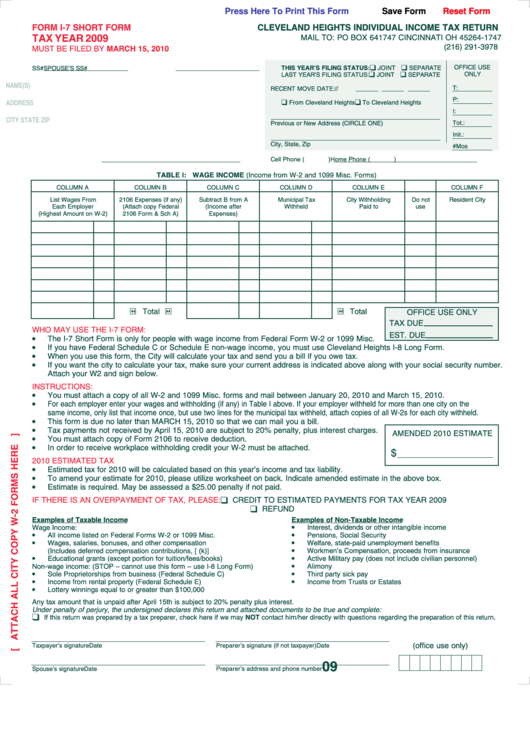

FORM I-7 SHORT FORM

CLEVELAND HEIGHTS INDIVIDUAL INCOME TAX RETURN

TAX YEAR 2009

MAIL TO: PO BOX 641747 CINCINNATI OH 45264-1747

(216) 291-3978

MUST BE FILED BY MARCH 15, 2010

K

K

OFFICE USE

SS#

SPOUSE’S SS#

THIS YEARʼS FILING STATUS:

JOINT

SEPARATE

K

K

ONLY

LAST YEAR’S FILING STATUS:

JOINT

SEPARATE

NAME(S)

T:

RECENT MOVE DATE:

/

/

K

K

P:

ADDRESS

From Cleveland Heights

To Cleveland Heights

I:

CITY STATE ZIP

Tot.:

Previous or New Address (CIRCLE ONE)

Init.:

City, State, Zip

#Mos

Home Phone (

)

Cell Phone (

)

TABLE I: WAGE INCOME (Income from W-2 and 1099 Misc. Forms)

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

COLUMN F

List Wages From

2106 Expenses (if any)

Subtract B from A

Municipal Tax

City Withholding

Do not

Resident City

Each Employer

(Attach copy Federal

(Income after

Withheld

Paid to

use

(Highest Amount on W-2)

2106 Form & Sch A)

Expenses)

Total

Total

OFFICE USE ONLY

TAX DUE

WHO MAY USE THE I-7 FORM:

EST. DUE

•

The I-7 Short Form is only for people with wage income from Federal Form W-2 or 1099 Misc.

•

If you have Federal Schedule C or Schedule E non-wage income, you must use Cleveland Heights I-8 Long Form.

•

When you use this form, the City will calculate your tax and send you a bill if you owe tax.

•

If you want the city to calculate your tax, make sure your current address is indicated above along with your social security number.

Attach your W2 and sign below.

INSTRUCTIONS:

•

You must attach a copy of all W-2 and 1099 Misc. forms and mail between January 20, 2010 and March 15, 2010.

•

For each employer enter your wages and withholding (if any) in Table I above. If your employer withheld for more than one city on the

same income, only list that income once, but use two lines for the municipal tax withheld, attach copies of all W-2s for each city withheld.

•

This form is due no later than MARCH 15, 2010 so that we can mail you a bill.

•

Tax payments not received by April 15, 2010 are subject to 20% penalty, plus interest charges.

AMENDED 2010 ESTIMATE

•

You must attach copy of Form 2106 to receive deduction.

•

In order to receive workplace withholding credit your W-2 must be attached.

$

2010 ESTIMATED TAX

•

Estimated tax for 2010 will be calculated based on this year’s income and tax liability.

•

To amend your estimate for 2010, please utilize worksheet on back. Indicate amended estimate in the above box.

•

Estimate is required. May be assessed a $25.00 penalty if not paid.

K

IF THERE IS AN OVERPAYMENT OF TAX, PLEASE:

CREDIT TO ESTIMATED PAYMENTS FOR TAX YEAR 2009

K

REFUND

Examples of Taxable Income

Examples of Non-Taxable Income

•

Wage Income:

Interest, dividends or other intangible income

•

•

All income listed on Federal Forms W-2 or 1099 Misc.

Pensions, Social Security

•

•

Wages, salaries, bonuses, and other compensation

Welfare, state-paid unemployment benefits

•

(Includes deferred compensation contributions, [e.g. 401(k)]

Workmen’s Compensation, proceeds from insurance

•

•

Educational grants (except portion for tuition/fees/books)

Active Military pay (does not include civilian personnel)

•

Non-wage income: (STOP – cannot use this form – use I-8 Long Form)

Alimony

•

•

Sole Proprietorships from business (Federal Schedule C)

Third party sick pay

•

•

Income from rental property (Federal Schedule E)

Income from Trusts or Estates

•

Lottery winnings equal to or greater than $100,000

Any tax amount that is unpaid after April 15th is subject to 20% penalty plus interest.

Under penalty of perjury, the undersigned declares this return and attached documents to be true and complete:

K

If this return was prepared by a tax preparer, check here if we may NOT contact him/her directly with questions regarding the preparation of this return.

Taxpayer’s signature

Date

Preparer’s signature (if not taxpayer)

Date

(office use only)

09

Spouse’s signature

Date

Preparer’s address and phone number

1

1